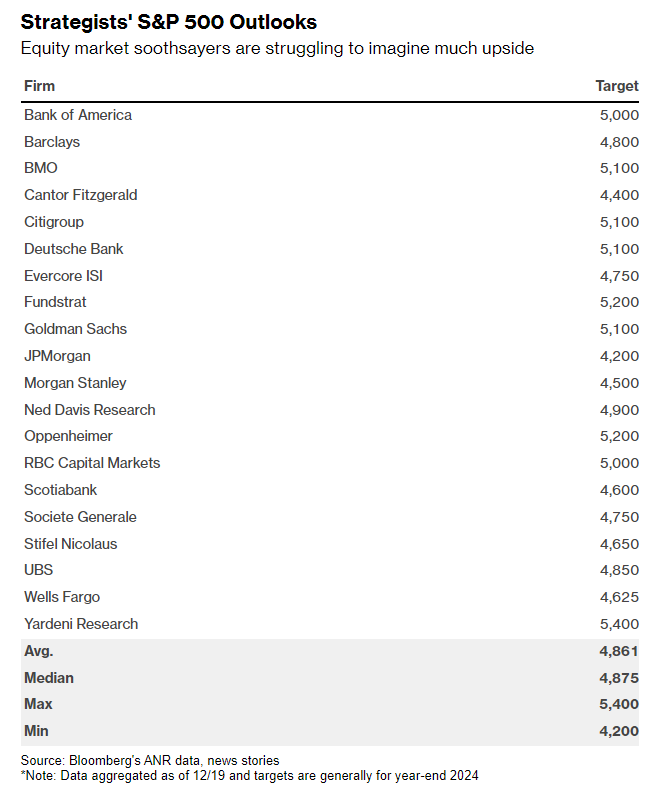

As 2024 kicked off, the stock market surged beyond initial forecasts, suggesting that the conservative nature of the projected price target for the S&P 500 would likely require adjustment soon.

The remarkable performance of the major players in the S&P 500, often referred to as the ‘magnificent seven,’ with the exception of Tesla (NASDAQ: TSLA), reported better-than-expected results since the turn of the year, led to the S&P 500 surpassing the historic 5,000 threshold on February 8 for the first time.

The Index consistently traded well above this significant milestone throughout the preceding week. With the median, average, and minimum expectations surpassed, the S&P 500 has already reached its highest target, leading some analysts to reconsider their positions.

Analysts initially cautiously approached their outlooks for the S&P 500 for a specific reason. At the beginning of 2024, concerns arose about the potential for an extended period of rising interest rates, the threat of inflation, and the looming possibility of a recession.

Sanctuary Wealth goes as far as 5,800 for the S&P 500

According to Mary Ann Bartels, the chief investment strategist at Sanctuary Wealth, the S&P 500 is projected to reach between 5,400 and 5,800 by the year’s end.

In an interview with CNBC, Bartels revealed that Sanctuary Wealth has revised its S&P 500 price target upward from the previous range of 5,200-5,400, set last November.

She also highlighted the impact of artificial intelligence on market transformation, noting that this evolution is already reflected in global markets.

Bartels emphasized that this market momentum is not solely confined to the United States, pointing out that European and Japanese stock markets have also reached historic highs.

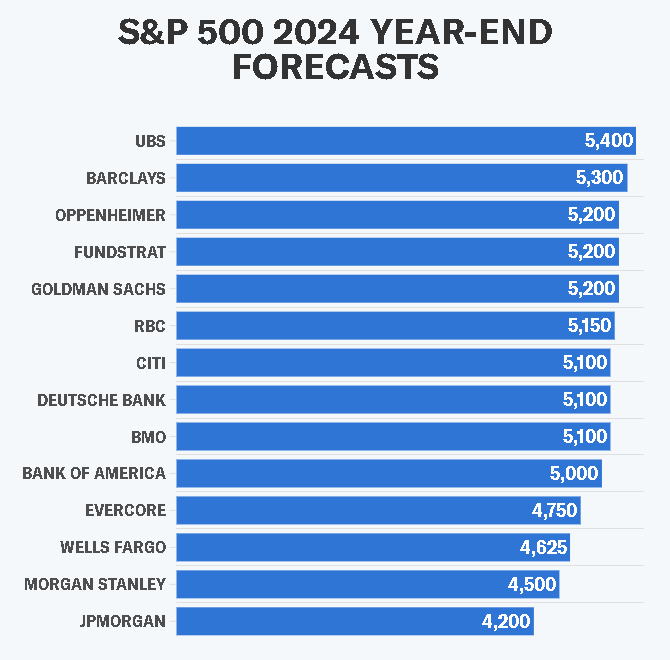

Barclays and UBS are readjusting their S&P 500 targets as well

Barclays recently adjusted its year-end price target for the S&P 500 upward to 5,300 from 4,800, citing better-than-expected earnings from Big Tech and the strong performance of the US economy.

What’s particularly noteworthy is that Barclays isn’t limiting the potential outcome to just 5,300. Venu Krishna, Barclays’ head of US equity strategy, suggested that if Big Tech earnings continue to beat expectations, their optimistic scenario of 6,050 for the S&P 500 could be within reach.

On February 20, UBS Global Research also increased its year-end forecast for the S&P 500 to 5,400, marking the highest projection among major global brokerages. This latest forecast suggests a potential 8% upside from the index’s recent close at 5,005.57.

Previously, UBS had raised its forecast to 5,150 in January, anticipating actions by the US Federal Reserve to lower interest rates, decrease inflation, and sustain expectations for strong corporate earnings.

The impressive performance of the S&P 500 has caught the eye of financial institutions and experts on Wall Street. There’s an anticipation that more of them will adjust their price targets in the upcoming weeks to reflect the market’s strength.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.