The Worldwide Developers Conference (WWDC) brought all the enthusiasm on Apple’s (NASDAQ: AAPL) side; with the announced integration of ChatGPT from OpenAI into new iPhones, the Cupertino giant’s stock has been on a surge since June 11, as it added almost 20% since the event.

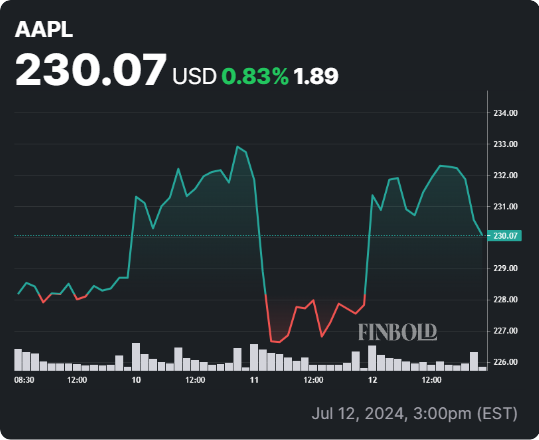

With a 1.44% gain in the previous five trading sessions, AAPL stock reached $230.54. The pre-market increase of 2.31% indicates a positive start for Apple stock in this trading week.

Additionally, Apple has achieved record annual sales of nearly $8 billion in India, highlighting the company’s growth in this rapidly expanding market.

The iPhone maker now assembles more of its devices locally and operates two flagship stores nationwide.

Revenue in India increased by about 33% in the 12 months through March, rising from $6 billion the previous year, according to reports. Apple’s high-priced iPhones made up more than half of these sales.

Apple’s growing sales and AI bid bring optimism to Wall Street

Wall Street analysts were keen to find out how Apple will respond to the growing artificial intelligence (AI) impact on the industry, as the implementation of ChatGPT is seen as a step in the positive direction.

On July 15, Morgan Stanley analysts upgraded Apple stock to a ‘Top Pick’ and raised the price target from $216 to $273.

Analyst Erik Woodring expressed strong confidence that the introduction of Apple Intelligence, despite its limited backward compatibility, could trigger a multi-year refresh cycle for Apple devices.

“We had previously underestimated, and the market still underappreciates, the significant impact of the impending upgrade cycle,” Woodring noted.

Based on their analysis of Apple’s upgradable iPhone base, upgrade rates, new user growth, and model mix, Morgan Stanley projects that Apple will ship nearly 500 million iPhones over the next two years—235 million in fiscal year 2025 and 262 million in FY26.

New Wall Street high for Apple stock

On the same date, Loop Capital upgraded Apple shares to a “buy” rating and a new price target of $300—the highest on Wall Street.

In a note to clients, Loop Capital expressed confidence that Apple is set to become the leading platform for next-generation AI, similar to its previous successes with the iPhone and iPod.

The firm’s Supply Chain Analyst believes Apple will solidify its position as the top AI platform, much like it did with social media 15 years ago and digital content consumption 20 years ago.

Loop Capital analysts believe this new trend can potentially drive significant AAPL stock gains, just as previous technological shifts did.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.