Summary: Saving money is hard, so it’s vital you make the most of any amount you successfully set aside. Stay with us as we unveil our top pick for the best interest rate savings account for 2026 – Interactive Brokers (IBKR). Their offering might just surprise you in terms of maximizing your hard-earned savings.

Best Platform for Worldwide Stock Trading & Investing

-

Highly trusted multi-asset broker with clients in over 200 countries

-

Trade on 150 markets globally from a single platform (stocks, ETFs, futures, currencies, crypto & more)

-

Low commissions starting at $0 with no platform fees or account minimums

-

Easily fund your account and trade assets in 26 currencies

-

IBKR pays up to 4.58% interest on cash balances of $10k or more

How to choose a savings account?

When picking the savings account that’s the right one for you, compare them based on the following characteristics:

- Interest Rate/APY: The most important thing to look for in a savings account is its interest rate or annual percentage yield (APY). The higher the interest rate, the faster your savings grow passively;

- Fees: Opt for a savings account with minimal or no fees, allowing more of your savings to stay intact and continue earning interest. The fewer the fees, the more beneficial the account is to you;

- Minimum balance: Certain savings accounts stipulate a minimum deposit to open an account. Some may also require maintaining a specific balance in the account to qualify for the highest APY. For instance, Interactive Brokers provides its top yield to customers who maintain a minimum cash balance of $10,000. If this threshold is not met, the yield reduces to a lower percentage;

- Convenience: While both brick-and-mortar and online banks offer online and mobile banking solutions, some may be more user-friendly than others. If you want to get in-person support, you might be better off with a brick-and-mortar bank (although you may find high-yield savings accounts are much more common at online banks);

- Deposit insurance: Make sure your deposits are insured by the relevant authorities, such as the Federal Deposit Insurance Corporation (FDIC);

- Other accounts: If you like to do all your banking in one place, look into what other bank accounts are available at your chosen financial institution. Some banks also offer added benefits to customers who open multiple accounts, which could help sway your decision if you’re undecided:

- Liquidity: Reflect on the ease and speed at which you can access your funds. Understanding these restrictions is vital, as you don’t want to be caught in a situation where you can’t access your money when needed. While high-yield savings accounts may offer superior interest rates, they may also require longer withdrawal notice periods, impacting liquidity. Make sure you balance your appetite for a good return with your need for quick access to your money.

Where to open a savings account?

While you might be familiar with Interactive Brokers as a stockbroker, they also offer attractive yields on your deposits.

Best Platform for Worldwide Stock Trading & Investing

-

Highly trusted multi-asset broker with clients in over 200 countries

-

Trade on 150 markets globally from a single platform (stocks, ETFs, futures, currencies, crypto & more)

-

Low commissions starting at $0 with no platform fees or account minimums

-

Easily fund your account and trade assets in 26 currencies

-

IBKR pays up to 4.58% interest on cash balances of $10k or more

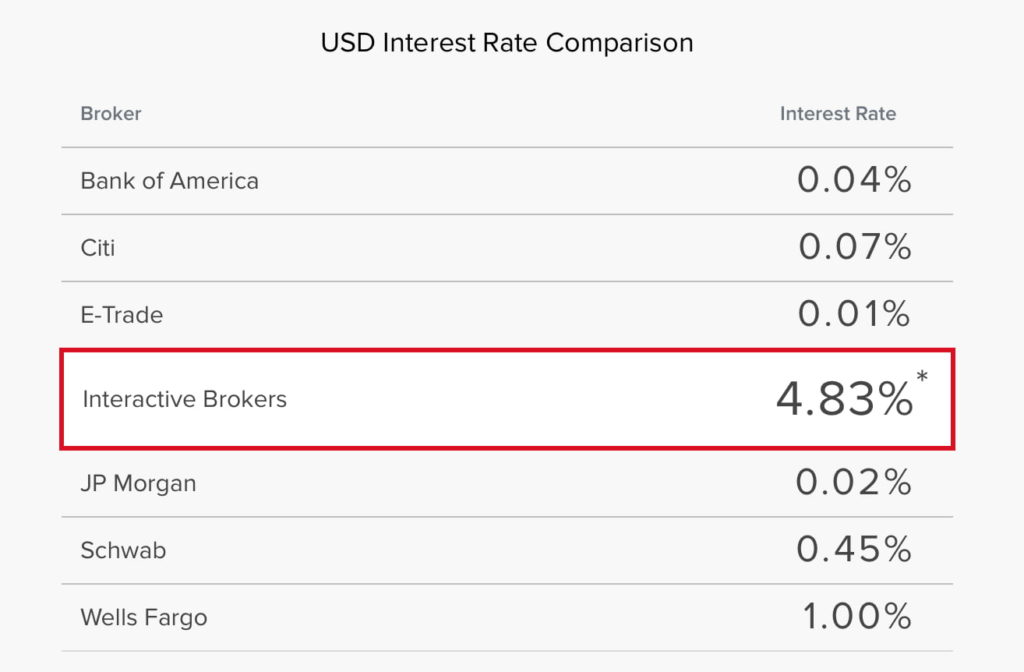

Indeed, Interactive Brokers clients can expect to earn up to USD 4.83% on instantly available cash balances exceeding $10,000, as of January 2024. Unlike other brokerages offering considerably lower rates, IB credits interest directly to the client’s accounts so that the cash is available immediately.

Moreover, with Interactive Brokers’ uncomplicated Cash Management service, clients can utilize these cash balances for various trading activities and transactions from a single account.

Note

Interactive Brokers calculates the interest paid using the Fed Funds rate as the benchmark for USD, subtracting 0.5%. As interest rates increase, so do earnings for Interactive Brokers’ clients. The Cash Management service provided by Interactive Brokers offers investors a simple means to earn at superior rates and manage their finances without the need for multiple accounts and services.

On top of the USD 4.83% on cash balances, IBKR’s Cash Management solution includes the following features (US users only):

- Borrowing: Borrow at rates ranging from USD 5.58% to 6.83% using a single brokerage account;

- Bill payments: Leverage the Bill Pay feature to pay any company or individual in the United States via electronic check;

- Card use: With the IBKR Debit Mastercard®, clients can make purchases or withdraw cash from ATMs at millions of locations globally, free of late fees or foreign transaction charges;

- Contactless payments: The Debit Card can be linked with Apple Pay and Samsung Pay for touch-free purchases or with PayPal and Venmo;

- Easy deposits: Utilize the mobile app for depositing checks anywhere or register for automatic payroll deposits;

- Security: Interactive Brokers’ robust financial standing and conservative business management safeguard both the company and its clients.

Plus, as a brokerage, IBKR will enable you to invest globally in stocks, options, futures, forex, bonds, and ETFs from a single unified platform.

Note

Best Platform for Worldwide Stock Trading & Investing

-

Highly trusted multi-asset broker with clients in over 200 countries

-

Trade on 150 markets globally from a single platform (stocks, ETFs, futures, currencies, crypto & more)

-

Low commissions starting at $0 with no platform fees or account minimums

-

Easily fund your account and trade assets in 26 currencies

-

IBKR pays up to 4.58% interest on cash balances of $10k or more

How to open a savings account? Step-by-Step

Opening a savings account can generally be done online or in person. The process varies slightly among different institutions. Here are the general steps you would typically follow:

- Decide on the financial institution and account type: Determine where you’d like to open your account. This could be a traditional bank, a credit union, or a neobank. Think about the determining factors mentioned earlier, such as interest rates and fees;

- Review the requirements: Different accounts have different requirements. Some might require a minimum deposit to open an account or maintain a minimum balance to avoid fees. Make sure you understand these requirements before you proceed;

- Gather your personal information: To open an account, you’ll need to provide some personal information. This typically includes your Social Security number (or other identification number for non-US residents), date of birth, and contact information like your residential address, email address, and mobile number. You will probably also need a valid form of ID, like a passport or a driver’s license;

- Register: Go to the bank’s website and navigate to the “open an account” section. Conversely, if you’re opening an account in person, visit the branch during business hours. Then, fill out the application form with your personal information;

- Fund your account: After registering, you can fund your account. This can often be done with a transfer from another bank account, by mailing in a check, depositing a check using your new bank’s mobile app, or transferring with a bank wire. Apart from wire transfers, there are typically no fees or costs with transferring funds to or from an online savings account;

- Set up your account: Once your account is open, set up online banking if available, which will enable you to check your balance and transaction history, transfer money, make investments, pay bills, etc.

Note

How are savings accounts taxed?

The interest you earn on a savings account is taxable by the Internal Revenue Service (IRS) in the United States and must be reported on your tax return. The specifics of how savings accounts are taxed can depend on the exact type of account and the individual’s tax situation. Here’s a general overview:

- Interest is taxable: The interest you earn in a savings account is considered income, much like wages from a job or income from investments. As a result, you are required to report this income on your annual tax return;

- Form 1099-INT: If you earn $10 or more in interest from a savings account during the tax year, the financial institution that holds your account will typically send you a Form 1099-INT. This form details the amount of interest you earned during the year. You will need this information when you file your taxes;

- State and local taxes: Depending on where you live, you may also owe state and/or local taxes on interest income.

Important

Do I need a savings account?

Anyone can benefit from a savings account, regardless of their financial standing.

In fact, a high-yield savings account can significantly bolster your savings and even speed up your journey toward your financial goals, whether buying a car, planning a dream wedding, or preparing for retirement.

As a result, researching the various savings account offerings to find the highest interest rate (rather than settling on an account simply because it’s at a familiar institution) is a task well worth the effort.

Remember, however, the highest interest rate isn’t the only factor to consider. Look for FDIC-insured institutions, evaluate the reputation and stability of the financial institution, and understand any possible fees or conditions associated with the account, as well as the additional features or benefits on offer. Ultimately, the best savings account for you is one that meets your needs and helps you save efficiently.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs about best interest savings accounts

How much interest will I earn in a savings account?

According to the FDIC, the national average APY on savings accounts is 0.46%. Interactive Brokers, on the other hand, offers 4.83% on cash balances exceeding $10,000.

Why do I need a savings account?

A savings account is an excellent place to store your emergency fund as it earns interest. Additionally, it is well-suited for reaching short-term financial goals like being able to afford a down payment or a trip. For a long-term goal like saving for retirement, on the other hand, it’s recommended to invest your money rather than park it in a savings account.

Can I open a savings account online?

Yes, online banks, credit unions, or other financial institutions like Interactive Brokers typically pay the highest interest rates on savings accounts, and all allow you to open an account from the comfort of your home.

Do savings accounts have fees?

Certain savings accounts come with monthly maintenance costs. Ideally, you’ll look for one that has minimal fees or no fees at all. For instance, Interactive Brokers does not charge account maintenance or inactivity fees.

Best Platform for Worldwide Stock Trading & Investing

-

Highly trusted multi-asset broker with clients in over 200 countries

-

Trade on 150 markets globally from a single platform (stocks, ETFs, futures, currencies, crypto & more)

-

Low commissions starting at $0 with no platform fees or account minimums

-

Easily fund your account and trade assets in 26 currencies

-

IBKR pays up to 4.58% interest on cash balances of $10k or more