In recent months, the economic landscape has been rife with speculation about a possible recession hitting the United States as several indicators turn red.

In the latest warning, macroeconomist Henrik Zeberg has cautioned that the US economy may face one of the worst recessions in history. Through an X post on June 6, the economist highlighted that the recession could come after a bullish momentum in the stock market and the crypto sector.

Notably, the analyst projected an impending crash in two-year Treasury yields, signaling a recession that could rival the Great Depression of 1929.

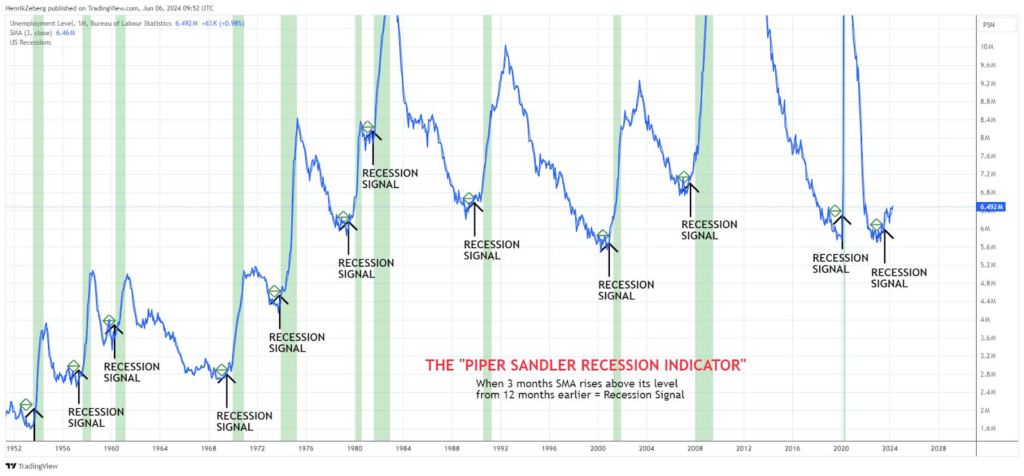

The expert shared a chart that compares two-year Treasury yields with the Federal Funds Rate, showing historical patterns where market yield changes preceded Federal Reserve actions.

The chart noted spikes before major economic declines. Presently, inflation is at 3.4%, echoing past concerning levels.

Additionally, the chart focused on the Relative Strength Index (RSI), which indicates momentum in price movements. Historically, large bearish structures in the RSI preceded market crashes. Therefore, the current “Mega Bearish Structure” suggests a similar impending decline.

“A CRASH in 2YR yields is coming. And we got clear #Recession signals. Be worried! Be very worried! I am! Coming recession will be the worst SINCE 1929. But – first BlowOffTop in US Equities and Crypto,” the expert said.

Implication of declining Treasury yields

Historically, the scenario of Treasury yields declining is often associated with increased investor demand for safe-haven assets amid growing economic uncertainty. A yield drop indicates rising bond prices, typically spurred by concerns about a market downturn or economic recession.

In line with projections of a potential blow-off top in US equities and cryptocurrencies, there is a suggestion of a final, unsustainable surge in asset prices before an abrupt decline. This scenario typically entails rapid price increases driven by speculative buying, often preceding significant market corrections or crashes.

Meanwhile, large-cap companies have taken the lead in the recent market rally, with indices like the S&P 500 standing out. At the same time, the cryptocurrency market remains in a consolidation phase, led by Bitcoin’s attempt to breach the $70,000 resistance mark.

It’s worth noting that the Great Depression, which began in 1929, is the most severe economic downturn in modern history. It led to widespread unemployment, deflation, and significant declines in industrial output.

Given several signals flashing red, questions have persisted regarding the timing of a possible recession. Finbold reported that the investment research platform Game of Trades highlighted that, based on the 10-year/3-month US Treasury curve, an indicator historically known for its predictive ability regarding economic contractions, the recession is likely to hit in the latter half of 2024.