The drama surrounding GameStop (NYSE: GME) stock and its most popular shareholder, Keith Gill, aka Roaring Kitty, seems far from over, as continuous developments seem to work in his favor.

As GameStop mania was renewed in recent months, spurred with cryptic tweets from Roaring Kitty and his constant holdings updates, the short sellers suffered billions in losses, making the most famous institutional short seller, Citron Research, step down with an explanation:

“It’s not because we believe a turnaround for the company’s fundamentals will ever happen, but with $4 billion in the bank, they have enough runway to appease their cult-like shareholders.”

The news followed the announcement of the completion of an at-the-market offering that raised $4 billion in cash, allowing it to address its debt load and finance other operations.

Subsequently, on June 13, Roaring Kitty updated his holdings, revealing that he exercised his June 21 call options and that his current GME stock holding has increased to 9 million shares worth over $262 million, effectively making him the 4th largest shareholder.

Now, with a rescheduled annual GameStop shareholder meeting set for today, June 17, the short squeeze might again take off.

A low supply of GME stock might cause a surge in price

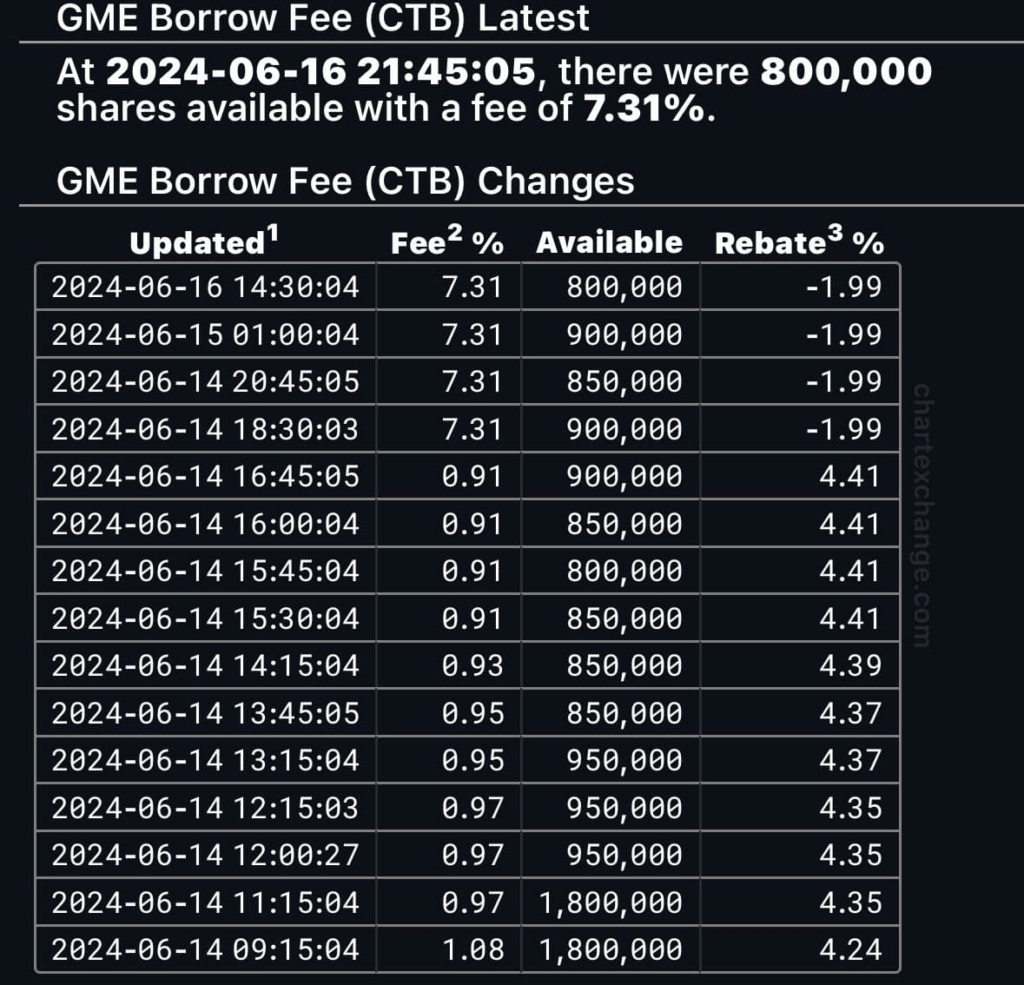

According to the latest update on the available shares, this number is now around 800,000, down from the starting 5 million, meaning that demand could easily outpace the supply if today’s GameStop shareholder meeting announces promising results.

In addition to scarcity, the increasing fees needed to borrow the stock could spur further growth in GME stock price.

A potential trend change in GME stock price

GameStop’s stock is currently in a consolidation phase between $26.10 and $30.68, following a period of high volatility. The interaction with various EMAs suggests the stock is trying to find a direction.

The MACD and Accumulation/Distribution line indicate mixed signals. Recent bearish momentum is waning, and the RSI is neutral, suggesting no immediate overbought or oversold conditions.

The annual shareholder meeting could spur a breakout above resistance at $30.68 or a breakdown below support at $26.10 to determine the stock’s next direction.

Renewed activity surrounding GME stock has also made Wall Street experts reassess their price targets to reflect the new information and developments.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.