As earnings season unfolds, we witness a spectrum of outcomes. This rollercoaster is particularly evident in the recent quarterly updates of several tech giants.

Now, the question arises: which artificial intelligence (AI) stock presents the most promising investment opportunity following last week’s significant movements? Is it Alphabet (NASDAQ: GOOG), Meta Platforms (NASDAQ: META), or Microsoft (NASDAQ: MSFT).

GOOG, MSFT, and META posted impressive financial reports

Alphabet’s Q1 revenue increased by 15% year over year to $80.5 billion. Earnings soared even higher, jumping 57% to nearly $23.7 billion. The company’s Search, YouTube, and Google Cloud segments experienced impressive growth, further buoyed by Alphabet’s decision to introduce its first-ever dividend, pleasantly surprising investors.

Meanwhile, Microsoft’s performance didn’t dazzle investors as much but delivered solid results in its fiscal 2024 third quarter. The tech giant reported revenue of $61.9 billion, marking a 17% year-over-year increase, with earnings climbing 20% to $21.9 billion. AI remained a significant driver, with revenue from server products and cloud services seeing a 24% uptick.

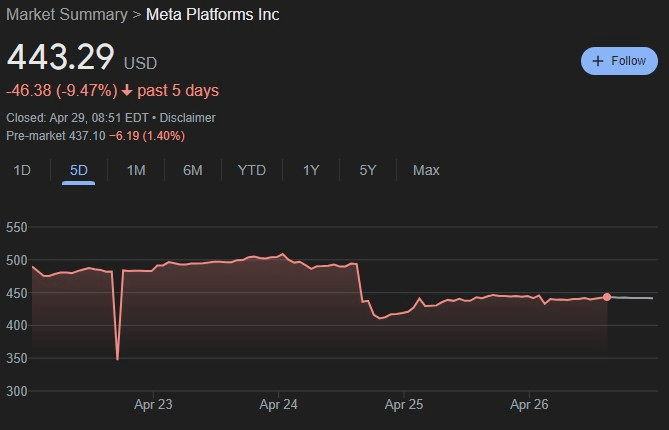

However, Meta, formerly Facebook, experienced a notable downturn in its stock following the announcement of its Q1 results on Wednesday. The company faced criticism despite reporting a 27% year-over-year revenue increase to nearly $36.5 billion and a staggering 117% surge in earnings to almost $12.4 billion—both exceeding Wall Street estimates.

During Meta’s Q1 earnings call, CEO Mark Zuckerberg focused on money-losing initiatives like AI and the metaverse. Additionally, the company revised its full-year guidance, anticipating increased expenses and capital expenditures, citing the need for more spending on AI and metaverse development.

Despite initial setback, META stock seems like the way to go

During Meta’s Q1 call, Zuckerberg appeared to anticipate the sell-off of Meta shares, noting, ‘I think it’s worth calling out that we’ve historically seen a lot of volatility in our stock during this phase of our product playbook — where we’re investing in scaling a new product but aren’t yet monetizing it.’

However, he remained optimistic, stating:

Historically, investing in building these new scaled experiences in our apps has been an excellent long-term investment for us and investors who have stuck with us.’

Zuckerberg’s remarks about the company’s track record of investing in new products before monetization were on point. Meta is expected to monetize its AI and metaverse products eventually successfully.

With the recent dip lowering META shares’ valuation to $443.29, now seems like a great opportunity for investors to ‘buy the dip.’

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.