After briefly nearing the critical level of $70,000 driven by the optimism stemming from the speech of the former United States President and current presidential hopeful Donald Trump, Bitcoin (BTC) has retraced into the area below $65,000, and artificial intelligence (AI) algorithms are bearish.

As it happens, Bitcoin started to drop upon the news that the U.S. government had transferred nearly 30,000 BTC, worth about $2.02 billion at the time, from the cryptocurrency wallets related to the Department of Justice’s Silk Road seizures, as per Arkham Intelligence information.

Interestingly, the move arrives after Trump reiterated he would be willing to commute Silk Road founder Ross Ulbricht’s sentence, as well as to “keep 100% of all Bitcoin the U.S. government currently holds or acquires into the future” if re-elected, during his address at the Bitcoin 2024 conference over the weekend.

Bitcoin price prediction

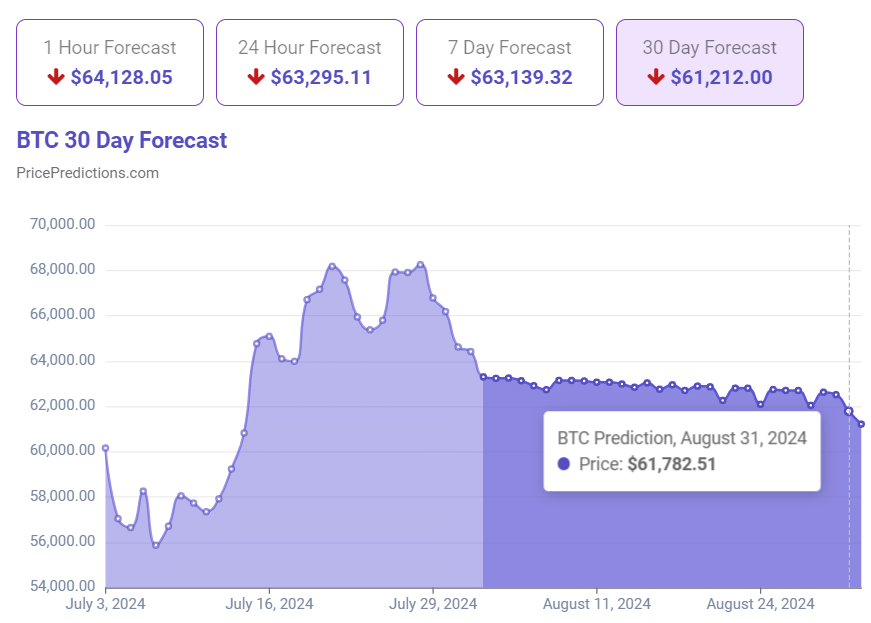

In this context, the advanced AI algorithm deployed by the crypto analytics platform PricePredictions is pessimistic regarding the future performance of the maiden cryptocurrency, setting its price on August 31, 2024, at $61,782.51, according to the data retrieved on August 1.

Indeed, should the AI’s forecast, which draws on technical analysis (TA) indicators like average true range (ATR), Bollinger Bands (BB), moving average convergence divergence (MACD), and others, come true, it would mean a decline of 4.02% from the price of Bitcoin at press time.

Bitcoin price analysis

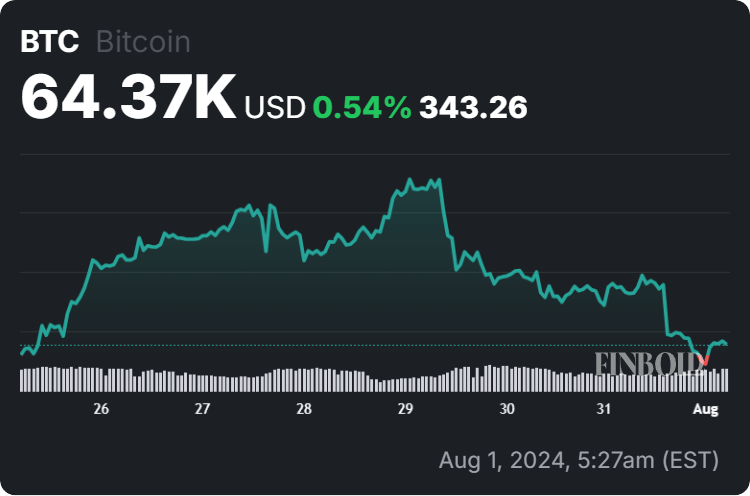

For the moment, the largest asset in the crypto industry by market capitalization is changing hands at the price of $64,370, recording a 2.36% drop in the last 24 hours, a modest gain of 0.54% across the previous seven days, and an accumulated increase of 3.02% on its monthly chart.

That said, crypto analyst CryptoCon has observed that Bitcoin bull markets historically commenced as gold bear markets began, suggesting that a significant shift could be imminent as the last gold bear market top took place in August 2020, or 208 weeks, as Finbold reported on July 31.

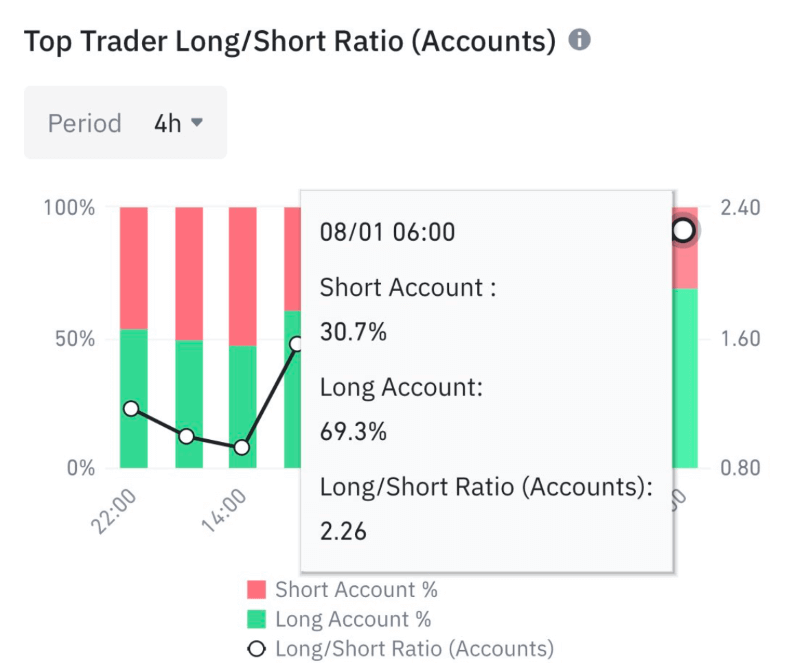

It is also worth noting that, more recently, crypto trading expert Ali Martinez pointed out that top traders on Binance, one of the largest crypto exchanges in the world, were buying the dip and that “nearly 70% of them are going long on BTC,” indicating widespread confidence in its recovery, according to the analysis he shared on August 1.

All things considered, Bitcoin might continue to drop towards the end of this month, as suggested by the AI algorithms, although experts are optimistic of its price advances in the long run. Regardless, doing one’s own research, including BTC trends, chart patterns, and relevant events, is critical when investing.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.