Although silver had gone through a correction last week alongside its main competitor, gold, things are looking up for precious metals in the week that has started, with the gray metal leading the pack and artificial intelligence (AI) platforms have remained optimistic about its future performance.

As it happens, support for the precious metal continues to grow, with silver advancing nearly four percentage points in the last 24 hours after triggering a strong bullish reversal from last week’s sluggish price action, showing signs of a possible reach to the $35.52 high.

AI silver price prediction 2024

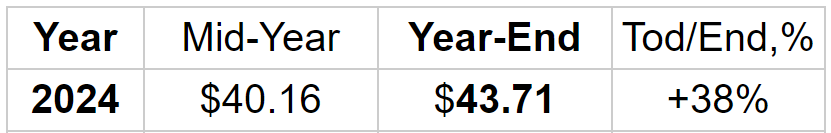

In this context, a price-predicting algorithm that uses technical analysis (TA) indicators, support and resistance, chart patterns, and other relevant factors, has projected that silver would reach the price of $43.71 by the end of 2024, which would represent an increase of 38% from its current price.

Picks for you

At the same time, the new model of OpenAI invention ChatGPT, called ChatGPT-4o, has provided a price range between $30 and $35, taking into account “present data and expert insights,” or specifically a lower bound prediction of $30, middle range of $32 – $33, and upper bound of $35.

“This range allows for speculative movements while being rooted in historical trends and expert forecasts.”

Meanwhile, Claude 3 Opus, the recent AI model by Anthropic, has set the price of silver at $35 – $40 per ounce as its conservative estimate and at $40 – $50 per ounce as its optimistic prediction, “considering the price trends and assuming the continuation of the current upward momentum.”

Elsewhere, the generative conversational AI innovation by Google (NASDAQ: GOOGL), called Google Gemini, has offered a bullish range of $30 – $34.70, citing JPMorgan (NYSE: JPM), Commerzbank, CitiGroup (NYSE: C), and Investing Haven, a neutral forecast of $27 – $31.65, and a bearish prognosis at $23.85 – $27.

Silver price analysis

For now, silver is changing hands at the price of $31.65, which suggests a 3.76% advance on the day, a very modest increase of 0.063% across the week but a more significant gain of 14.43% in the past month, while growing 32.13% since the year’s turn, as per data on May 28.

So, how much is a kilo of silver worth? Notably, one kilogram of silver currently costs $1,015.06, whereas the price of one gram of silver at press time stood at $1.02. Taking its current price per ounce into consideration, it also means that a typical silver bar of 10 oz presently goes for about $316.5 at current market prices.

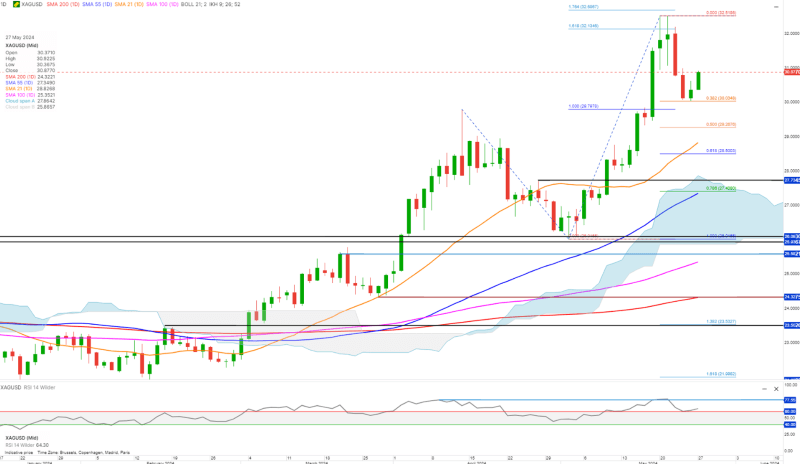

Indeed, silver has bounced from the 0.382 Fibonacci retracement at $30 and will likely resume its uptrend, with the daily relative strength index (RSI) showing positive sentiment with no divergence, suggesting a push above $32.52, per observations by Saxo Bank’s Kim Cramer Larsson.

On the other hand, silver making “a break below $30 could continue the correction down to the 0.618 retracement at $28.50,” as the Danish investment banking giant’s technical analyst pointed out, demonstrating his analysis on charts shared on May 27.

All things considered, silver might continue to advance on the path predicted by one of the AI platforms above, particularly as some market experts concur with such a possibility. However, doing one’s own research is critical when investing, as trends can make sudden shifts.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.