Institutional trading reports, when actually submitted, represent a treasure trove of invaluable information for more astute retail traders. That is, by strategically analyzing and copying institutional trading strategies, many traders have been able to gain an edge in the market, marginally outperforming their peers.

However, without a proper understanding of the data and a heavy dose of caution, relying on institutional data can lead to severe financial losses. In this guide, we’ll be covering some of the most common trading mistakes when relying on institutional trading data.

What is institutional investing?

What is institutional trading data?

Most often, the data includes details on:

- Trade volume: The number of shares or securities bought or sold;

- Ownership changes: The changes in ownership percentages that institutions have in a particular asset;

- Trade timing: The timing of when institutions enter or exit a position;

- 13F Filings: US-based institutional investment managers with over $100 million in assets must file a quarterly report known as Form 13F, which reveals their equity holdings.

Common trading mistakes to avoid when relying on institutional trading data

As mentioned, without a proper understanding of the data, relying on institutional trade information to carry you to success can backfire and undermine your success. Here are some of the key pitfalls to avoid:

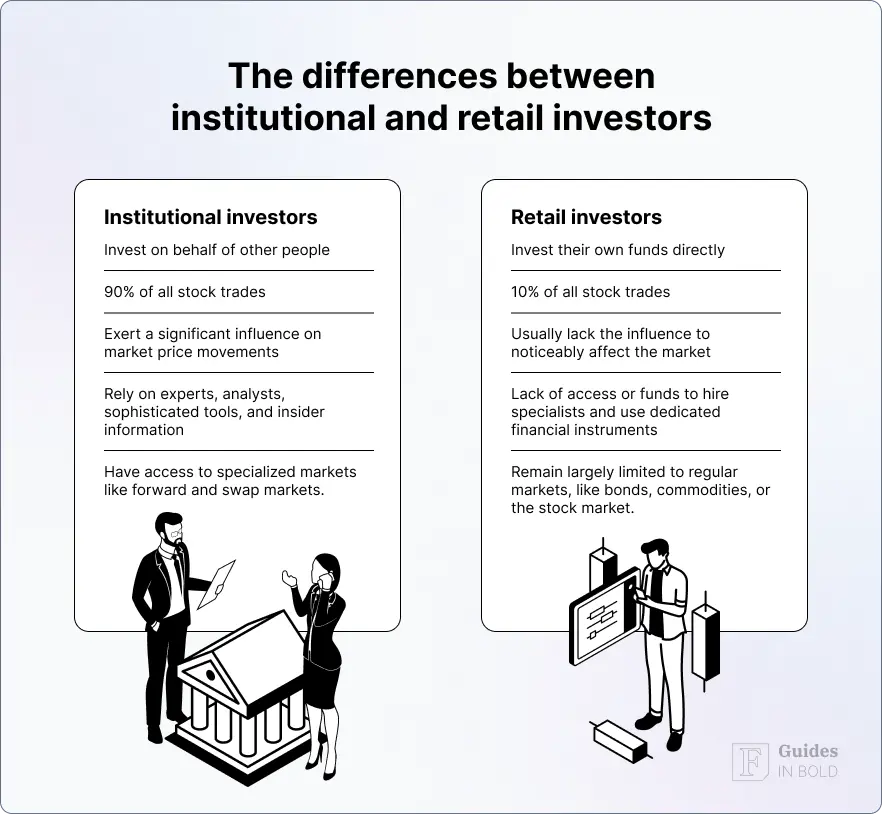

1. Believing retail and institutional investing is the same

A large number of retail traders assume that institutional trades can always be mimicked by retail investors. That is far from the truth.

The biggest differences between institutional and retail investors lay in capital size and market influence. The sheer amount of funds available to institutional investors allows them to trade stock in bulk, leaving a major impact on the market, often moving prices significantly. Few if any retail investors hold such power.

Moreover, institutional investors often have access to certain stocks and investment opportunities that are not available to the public, such as pre-IPO investments, angel investments, etc.

For example, they operate under different regulations, with financial authorities like the US Securities and Exchange Commission (SEC) imposing fewer restrictions on them compared to retail investors.

2. Assuming institutions are always right

Large institutions are often profitable, so that must mean they have impeccable trading strategies that lead to unquestionable profits, right? Wrong — institutional investors often face challenges in their trades, some of which include portfolio balancing or even regulatory requirements, which may not align with or even be relevant to a retail trader’s approach.

Institutions are likewise not immune to unforeseen market events and simple errors in judgment. They are run by people, after all, and people err. Consequently, retail traders should not blindly trust all institutional data but instead, use it as a potentially useful tool in their trading arsenal.

A 2020 study examined the reported sophistication of institutional traders in Korea and found that institutions don’t trade consistently with stock anomaly predictions since they are reluctant to hold highly overvalued and highly undervalued stocks:

“Our findings cast doubt on the widely accepted notion that institutions are highly skilled investors and that institutional arbitrage trading corrects any mispricing in the market. Instead, we find that institutions are reluctant to buy both highly overvalued and highly undervalued stocks. Even when institutions utilize anomalies, they merely use the characteristics passively to avoid stocks known to underperform. Because of this institutional preference, mispricing is magnified rather than corrected.”

— Kim et al. (2020)

3. Focusing solely on institutional data

As mentioned, institutional data is just one piece of the puzzle, and traders who ignore other market indicators, technical analysis, or macroeconomic trends can miss critical insights and nuances.

Even institutional trades rely on a wide variety of data, including proprietary research and market sentiment. Some institutional players may even have access to confidential insider information. Retail traders often lack access to this kind of information, so it’s unwise to mimic institutional moves without fully understanding what kind of reasoning led to them in the first place.

4. Ignoring the time lag

Institutional trading data takes time to be processed, so it often comes with a delay, sometimes by days or even weeks. In other words, by the time you have access to the desired information, the market conditions that made the trades under scrutiny possible will have likely changed. Consequently, institutional data is usually not helpful to retail day traders.

5. Overlooking market liquidity

Institutional trades are often large enough to impact market liquidity. In fact, institutional investors account for over 80% of stock transactions, meaning they essentially define the stock market by driving supply and demand and holding the largest positions in key companies.

Entire businesses can rise or fall based on the actions of mutual funds and investment firms. A 2014 study highlighted how institutional investors amplified the effects of the Great Recession, demonstrating their significant role in market dynamics.

Additionally, firms like Institutional Shareholder Services (ISS), which controls nearly half of the shareholder voting advisory market, show the impact institutional investors have in shaping corporate policies. This influence is particularly evident in the rise of environmental, social, and governance (ESG) investing, which has reshaped sectors like energy and technology.

Institutional investors are also a dominant force in broader market policies and trends. Their actions influence management decisions and can sometimes set controversial precedents, as seen in the 2021 GameStop (NYSE: GME) short squeeze. Retail traders who attempt to follow these moves may find themselves caught in price fluctuations that do not align with their strategies, leading to poor entry or exit points.

Why should you track institutional trading data?

Tracking institutional stock trades can give individual investors a lot of valuable insight into the market, especially in regard to:

- Market sentiment: Institutions have access to more comprehensive information, meaning their trades may reflect deeper insights into companies or industries;

- Stock price movement: Large trades by institutions can directly influence stock prices, especially in less liquid markets;

- Investment opportunities: Following institutional buying trends can help spot promising stocks early.

Institutional investors can drive stock market volatility due to the sheer size of their trades. In less liquid markets, their transactions can cause notable price shifts, creating opportunities or risks for individual investors. A 2005 study highlighted how large institutional trades often lead to spikes in stock returns and volumes, even without new information.

Recommended video: What is Insider Trading? Explained in 2 Minutes

How to track institutional stock trading?

There are several ways you can track institutional stock movements.

As mentioned, institutional investors must submit quarterly reports, called 13F filings, to the SEC. These reports reveal the stocks, bonds, and other investments held by institutions at the end of each quarter. You can access this data through the SEC’s EDGAR database.

For a more streamlined approach, you can use the notification system delivered by Finbold Signals, which offer real-time updates on institutional trading activity via email, Telegram, and Discord.

The bottom line

In conclusion, while institutional trading data can offer retail traders valuable insights, it is essential to approach it with caution. Misinterpreting the data, overlooking market liquidity, and ignoring the time lag can lead to significant financial losses. Retail traders must recognize that institutional investing operates on a different scale, with access to exclusive resources and market opportunities.

Therefore, relying solely on institutional data without a broader understanding of market dynamics, technical analysis, and individual risk tolerance can be a risky strategy. A balanced, well-informed approach is key to making the most of this data.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs

What is institutional trading data?

Institutional data refers to information pertaining to the trading activities of large financial institutions such as hedge funds, pension funds, mutual funds, insurance companies, and banks.

Who are institutional investors?

Institutional investors are large entities that pool funds to invest in securities, real estate, and other assets or to provide loans.

What is the difference between retail trading and institutional trading?

Institutional investors manage far larger capital than retail investors, so their trading volumes can include hundreds or thousands of shares in a single transaction. This massive scale enables them to make bulk purchases that impact overall market dynamics significantly.

What strategies do institutional traders use?

Institutional investors use various trading strategies, like fundamental and technical analysis, mass-trading models such as high-frequency trading and AI-driven algorithms, and so on.

What are the most common trading mistakes when trading based on institutional trading data?

The most common trading mistakes when trading based on institutional trading data include not understanding the differences between institutional and retail investing, assuming institutions always make the right investment choices, relying on institutional data alone and not doing more research, ignoring time lags between institutional filings and their public availability, and overlooking the sheer potential of institutions to affect the market.

How to track institutional trading?

You can track institutional trading via tracking tools such as Finbold Signals.