Ethereum (ETH) has shown significant strength against Bitcoin (BTC), reclaiming a key trend line and sparking discussions of a potential altseason.

The cryptocurrency has outperformed BTC since mid-May, driven by the anticipation of spot Ether exchange-traded funds (ETFs) in the United States.

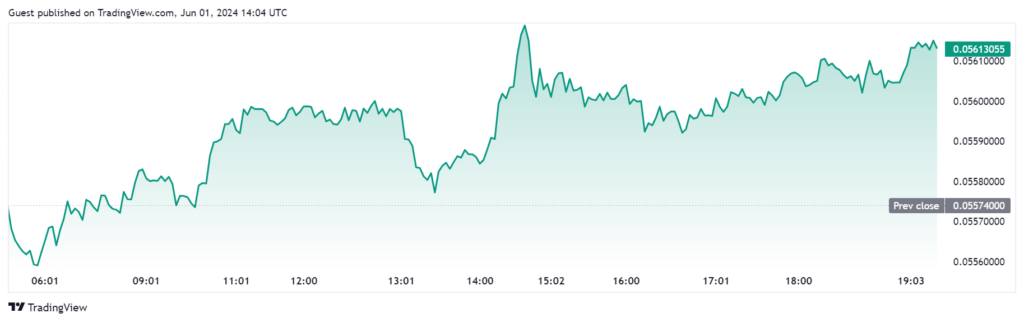

Ethereum’s price saw a significant surge following the announcement of the approval for the Ethereum Spot ETF. The ETH to BTC ratio currently stands at 0.056, indicating a significant increase for Ethereum.

By contrast, Bitcoin has found support at $67,000 and faces potential drops to $65,000. Meanwhile, Ethereum holds steady at $3,700 amid heightened volatility.

Since May 15, ETH has surged approximately 30%, compared to BTC’s modest 9% gain. This performance is reflected in the ETH/BTC ratio, which reached a two-week high of 0.05854 on May 23, marking a 31% increase.

A detailed analysis by pseudonymous crypto analyst Moustache revealed that the ETH/BTC ratio is reversing from a multi-year support trend line. Historically, when prices bounce from this line, altcoin prices tend to trend higher.

Bullish sentiment amid ETF approval

The ETH/BTC ratio measures how Ethereum performs against Bitcoin. Technical analysts closely watch this ratio as it compares the two most valuable cryptocurrencies.

Although Bitcoin has been strong over the past two years, the monthly chart for the ETH/BTC ratio shows a downward channel , suggesting an upward trend for Ethereum.

This trend is attributed to higher lows over time, indicating that buyers have been absorbing selling pressure, keeping ETH prices higher.

Renowned crypto analyst Michaël van de Poppe has observed that the ETH/BTC weekly chart showed a bullish divergence from the relative strength index (RSI), suggesting a trend reversal had started. This ratio is considered bullish as long as it remains above 0.051.

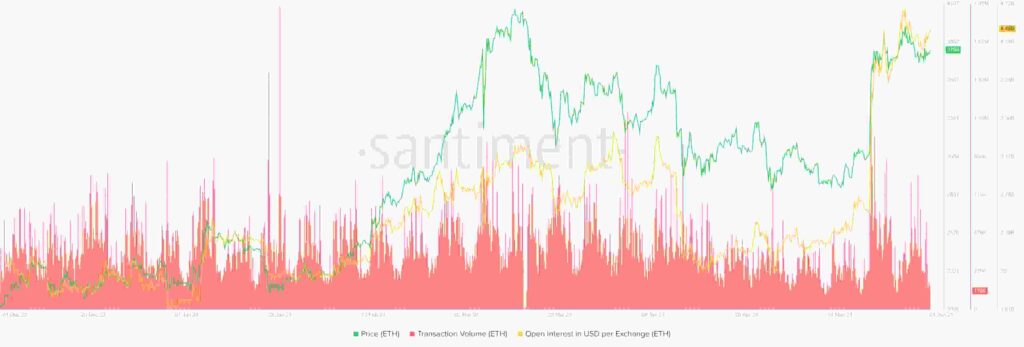

Data from Santiment shows increased network activity in Ethereum. The number of unique smart contracts on Ethereum also rose from 37,870 on May 20 to 38,066 on May 31, according to CryptoQuant.

The approval of spot Ether ETFs by the United States Securities and Exchange Commission (SEC) on May 23 has further fueled bullish sentiment. This development is seen as a significant milestone for Ethereum, increasing its attractiveness to institutional investors and potentially driving further price appreciation.

Adding to the bullish outlook, on May 31, 920,000 Ether options worth $3.5 billion expired.

Historically, the expiry of crypto options contracts is linked to price volatility in the market. The put/call ratio (PCR), a technical indicator that reflects trader market sentiment, is crucial here.

A PCR below 0.7 is considered a strong bullish sentiment, while a PCR above 1 is considered bearish. This ratio compares the number of active puts (bearish) contracts to call (bullish) options, with a lower PCR typically indicating a bullish bias.

Ethereum price analysis

Ethereum’s price has experienced significant volatility over the past week, fluctuating between a high of $3,965 and a low of $3,757. Despite this, in the last three days, the price has struggled to stay above $3,800, with bearish momentum prevailing.

At press time, ETH is trading at $3,803.09, reflecting a 27% increase on a monthly basis.

A bullish momentum is anticipated due to the expectations of spot Ethereum ETFs, with the SEC asking firms for their amended S-1 forms.

The overall outlook for Ethereum remains positive as investors watch for further regulatory developments and market reactions

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.