Anthropic recently unveiled Claude 3 Opus, its new artificial intelligence (AI) model deemed a superior tool to OpenAi’s ChatGPT-4. Meanwhile, Bitcoin (BTC) investors eagerly seek insights on the leading cryptocurrency price for the end of 2024.

In this context, Finbold accessed Claude 3 Opus and prompted the premium AI to predict Bitcoin’s price by the end of the year. For the prompt, we asked Claude the most likely range, maximum, and minimum exchange rates BTC will trade at in 2024.

ChatGPT’s promising competitor forecasts a significantly bullish run for Bitcoin this year, facing positive fundamental analyses on supply and demand.

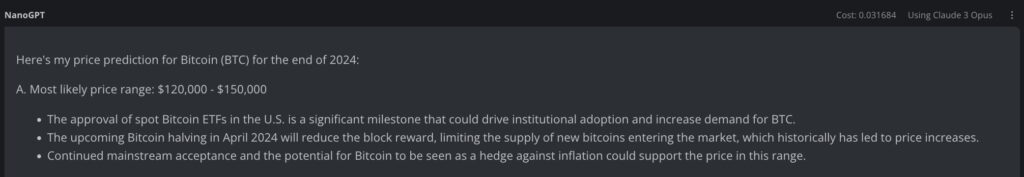

Claude AI most likely price range for Bitcoin in 2024

In particular, Claude AI predicts Bitcoin will trade between $120,000 and $150,000 by the end of 2024. This “most likely range” considers increased institutional adoption for BTC through the spot Bitcoin ETFs. Moreover, changes in the supply emission through the halving and Bitcoin’s use as an inflation hedge.

Most likely price range: $120,000 – $150,000

- The approval of spot Bitcoin ETFs in the U.S. is a significant milestone that could drive institutional adoption and increase demand for BTC.

- The upcoming Bitcoin halving in April 2024 will reduce the block reward, limiting the supply of new bitcoins entering the market, which historically has led to price increases.

- Continued mainstream acceptance and the potential for Bitcoin to be seen as a hedge against inflation could support the price in this range.

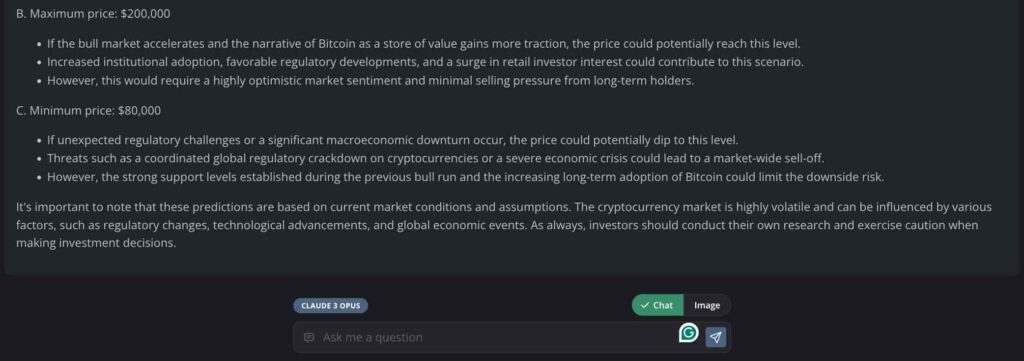

Bitcoin’s maximum and minimum prices for the end of 2024

Notably, Claude 3 Opus forecasted a maximum possible price of $200,000 per BTC with a minimum of $80,000. However, the AI warns that Bitcoin needs a “highly optimistic market sentiment” and “minimal selling pressure” to reach the $200,000 bullish forecast.

On the other hand, Claude points out that, even under negative fundamentals, BTC could hold support levels above the previous cycle’s all-time high of $69,000.

B. Maximum price: $200,000

– If the bull market accelerates and the narrative of Bitcoin as a store of value gains more traction, the price could potentially reach this level.

– Increased institutional adoption, favorable regulatory developments, and a surge in retail investor interest could contribute to this scenario.

– However, this would require a highly optimistic market sentiment and minimal selling pressure from long-term holders.

C. Minimum price: $80,000

– If unexpected regulatory challenges or a significant macroeconomic downturn occur, the price could potentially dip to this level.

– Threats such as a coordinated global regulatory crackdown on cryptocurrencies or a severe economic crisis could lead to a market-wide sell-off.

– However, the strong support levels established during the previous bull run and the increasing long-term adoption of Bitcoin could limit the downside risk.

Finally, artificial intelligence noted these predictions are based on specific market conditions and assumptions. The cryptocurrency market and Bitcoin are known for their high volatility; multiple factors might influence performance. In closing, Claude AI urges investors to conduct their own research and invest cautiously.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk