The stock market often becomes volatile as elections approach. With every new campaign cycle, investors, policymakers, and everyday people worry whether election years are good for the stock market. In this article, we’ll explore how elections impact stock market behavior, what the data reveals, and whether investors should welcome elections.

Receive Signals on US Congress Members' Stock Trades

Stay up-to-date on the trading activity of US Congress members. The signal triggers based on updates from the House disclosure reports, notifying you of their latest stock transactions.

Stock market during election years

Elections in general tend to bring uncertainty. Simply put, investors don’t like uncertainty because it makes it harder to forecast economic policies, taxes, and government spending, and as a result, market fluctuations increase. Political decisions can influence everything from taxes to international trade, impacting the stock market on a grand scale.

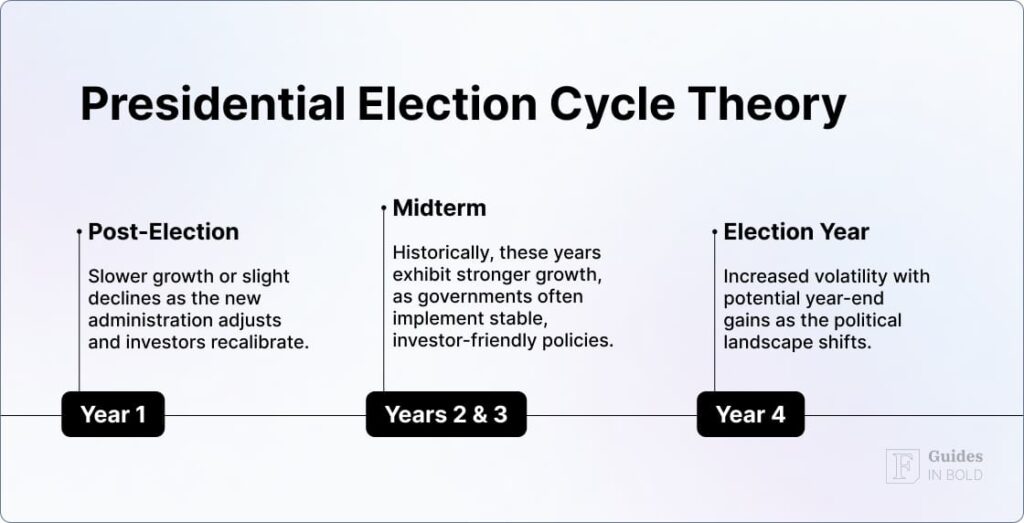

Stock market performance in election years indicates that the market typically experiences both gains and losses. According to the Presidential Election Cycle Theory, the stock market follows a four-year pattern:

- Year 1 (Post-election): Typically shows slower growth or even slight declines as the new administration adjusts and investors recalibrate;

- Years 2 and 3 (Midterm): Historically, these years exhibit stronger growth, as the government often implements more stable, investor-friendly policies;

- Year 4 (Election year): The stock market sees increased volatility but may end the year with overall gains.

Election types and their market impacts

Different types of elections impact the market differently, depending on the scope of power changes:

1. Presidential elections

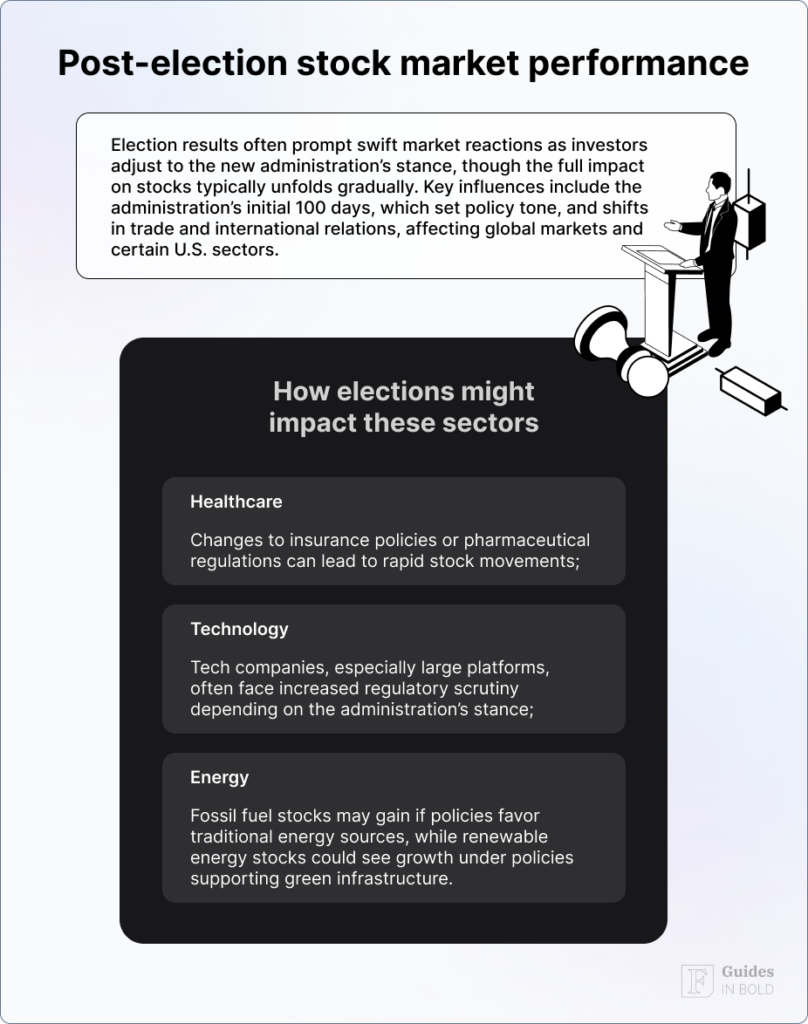

Presidential elections generally have the most significant impact, as a new president can shift policies on trade, energy, healthcare, and taxes.

In the past, when an incumbent president wins re-election, markets react positively, viewing this as a sign of stability. On the flip side, when a new president wins, markets may experience uncertainty as investors anticipate policy changes.

2. Midterm elections

Midterm elections can also sway the market, especially if they shift the balance of power in Congress. If one party gains control of both the House and Senate, it could either support or obstruct the president’s policies.

For example, a split Congress (with different parties controlling the House and Senate) may create a stable environment, as it’s less likely to pass extreme legislation.

Election impact on the S&P 500

The S&P 500 is one of the most commonly followed stock indices, as it offers a reliable picture of how the broader market responds to elections. Studies show that election years often bring increased market activity but not always predictable returns.

Here’s a look at average S&P 500 annual returns in recent election years:

| Year | Type of election | S&P 500 return |

| 2016 | Presidential | +9.54% |

| 2018 | Midterm | -6.24% |

| 2020 | Presidential | +16.26% |

| 2022 | Midterm | -19.44% |

What studies show about election volatility

In a 2017 study titled The Price of Political Uncertainty: Evidence from the 2016 US Presidential Election and the US Stock Markets, Jamal Bouoiyour and Refk Selmi explored how political uncertainty stemming from presidential elections affects stock market volatility.

The study used an event-study methodology to examine abnormal return behavior around the election date and found that political uncertainty is greater before the elections but is resolved once the election outcome is determined.

“There is bountiful evidence that political uncertainty stemming from presidential elections or doubt about the direction of future policy make financial markets significantly volatile, especially in proximity to close elections or elections that may prompt radical policy changes.” — Bouoiyour and Selmi

Why do elections matter to investors?

Investors watch elections closely because new policies can impact entire industries. For instance, a president favoring renewable energy might boost solar and wind stocks, while a candidate supporting fossil fuels might uplift the oil and gas industries.

That said, here are some ways election outcomes can impact the market:

- Policy shifts: Tax changes, trade agreements, healthcare reforms, and other significant policies influence different sectors. For instance, higher corporate taxes can reduce profit margins, leading to declines in stock values for large corporations;

- Economic stability: Markets tend to favor stability, and predictable government policies create a favorable investment climate. When government policy becomes uncertain, such as during elections, it creates risk and discourages investors.

Campaign promises and investor sentiment also drive election impact on the stock market. Media-fueled optimism or fear can lead to dramatic swings as investors speculate on how policies might favor or challenge specific sectors. Polling data, debates, and campaign shifts keep markets on edge, with sentiment-driven volatility peaking near election day.

Should investors adjust their portfolios during election years?

Timing the market during election years typically proves less effective than maintaining a balanced, diversified portfolio. A general approach is to consider both the potential risks and opportunities of the policies being debated.

How to track election-related stock movements?

Many investors rely on tools that provide real-time updates to stay ahead during election cycles. A solid example is Finbold Signals, which offers timely insights for tracking institutional investors, politicians’ trading activities, and insider trading patterns.

These insights can help you as an investor understand how political figures and large institutions position themselves during critical moments, providing valuable context for making informed decisions.

Receive Signals on US Senators' Stock Trades

Stay up-to-date on the trading activity of US Senators. The signal triggers based on updates from the Senate disclosure reports, notifying you of their latest stock transactions.

Pros and cons of investing in election seasons

Before we wrap up, here are the potential benefits and drawbacks of investing during election years:

Pros

- Opportunity to benefit from policy-driven trends;

- The market has shown resilience, often recovering quickly post-election;

- Election-driven dips may present buying opportunities for long-term investors.

Cons

- Increased volatility can lead to short-term losses;

- Predicting election outcomes and their effects is challenging;

- Policy shifts could negatively impact specific sectors, making targeted investments riskier.

The bottom line

In summary, election years bring increased volatility as the market reacts to anticipated policy changes and investor sentiment shifts. While history shows patterns, like increased market strength in pre-election years, the best approach for investors is often a balanced, long-term strategy.

Rather than attempting to time the market based on election outcomes, it’s better to consider tools like Finbold Signals to stay informed about institutional and political trading trends.

Receive Signals on US Congress Members' Stock Trades

Stay up-to-date on the trading activity of US Congress members. The signal triggers based on updates from the House disclosure reports, notifying you of their latest stock transactions.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs

Are election years good for the stock market?

Elections can increase market volatility as investors react to potential policy shifts. However, markets often rebound post-election once uncertainty subsides. Over the past few decades, the third year of a presidential term shows the strongest market gains, with election years typically seeing moderate gains on average.

Why does market volatility increase during election years?

Market volatility rises in election years due to the uncertainty about policy changes that could affect taxes, trade, healthcare, and other key areas. Driven by campaign promises and polling data, investor sentiment can fuel this volatility as people try to anticipate which industries might benefit or face new challenges depending on the election outcome.

How to invest during an election year?

Experts typically recommend a balanced, long-term approach over trying to time the market based on election outcomes. Election-related volatility tends to be short-lived, so a diversified portfolio may be more resilient than one based on speculative, election-driven changes.

What stock do well in election years?

In election years, defensive sectors like utilities and consumer staples often perform well due to their stability amid uncertainty, as investors seek safer options. Also, infrastructure and renewable energy stocks may gain attention if campaign promises focus on these areas, depending on the policy outlook of leading candidates.

How can I track investment trends around elections?

Tools like Finbold Signals offer valuable insights, providing updates on institutional investing, insider trading, and politicians’ stock trades. These resources can help investors stay informed about key market moves during election seasons without needing to monitor trends constantly.

What is the Presidential Election Cycle Theory?

The Presidential Election Cycle Theory suggests that the market performs best in the third (pre-election) year and remains steady or slightly volatile in election years. While historical data supports this pattern, specific factors like global events and economic conditions also significantly influence outcomes, so it’s essential to consider the theory alongside current market conditions.