In this guide, we’ll examine what passive income is, the five popular passive income investment ideas, methods to earn passive income, how they work, how much you can expect to make, and limitations to consider.

Best Crypto Exchange for Intermediate Traders and Investors

-

Invest in cryptocurrencies and 3,000+ other assets including stocks and precious metals.

-

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

Copy top-performing traders in real time, automatically.

-

eToro USA is registered with FINRA for securities trading.

What is passive income?

There are two primary types of income: passive and active. Active income is exchanging time for money, where your earnings are directly related to how much time you work. Passive income, on the other hand, is a way of making money without active participation and isn’t directly linked to how many hours you’ve worked. Hence, one of the best passive income ideas is passive investing.

What is passive investing?

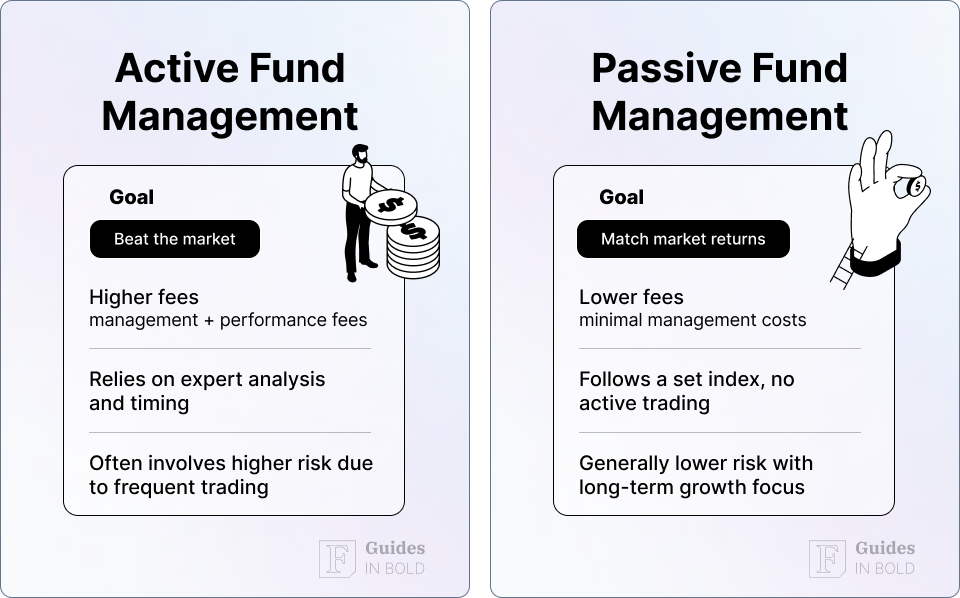

There are two ways of investing: passive vs active investing. Passive investing is an overarching term for different investing strategies that generate consistent, passive income gradually, whereas active investing requires constant attention, research, and management of the portfolio.

Passive investing is one of the best ways to make passive income. It is a long-term investing method, also known as the buy-to-hold strategy, which means buying a security or asset and keeping on to it long-term with the aim that this investment keeps generating regular, passive income. For example, investor and author Robert Kiyosaki particularly focuses on passive income investing strategies in his best-selling book “Rich Dad, Poor Dad.”

How to make passive income?

Some of the best passive income ideas are dividend investing, crypto staking, P2P investing, index fund investing, and investing in REIT’s. This guide will inspect these five passive income ideas or passive investing strategies you can use to earn passive income.

The opportunities and requirements to generate passive income differ depending on the passive income type. Still, they generally call for an up-front investment that continually generates income flows without requiring the investor to monitor or actively adjust their holdings.

What is the difference between earned income, passive income, and investment income?

Earned income, passive income, and investment income are three distinct types of income, each with its own characteristics:

- Earned income: This is income generated from active work, such as wages, salaries, tips, and commissions. It’s money you earn from a job or self-employment. It typically requires direct involvement and effort on your part;

- Passive income: This type of income is generated from activities in which you are not actively involved on a day-to-day basis. Examples include rental income from property, earnings from a business in which you’re not actively involved, and royalties from intellectual property like books or patents. The key aspect of passive income is that it doesn’t require your direct, ongoing effort to continue earning it;

- Investment income: This comes from money you’ve put into financial assets like stocks, bonds, mutual funds or exchange-traded funds (ETFs), or interest from savings accounts. It includes dividends, interest payments, and capital gains. Investment income is generated from the money you’ve invested, rather than from your direct labor.

In short, earned income is from active work, passive income requires little to no daily effort, and investment income is derived from your financial investments.

Related reads:

- What is Value Investing?

- What is Momentum Investing?

- How to Buy and Sell Stocks?

- What is Liquidity Mining? | DeFi

- How to invest $500, $5k, $10k, $30k or $100k

Passive income ideas 2026: Best passive investing strategies

Here is our pick for the best passive income investment ideas for 2026:

- Dividend Investing

- Cryptocurrency Staking

- P2P Investing

- Index Fund Investing

- Real Estate Investment Trusts (REITs)

Let’s explore these options further.

#1 Dividend investing

Dividend investing is a method of buying shares that pay dividends to receive a regular income stream from your investments and is one of the easiest ways for investors to generate passive income. Compared to growth investing where profits are made through capital appreciation, dividend investing offers a passive income stream.

Dividends are payments that a corporation (typically publically traded companies) offers to shareholders. When an investor owns stocks that pay dividends, they are getting a share of the company’s profits.

Many investors expect regular payments as compensation for holding their money in the company, allowing them to secure a stream of income on top of any growth in their portfolio as its stocks or other holdings gain value (share price appreciation).

However, not all companies pay a dividend. Generally, based on various financial and economic factors, the board of directors decides if a dividend is desirable for their respective company. Dividends are commonly paid in cash distributions to the shareholders monthly, quarterly, or yearly.

Dividend yields can vary significantly between companies, and they can also fluctuate from year to year. So investors unsure about which dividend-paying stock to choose should stick to those that fit the dividend aristocrat label, meaning the company has at least a 25-year track record of paying out sizeable dividends.

Recommended video: Getting started with dividend investing

Best dividend stocks for passive income

Consider these factors when on the lookout for worthy dividend-paying stocks:

- Long-term profitability is a crucial consideration. Seek out companies with long-term profitability and earnings growth expectations between 5% and 15%;

- Strive to find companies with healthy and sustainable cash flow generation, which is needed to pay those dividends;

- A minimal five-year track record of solid dividend payouts, which signals continued dividend growth;

- Avoid dividend-paying companies that are burdened with excessive debt. Examine a company’s debt-to-equity ratio and avoid companies with debt-to-equity ratios higher than 2.00;

- On top of analyzing a specific company’s fundamentals, educate yourself about broader sector trends.

Pros and cons of dividend investing

Pros

- Potential for double profits: share price appreciation and dividends;

- regular payments;

- Companies tend to increase their dividend payout rate annually;

- Generally, low volatility as dividend-paying stocks tends to be large-cap companies with stable earnings and growth.

Cons

- Limited future growth potential;

- Lack of diversification;

- Dividends are not guaranteed; companies can choose to suspend dividend payouts during challenging times.

Best Crypto Exchange for Intermediate Traders and Investors

-

Invest in cryptocurrencies and 3,000+ other assets including stocks and precious metals.

-

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

Copy top-performing traders in real time, automatically.

-

eToro USA is registered with FINRA for securities trading.

Dividend investing typical returns

Historically, the average dividend yield (the percentage of the current share price you get annually in dividends) on S&P 500 index companies that pay a dividend fluctuates between 2% and 5%, depending on market conditions.

#2 Cryptocurrency staking

Cryptocurrency staking can present digital asset holders with a way of putting their digital assets to work without selling or trading them.

Staking crypto is similar to putting money in a high-yield savings account, hence it is one of the easiest passive income ideas. When you deposit money in a savings account, the bank takes those funds and typically lends them to others. In exchange, you receive a portion of the interest earned from lending.

Likewise, when you stake your digital assets, you lock up the coins to participate in operating the blockchain network and maintaining its security. In return, you can earn rewards calculated in percentage yields, typically much higher than interest rates offered by banks.

Watch the video: What is proof-of-stake? Earn passive income with staking (on Ethereum)

How does crypto staking work?

Staking is only possible via the proof-of-stake (PoS) consensus mechanism – a method blockchains use to select honest participants and verify new blocks of data being added to the network.

Network participants (validators or stakers) purchase and lock away a certain amount of tokens, incentivizing good behavior within the network. If the blockchain were to be corrupted through malicious activity, the native token associated with it would likely plummet in price, and the perpetrator(s) would stand to lose money. Staking, therefore, is an effective way of preventing fraud and errors in this process.

The most prominent cryptocurrencies you can stake include Ethereum (ETH), Cardano (ADA), Solana (SOL), Luna (LUNA), Avalanche (AVAX), Polkadot (DOT). In addition, most of the more well-known crypto exchanges and investing apps, such as Coinbase, Binance, and Kraken, offer staking opportunities on their platform.

Pros and cons of staking coins

Pros

- Lower entry requirements compared to mining;

- More energy-efficient than mining;

- More flexible between staking different coins compared to mining;

- Typically, higher returns than mining coins.

Cons

- Cryptocurrencies are highly volatile;

- Some coins require a minimum lock-up period making you unable to withdraw your assets;

- If you do decide to withdraw your assets from a staking pool, each blockchain has a specific waiting period before getting your coins back;

- Staking pools can be hacked, in which case you would lose the entirety of your staked funds. Furthermore, because the assets are not protected by insurance, there’s little hope of compensation;

- Highly technical, driving most non-technical investors to opt for staking services;

- Opportunity costs are particularly high;

- An added counterparty risk of the staking pool operator. If the validator doesn’t do its job correctly and gets penalized, you, too, might miss out on rewards.

Crypto staking typical returns

According to data collected by Staking Rewards, the average staking reward rate of the top 261 staked assets exceeds 11% annual yield. However, rewards can change over time.

Remember, fees also affect rewards as staking pools deduct fees from the rewards for their work, affecting the overall percentage yields. Therefore, you can maximize rewards by selecting a staking pool with low commission fees and a good track record of validating many blocks.

#3 P2P investing

Peer-to-peer (P2P) lending, also known as “social lending” or “crowdlending,” enables individuals to obtain loans directly from other individuals, removing the financial institution as the middleman. Currently, most P2P lending platforms operate in the UK and the US, with the trend slowly approaching Europe and some Asian countries.

P2P lending directly connects people with stagnant funds interested in lending to individuals in need of credit, enabling the lenders to earn higher returns from their investments and borrowers to access quick loans more conveniently (online) and transparently.

Lenders have the money they borrow reimbursed monthly in EMIs (equated monthly investments), including principal and earned interest income. The P2P lending platform collects the EMIs on behalf of the lender from the borrower and adds them to the lender’s escrow account from where the lender can withdraw or reinvest.

Another critical point is that lenders’ risk is diversified, meaning tens or hundreds of creditors with different risk profiles, demographics, and occupations invest in one loan. And as a result, reducing the loss in the event of the borrower’s insolvency since it’s shared between multiple investors. In addition, P2P lending platforms involve innovative products and processes to cut down on the time and effort needed to create a portfolio.

While the first P2P platform, Zopa, was launched in the UK in 2005, several others have since popped up, including Mintos, Neo Finance, Bondora, PeerBerry, Estate Guru, Profitus, and Debitum Network.

Recommended video: Peer-to-Peer lending explained in 1 minute

How does P2P lending work?

P2P lending earnings have the potential to become passive income through savvy investment choices.

Reinvestment

An investor can withdraw EMIs or reinvest them back in loans listed on the platform. Firstly, data shows that lenders who reinvest earn up to 10% more returns than those who don’t. Secondly, by activating reinvestment, lenders ensure that their monthly earnings automatically get reinvested in the same products or plans they have selected and continue to generate returns.

Automated Investment

P2P lending platforms provide automated investment options that reduce the time and effort required to build a portfolio, creating a straightforward process for you to add funds to auto-invest and select the various parameters which match your investment strategy with borrower profiles listed on the platform.

Systematic Income Generation Plans

The latest, most efficient, and least time-consuming method of investing in P2P lending is when many investors pool their funds into a single portfolio to achieve efficiency in portfolio building and management. The platform’s algorithm will disburse the pool money into a diverse mix of loans and loan products (with the repaying capacity) to provide high returns.

Pros and cons of P2P lending for investors

Pros

- P2P lending platforms are especially appealing to those who want high financial returns with minimal work;

- Low entry requirements: you can start investing with as little as 5 to 100 dollars;

- Demands less knowledge and experience than other popular investment methods (stocks or bonds). Many platforms have an automatic investment option.

Cons

- No insurance/government protection, no concrete regulations: The government does not provide insurance to the lenders in case of the borrower’s default;

- You may have to pay additional fees on top of the interest rate charged for the loan;

- It is not available to everyone: some jurisdictions do not allow P2P lending.

P2P lending returns

The amount of money you can earn differs from one platform to the next and from one jurisdiction to another. Therefore, ultimately, it is possible to make considerable amounts using P2P lending platforms, generally between 5% and 10% annually.

#4 Index fund investing

An index fund is a type of mutual fund or ETF with a portfolio designed to track the components of a financial market index, such as the S&P 500. Rather than choosing individual stocks for investment, you can own a slice of various companies by investing in index funds, which are one of the best and safest passive income ideas there is.

Index funds are affordable, enable greater diversification, are generally low risk, and generate attractive returns over time. Furthermore, index funds are commonly regarded as ideal core portfolio holdings for retirement accounts, like individual retirement (IRAs) or 401(k) accounts.

The Standard & Poor’s 500 index is one of the most famous indexes because the 500 companies it tracks include large, well-established U.S.-based businesses representing a vast range of industries. However, some other options include Nasdaq Composite, Dow Jones Industrial Average, and Wilshire 5000.

Index funds whose portfolio of stocks are designed to track S&P 500 include Vanguard 500 Index Fund Admiral Shares (VFIAX), Schwab S&P 500 Index Fund (SWPPX), Fidelity 500 Index Fund (FXAIX), Fidelity Zero Large Cap Index (FNILX), Rowe Price Equity Index 500 Fund (PREIX).

Watch the video: Warren Buffett: Why Most People Should Invest In S&P 500 Index

How to choose an index fund?

When buying an index fund, it’s essential to consider several different aspects. Foremost, consider how much risk you are willing to take for the return and the potential risks associated with the fund you’re interested in. Then, set up a strategy that fits your investment goals and compare transaction costs of funds that cover the same sector.

Here are some factors to keep in mind:

- Company size and capitalization;

- Location: some funds focus on stocks that trade on foreign exchanges or a combination of international exchanges;

- Business sector or industry;

- Asset type;

- Market opportunities: funds that examine emerging markets or other nascent but growing sectors for investment.

Pros and cons of investing in index funds

Pros

- Reliable performance/stability;

- Low costs;

- Transparency;

- Easy diversification.

Cons

- Lack of flexibility;

- Tracking error;

- Gradual returns;

- Management differences.

Average index fund return

The S&P 500 index serves as a benchmark of the overall performance of the U.S. stock market. It has returned a historic annualized average return of around 10.48% since its 1957 inception through end of 2024.

#5 Real Estate Investment Trusts (REITs)

REITs are companies that own, operate or finance income-producing real estate, such as farmland, apartments, self-storage facilities, data centers, office buildings, industrial facilities, and more.

REITs allow individual investors to collect dividends from real estate investments without buying, managing, or financing any properties; hence, it is one of the best passive income ideas. In addition, most REITs are publicly traded on major securities exchanges like stocks, making them highly liquid instruments (unlike physical real estate investments).

REITs can be classified based on how their shares are bought and held:

- Publicly Traded REITs are listed on a national securities exchange, where they are bought and sold by individual investors;

- Public Non-Traded REITs also registered with the SEC but don’t trade on national securities exchanges;

- Private REITs aren’t registered with the SEC and don’t trade on national securities exchanges.

According to Nareit, an estimated 145 million U.S. investors own REITs either directly or through their retirement savings and other investment funds.

Watch the video: How do REITs work?

How to find passive real estate investment opportunities?

To find passive real estate investment opportunities, begin by setting up a brokerage account, where you’ll be able to buy and sell REITs just as you would any other stock.

If you don’t want to trade individual REIT stocks, it can make a lot of sense to buy an ETF or mutual fund that vets and invests in a vast selection of REITs. You get immediate diversification and lower risk, and investing in them is less time-consuming than researching individual REITs for investment.

Some of the top-performing publicly listed REITs in 2024 include Diversified Healthcare Trust (DHC), Angel Oak Mortgage Inc. (AMOR), and Seven Hills Realty Trust (SEVN).

And some of the best-performing property-focused ETFs of 2024 include Vanguard Real Estate ETF, iShares U.S. Real Estate ETF, and Schwab U.S. REIT ETF.

Pros and cons of investing in REITs

Pros

- High liquidity (publicly traded REITs);

- Diversification;

- Low volatility;

- Transparency;

- Steady cash flow through dividends since REITs are required to pay 90% of their yearly income as shareholder dividends, offering some of the beefiest dividend yields on the market;

- Higher returns compared to equity indexes;

- Attractive risk-adjusted returns.

Cons

- Low growth;

- Low liquidity (especially non-traded and private REITs);

- Dividends are taxed as regular income;

- Subject to market risk;

- Potential for high management and transaction fees;

- Non-traded REITs can be expensive; the cost for an initial investment in a non-traded REIT can go for $25,000 or more;

- Heavy debt, REITs are usually among the most indebted companies.

Historical REIT returns

Real estate investment trusts are one of the top-performing asset categories out there. The FTSE NAREIT Equity REIT Index is what a majority of investors use to measure the performance of the U.S. real estate market.

Between 2010 and 2020, the index’s average annual return was 9.5%. And more recently, the three-year average for REITs between November 2017 and November 2020 was 11. 25%, comfortably above the S&P 500 and the Russell 2000, which racked up at 9.07% and 6.45%, respectively.

In conclusion

Many people worldwide earn income by making savvy investment choices and implementing a system that helps them exploit their skills with minimal labor. Passive income is one of these ways and refers to earnings derived from various sources without putting in a considerable amount of time, energy, effort, or other resources.

However, it is crucial to understand that passive income often requires research and relevant knowledge before you start to earn money and a sometimes hefty up-front investment.

For most people, creating this new revenue stream will involve investing money made from more conventional means like employment or investing our time building a source of income from the ground up.

Read also:

- 6 Basic Rules of Investing

- 15 Top-Rated Investment Books of All-Time

- 10 Best Stock Trading Books for Beginners

- 17 Common Investing Mistakes to Avoid

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs about passive income

What is passive income?

Passive income is a cash stream that demands little or no daily effort to maintain and isn’t directly linked to how many hours you’ve worked. Passive income generally calls for an up-front investment that continually generates income flows without requiring the investor to monitor or actively adjust their holdings.

What's a typical return for passive investing?

Returns vary between passive income approaches and strategies, and the risk you’re willing to take. But, on average, you can expect returns anywhere from 5% to 11%, which is still a lot more profitable than low-yield savings accounts.

What are common mistakes to avoid when passive investing?

You should never invest money you cannot afford to risk; always consider your risk tolerance and potential returns, and don’t let emotions get the better of you. In addition, try not to buy into stocks you don’t understand, and be sure to diversify your portfolio. Finally, perhaps the biggest mistake is not investing at all, as inflation rates will often erode your hard-earned cash sitting on low-yield savings accounts.

How to learn passive investing?

There are endless avenues to learn passive investing online. You can find both paid and free courses, but try to avoid ‘get rich fast’ scams. Another great source is Youtube and verified financial websites that provide various guides and ideas completely free. Additionally, diving into books on passive income can significantly enhance your understanding and strategy.

Is passive income taxable?

Yes, passive income is taxable. Income from rental properties, royalties, and earnings from businesses in which you are not actively involved are subject to taxation. The tax rate and rules can vary depending on the type and source of passive income, as well as your overall income level and tax bracket.

What is the difference between passive income vs active income?

Passive income is earned through sources where ongoing, active involvement is minimal or non-existent, such as rental properties, dividends from investments, or royalties from intellectual property. In contrast, active income is earned through direct, continuous work, like salaries, wages, and business income where you’re actively involved. Essentially, passive income typically involves initial effort followed by minimal involvement, while active income requires consistent effort and time.

Explain why you might not want to have passive income as your only source of income.

Having passive income as your only source of income can be risky due to its potential instability and unpredictability. Unlike a regular salary, passive income, such as rental income or dividends, can fluctuate and isn’t guaranteed. Economic downturns, market volatility, or unexpected expenses (like property repairs) can significantly impact these income streams. Moreover, relying solely on passive income may limit opportunities for active income growth, career advancement, and skill development.

How to earn passive income with crypto?

Earning passive income with cryptocurrency can be achieved through a process known as staking. Staking involves holding and locking up a certain amount of cryptocurrency in a wallet to support the operations of a blockchain network. In return for contributing to network security and operations, stakers receive rewards, typically in the form of additional cryptocurrency.

Why does passive investing typically do better than active investing?

Passive investing typically outperforms active investing because it incurs lower costs, avoids the risks of market timing, and benefits from the market’s long-term upward trend. Active management often fails to consistently outperform market benchmarks due to higher transaction fees, management costs, and the challenge of consistently making accurate market predictions. The passive approach, by tracking market indexes, minimizes these risks and expenses, allowing for potentially better net returns over the long term.

What is a passive real estate investment?

A passive real estate investment involves putting money into real estate ventures without requiring active management or day-to-day involvement from the investor. This can include investments in Real Estate Investment Trusts (REITs), where one invests in a portfolio of properties managed by professionals, or in real estate crowdfunding platforms, which pool money from multiple investors to fund real estate projects.

Highly Rated Stock Trading & Investing Platform

-

Invest in stocks, ETFs, options and crypto

-

Copy top-performing crypto-traders in real time, automatically.

-

0% commission on buying stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

eToro USA is registered with FINRA for securities trading.

![5 Passive Income Ideas [2023] | Investing for Beginners](https://assets.finbold.com/uploads/2022/04/5-Passive-Income-Ideas-2023-_-Investing-for-Beginners.jpg)