XRP has captured the attention of traders and investors with its recent surge to $1.91, reflecting a 2.75% daily gain and a robust 37.5% weekly increase.

Analysts are optimistic about the cryptocurrency’s outlook, mapping a bullish trajectory that could see XRP reaching $6.42.

This optimism is driven by a combination of technical strength, regulatory shifts, and Ripple’s strategic moves to position itself at the forefront of the evolving crypto landscape.

Technical analysis: XRP charts a path toward $6

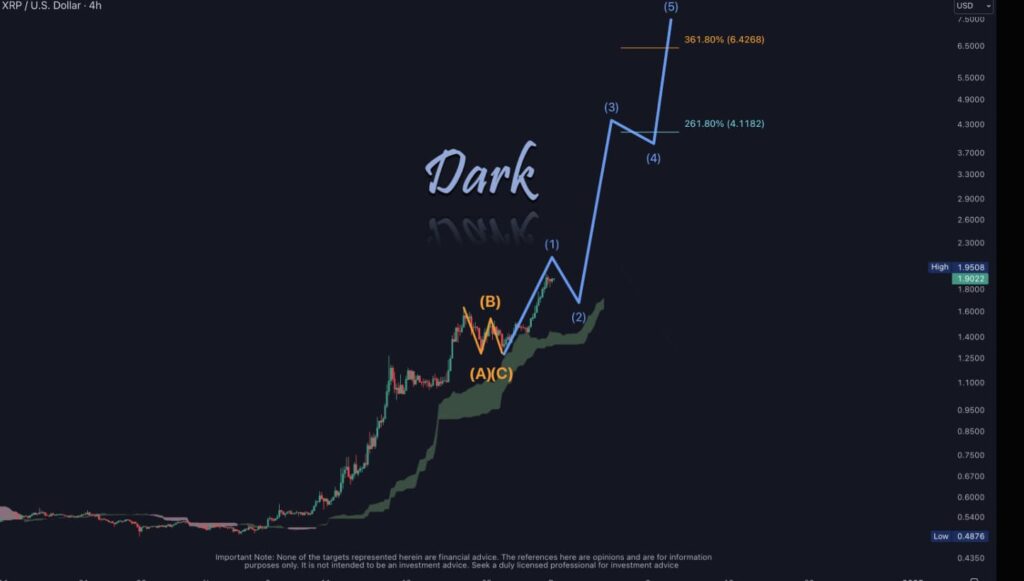

XRP’s price action reveals a well-defined bullish roadmap, with multiple technical indicators supporting its upward trajectory. Crypto analyst Dark Defender, in an X post on December 1, highlighted that XRP has recently shown significant strength, reinforcing its potential for continued gains.

Having decisively broken the critical resistance at $1.88, which now acts as support, XRP is poised to test $2.13 in the short term.

Mid-term targets are identified at $4.11, a key level aligning with the 261.8% Fibonacci extension, and $5.85, paving the way for the ultimate target of $6.42, supported by the 361.8% Fibonacci extension.

Trading well above the Ichimoku Cloud, XRP demonstrates strong momentum, with any pullbacks expected to find robust support within the cloud.

Elliott Wave analysis further bolsters this outlook, suggesting the cryptocurrency is in the impulsive third wave of its bullish cycle, typically the most expansive phase.

Derivatives data paints a bullish outlook

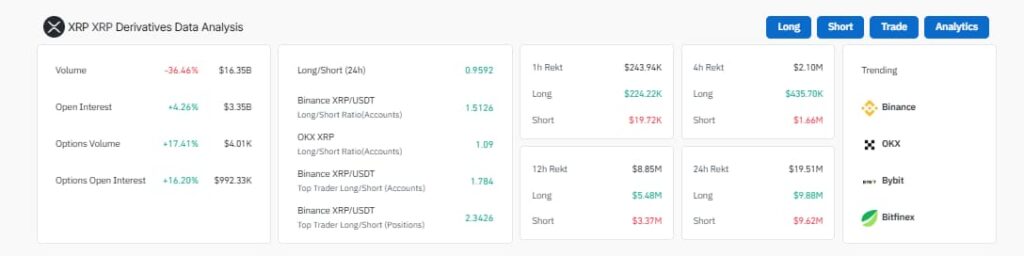

Complementing this technical strength, derivatives data from CoinGlass reflects a bullish bias, with several indicators pointing to positive sentiment among traders.

Open interest has increased by 4.26% to $3.35 billion, signaling heightened participation in XRP futures markets, while options volume and options open interest have grown by 17.41% and 16.20%, respectively, showing increased trader activity and positioning for potential price movements.

Binance’s long/short ratio of 1.5126, along with a strong long bias among top traders, underscores the optimistic sentiment driving XRP toward its ambitious price targets.

Although overall trading volume has decreased by 36.46%, indicating reduced activity or potential consolidation, this does not diminish the bullish momentum evident in other metrics.

Furthermore, liquidation data reveals a slight edge in long liquidations, approximately $9.88 million, compared to shorts at $9.62 million. This suggests some volatility but no significant bearish pressure. Overall, the data continues to support a bullish outlook for XRP in the near term

Regulatory developments and market sentiment boost XRP

Speculation about a pro-crypto shift in SEC leadership under a potential Trump administration has significantly boosted XRP demand.

Former SEC Commissioner Paul Atkins has emerged as the leading contender for the SEC Chair position, with a 68% probability, according to betting platform Kalshi.

Brad Bondi, another pro-crypto candidate, holds a distant second position with a 20% probability of succeeding current Chair Gary Gensler.

Both Atkins and Bondi are viewed as potential catalysts for ending the SEC’s appeal in the Ripple case, a development that could set a crucial legal precedent for the cryptocurrency industry.

Ripple’s legal victories against the SEC remain a pivotal driver of XRP’s bullish momentum. The recent approval by the California District Court to amend the judgment and stay in the XRP lawsuit has brought the protracted legal battle closer to resolution.

Adding to this optimism, the approval of XRP ETF filings by Canary Funds, Grayscale, and WisdomTree could attract substantial institutional investment, fueling XRP’s ongoing rally and reinforcing its market position.

If approved, these ETFs could mirror Bitcoin’s success, which saw its price soar 129% after Bitcoin spot ETFs launched in January 2024.

Furthermore, Ripple co-founder Brad Garlinghouse’s $25 million donation to Fairshake PAC is widely seen as the company’s proactive efforts to build stronger relationships with pro-crypto policymakers. This move has further energized the market, contributing to a bullish reversal.

In summary, institutional interest and rising derivatives activity continue to signal strong confidence in XRP’s long-term growth.

Coupled with increasing open interest in derivatives markets, these factors position XRP as a leading asset for sustained market gains. If current momentum persists, XRP’s roadmap to $6.42 becomes increasingly attainable.

Featured image from Shutterstock