As tensions escalate in the Middle East, with the Iran-Israel war nearing escalation, gold prices are on the rise while Bitcoin (BTC) takes a hit. However, the real winners in this scenario could be defense stocks.

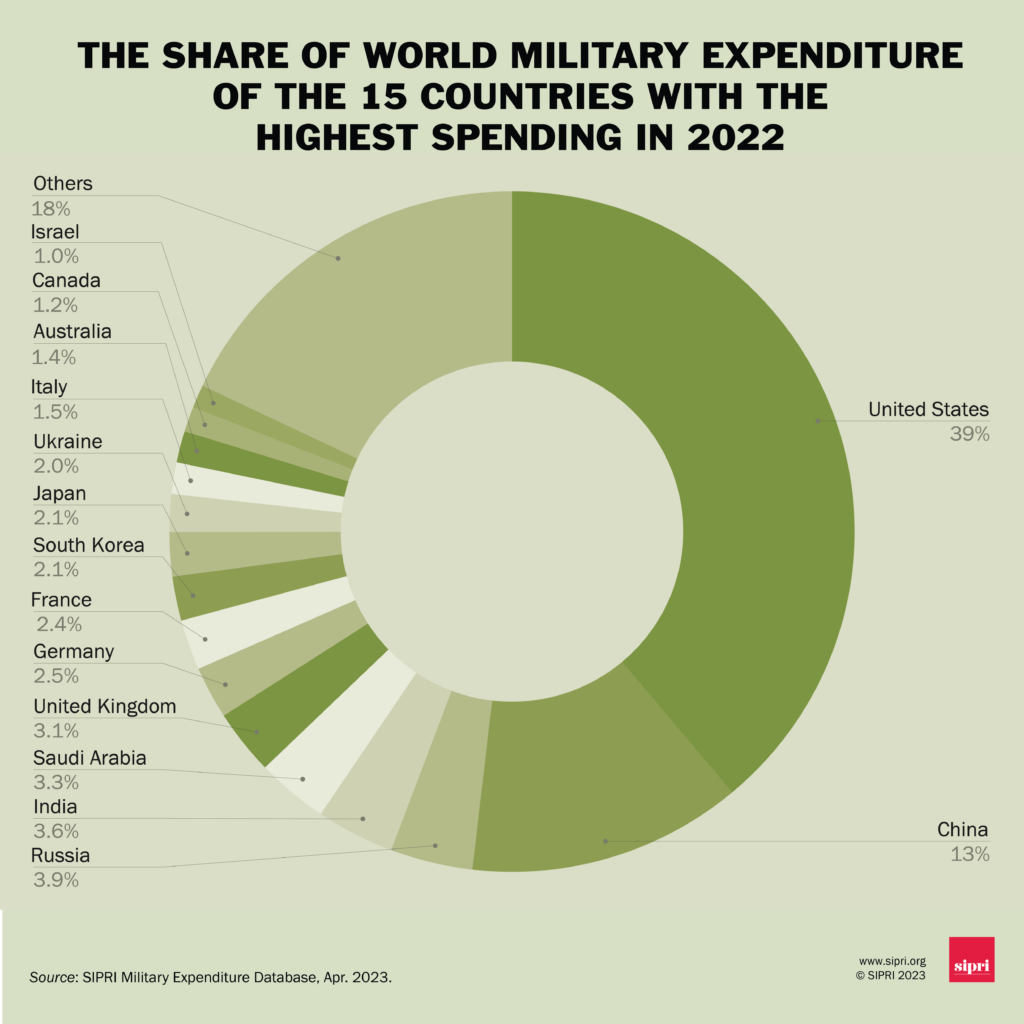

With countries ramping up military expenditures, companies leading in defense tech and innovation stand to gain.

The U.S. defense sector, renowned for its global arms trade dominance and advanced AI, seems poised for significant profit gains. Northrop Grumman (NYSE: NOC) and Lockheed Martin (NYSE: LMT) are among the top contenders in this lucrative race.

Having that said, a few months ago, the House passed a $825 billion defense bill. This is $29 billion more than what Congress enacted in 2023.

Northrop Grumman (NYSE: NOC)

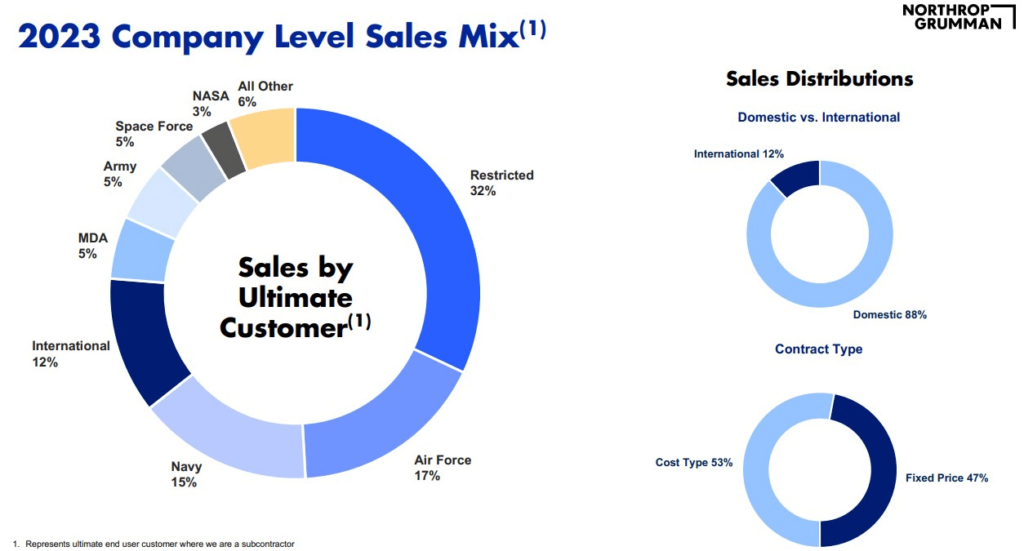

Northrop Grumman stock thrives on stable revenue streams thanks to government spending that remains steady even during economic downturns.

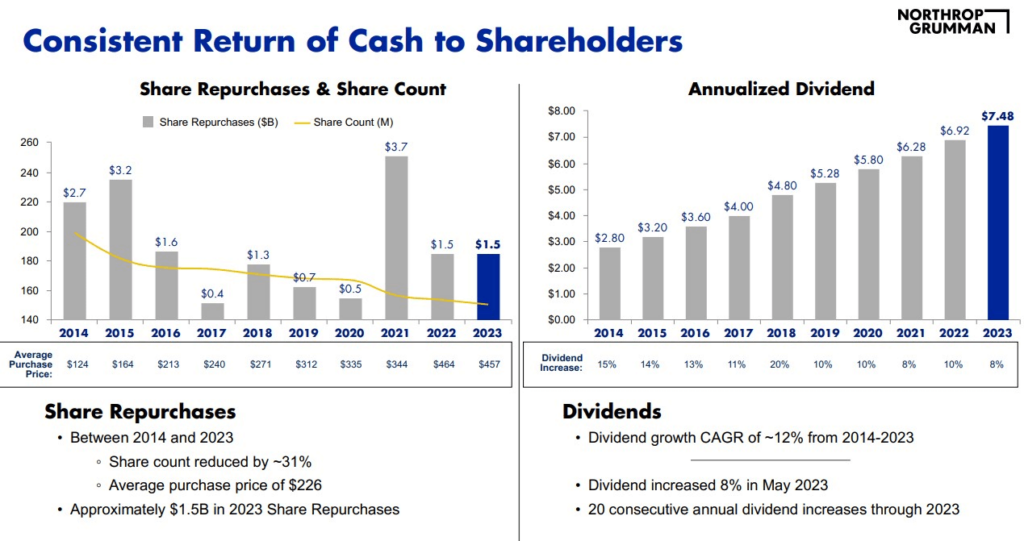

Their emphasis on innovation syncs well with the Department of Defense’s objectives, positioning them to excel in meeting future defense needs. Moreover, with robust financial health, including strong cash flow growth, and a track record of reliable shareholder returns through dividends and buybacks, the most recent dividend increase of 8% in May 2023, NOC stock poses a lucrative option for investors.

Northrop Grumman ensures consistent value for investors. Additionally, its diversified portfolio mitigates risks associated with overreliance on any single program, further bolstering its resilience in the market.

Lockheed Martin (NYSE: LMT)

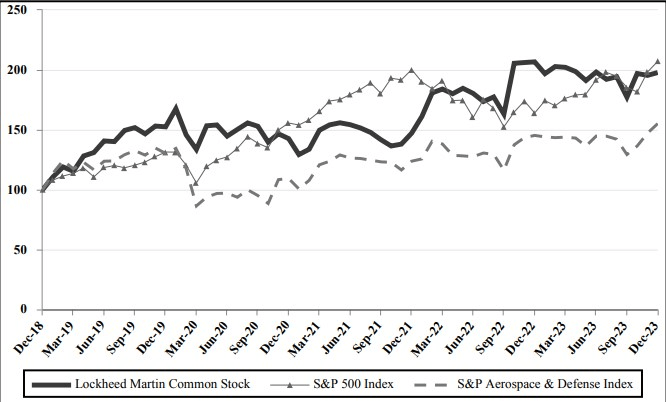

Despite sharing a similar robust financial performance Lockheed Martin’s current stock price of $450.40 might undervalue it. Last year, the company generated a significant $7.92 billion in operating cash flow, which comfortably covered both the $1.69 billion spent on capital expenditures and the $3.06 billion allocated to dividends.

Moreover, Lockheed Martin didn’t stop there; it also invested over $6 billion in buying back existing shares, equivalent to 5.56% of its $108 billion market capitalization. This translates to a 5.56% buyback yield. When combined with the 2.78% dividend yield, existing investors enjoy a total shareholder yield of 8.38%.

These strong financial indicators suggest that the LMT stock is poised for growth, regardless of global uncertainties surrounding geopolitical conflicts, which could only further aid its surge.

Investing in defense stocks, like any other sector, comes with its share of risks. This industry is deeply intertwined with government policies, geopolitical dynamics, and public opinion. Shifts in political leadership, alterations in foreign policy, and changes in public attitudes toward military actions can all sway the performance of defense stocks.

Additionally, strict regulations and oversight impose constraints on companies, influencing their ability to secure contracts or export their products.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.