Despite the undeniable strength of the 2024 stock market – with many individual stocks reaching new all-time highs (ATH), and the benchmark S&P 500 index itself at unprecedented peaks above 6,000 – few expected this year to feature the world’s first $4 trillion company.

Seemingly against all odds, Apple’s (NASDAQ: AAPL) recent rally has opened up the possibility that this could happen before the New Year as the technology behemoth boasts a market capitalization of $3.831 trillion at press time on December 18.

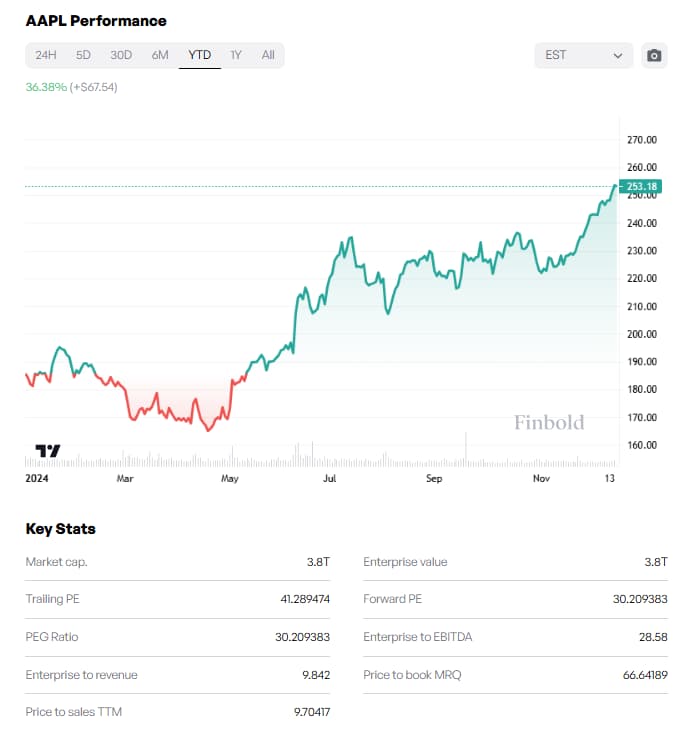

Indeed, AAPL managed an impressive climb from its late 2023 valuation of $2.994 trillion and is up 36.39% year-to-date (YTD). Similarly, Apple shares have gained $67.54 and, at press time, stand at $253.18.

The case for Apple hitting $4 trillion in 2024

While $170 billion appears to be a hefty difference that would have to be closed in less than two weeks, converting it into share price demonstrates it is somewhat trivial in the grand scheme of things.

Specifically, for Apple to reach a valuation of $4 trillion, AAPL shares would have to trade at approximately $263.64 – just slightly more than $10 above the press time price. Put in perspective, Apple stock climbed about $7 in the last 5 days and $25 in the last 30.

Though the rally would, indeed, have to accelerate for the milestone to be hit by December 31, the current momentum, as well as the current technicals, favor such a move.

The current sentiment about the shares is bullish, Apple recorded 19 green days out of the last 30, and technical analysis (TA) retrieved from TradingView on December 18 and based on the last week of trading highlights AAPL as a ‘strong buy.’

Furthermore, the final days of a year tend to generate an upsurge in the stock market – the so-called ‘Santa Claus Rally’ – and the technology giant is likely to benefit from the buying pressure, particularly if the $4 trillion milestone serves as a psychological magnet.

The case against Apple hitting $4 trillion in 2024

On the flip side, while many aspects of technical analysis favor a continued Apple stock rally, it is worth pointing out that the current rally has already flashed multiple strong sell signals.

Perhaps the most pointed of these for AAPL is the relative strength index (RSI), which – at 79.97 – paints the shares as exceptionally ‘overbought.’

Additionally, while a $10 climb in a handful of trading days is not impossible, it is well above Apple stock’s average in the last 30 days as well as throughout 2024.

This year, AAPL shares averaged a gain of about $5.6 per month, and even in the last 30 days, the average daily gain was at $0.84.

Featured image via Shutterstock