While the Stop Trading on Congressional Knowledge (STOCK) Act is meant to prevent Congress members from making investment decisions based on non-public information, political insider trading still prevails. In fact, during the peak of the COVID-19 pandemic, twelve US senators engaged in stock trades valued at up to $98 million, according to a 2020 article published by The New York Times.

As the debate on whether politician stock trading is unethical continues to raise questions regarding conflicts of interest, corruption, and social distrust, the inadequacies of current regulations become increasingly apparent, as do investor concerns regarding the fairness of the market. Consequently, exploring how the existing legal frameworks address these concerns becomes paramount for every investor.

Receive Signals on US Congress Members' Stock Trades

Stay up-to-date on the trading activity of US Congress members. The signal triggers based on updates from the House disclosure reports, notifying you of their latest stock transactions.

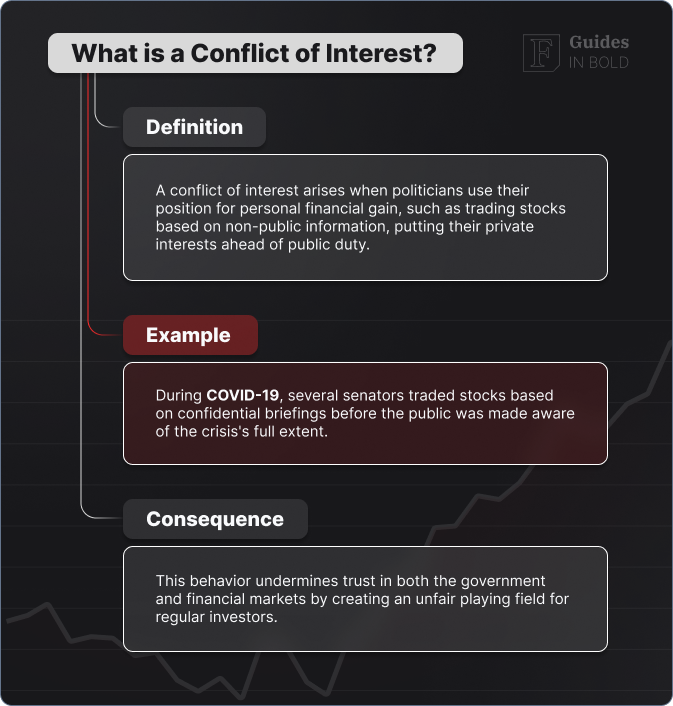

What is a conflict of interest?

“Congress should not be here to make a buck.”

— Senator Josh Hawley.

Given that politicians have a fiduciary duty to act in the public’s best interest, political insider trading highlights potential conflicts of interest, suggesting that personal gain is being prioritized over public responsibility. Social contract theory, a key idea in modern moral and political philosophy, emphasizes that society operates based on a collective agreement that ensures cooperation and fairness among all members.

Accordingly, a politician’s ethical obligations should align with principles of fairness, harmlessness, property rights, and fiduciary responsibility. Therefore, while trading based on non-public information may not be inherently unethical, it raises significant concerns when it leads to a conflict of interest.

According to a 2022 study, senator stock purchases are often influenced by exclusive information. Consequently, stocks acquired by senators tend to outperform the market, yielding returns approximately 4.9% higher than the S&P 500 index over three-month periods following the trades.

The same study finds elevated levels of information asymmetry (AIV) around the dates of these trades. This suggests that more individuals are likely trading based on the same congressional knowledge. Notably, senator transactions see AIV levels significantly higher than those seen around earnings announcement days.

These statistics lead to a loss in investor confidence and diminishing belief in the integrity of governmental decision-making.

“Overall, our results showing high AIV around politicians’ trades support the view that senators’ use of inside political information represents only the tip of the iceberg. Many more legislators, politicians, and selected market participants have access to the same information but do not file their returns.”

— Hanousek Jr., et al. (2022)

The STOCK Act

Political trades are heavily scrutinized, and despite the growing polarization of American politics, all parties are becoming louder in their demands to reform congressional insider trading.

The STOCK Act is legislation aimed at curbing congressional insider trading. It prohibits Congress members (and employees) from using congressional, non-public information for personal gain and makes mandatory public disclosure of financial transactions (stocks, bonds, commodities) exceeding $1,000 within 45 days.

Additionally, the act mandates a one-year study of the political intelligence industry and full disclosure of mortgage terms by Congress members. Likewise, it prohibits special access to initial public offerings (IPO) and revokes federal pensions for members convicted of public corruption-related felonies.

Enhancing monitoring and transparency, the STOCK act helps dissuade politicians from leveraging their position for financial gain.

Regulatory limitations and loopholes

The existing legal framework may be robust, but it has its limitations.

For example, there are currently no regulations preventing politicians from holding shares in companies regulated by their committees. In addition, while Rule 37(4) of the Senate Ethics Manual prohibits politicians from leveraging their positions for financial interests, enforcement of the rule remains an issue, a 2023 study finds.

Likewise, the study points out that Congress is responsible for funding the Securities and Exchange Commission (SEC), which could create a conflict of interest and complicate efforts to investigate congressional members. During Congressional hearings, former SEC Director of Enforcement Robert Khuzami testified that insider trading laws had not been enforced against Congress members, noting that:

“[T]here does not appear to be any case law that addresses the duty of a member [of Congress] with respect to trading on the basis of information the member learns in an official capacity.”

— Former SEC Director of Enforcement Robert Khuzami

Richard Burr and the 2020 congressional insider trading scandal

2020 saw a political scandal alleging that several US Senators violated the STOCK Act by selling stocks before a major market crash on February 20, 2020, using insider information. The Department of Justice (DOJ) launched an investigation on March 30, 2020, but no charges were filed, and the case was eventually closed.

Among those under investigation was Senator Richard Burr. The stock sales took place a week before the US and global equities markets went down due to the COVID-19 pandemic, following briefings Burr had received regarding the outbreak threat. Court filings by the SEC reveal that Burr had a brief, questionable conversation with his brother-in-law Gerald Fauth on the same day as the stock transactions.

Although the reasons behind the Department of Justice’s decision to drop its investigation into Burr remain unclear, a 202 study suggests it could have been impossible to prove insider trading under current laws.

After all, to successfully prove a STOCK Act violation, prosecutors must demonstrate that the information acted upon was really obtained by leveraging one’s position. However, such information can be shielded from scrutiny due to the Constitution’s Speech or Debate Clause.

Moreover, with a wealth of information available from public sources, proving that the information used in trading was indeed nonpublic becomes increasingly challenging. After all, Burr himself asserted that he “relied solely on public news reports to guide [his] decision.”

Receive Signals on US Senators' Stock Trades

Stay up-to-date on the trading activity of US Senators. The signal triggers based on updates from the Senate disclosure reports, notifying you of their latest stock transactions.

Examining politicians’ trades in industries they regulate

As mentioned, the STOCK Act was enacted to curb insider trading and conflicts of interest among Congress members. However, many have failed to comply with the requirements mandated by the SEC, citing ignorance of the law and clerical errors as excuses. As a result, some lawmakers have called for a complete ban on members of Congress trading individual stocks.

Although seriously considered at one point, Democrats, holding majorities in both the House and Senate, did not advance it. Consequently, the effort to ban stock trading among lawmakers came to a halt, and any serious push toward a general ban would require bipartisan cooperation.

Here are the lawmakers recently found to have violated the STOCK Act or are suspected by some to have done so:

#1 Josh Gottheimer

In November 2021, Josh Gottheimer and his wife traded up to $15,000 worth of stock but did not report it until August 2022. Gottheimer also traded over $60 million in contracts, all of which involved call options on Microsoft (NASDAQ: MSFT) stock.

On September 6, 2024, Gottheimer filed 32 stock trades amounting to nearly $480,000, reflecting transactions made throughout the previous month. Some of these purchases were made over multiple trading sessions, according to filings.

Among the most notable trades, Gottheimer sold up to $30,000 worth of Advanced Micro Devices (NASDAQ: AMD), purchased up to $30,000 in Coca-Cola (NYSE: KO), bought up to $15,000 in Goldman Sachs (NYSE: GS), and both bought and sold up to $50,000 in Microsoft stock again.

#2 Tommy Tuberville

Amid ongoing debates over whether Congress and Senate members should be allowed to trade stocks, Senator Tommy Tuberville filed five stock sales and one purchase. Specifically, Tuberville sold up to $50,000 worth of Apple (NASDAQ: AAPL) shares, up to $15,000 in CVS (NYSE: CVS) stock, up to $100,000 in Eaton Vance Floating Rate Fund (MUTF: EIBLX), up to $50,000 in Medtronic (NYSE: MDT), and up to $50,000 in United Parcel Service (NYSE: UPS).

His only reported purchase, however, was up to $100,000 worth of shares in the American Funds Bond Fund of America (ABNFX) F2 class, executed on August 26, the same date as the other reported trades. In early 2024, Tuberville stopped reporting his stock trades following the launch of a trading bot by Nancy Pelosi Stock Tracker, a platform monitoring US politicians’ stock activities. This pause put a stop to a streak of 38 consecutive months of trading.

Receive Signals on US Senators' Stock Trades

Stay up-to-date on the trading activity of US Senators. The signal triggers based on updates from the Senate disclosure reports, notifying you of their latest stock transactions.

#3 Michael McCaul

Representative Michael McCaul reported 306 trades totaling around $25 million on September 18, 2024. These trades, executed between August 1 and September 18, indicate that McCaul waited until the last possible moment to file his Congressional trades, as permitted by law.

Among the large batch of trades, some of the more notable purchases include shares of Meta (NASDAQ: META) and Bayer (ETR: BAYN). On the sell side, McCaul divested significant holdings in Alphabet (NASDAQ: GOOGL), Microsoft (NASDAQ: MSFT), Mastercard (NYSE: MA), Adobe (NASDAQ: ADBE), Uber (NYSE: UBER), Visa (NYSE: V), ASML (NASDAQ: ASML), and Apple (NASDAQ: AAPL).

This was not McCaul’s first controversy. In April, he made a substantial investment in Meta just before voting in favor of the TikTok ban, a move that attracted widespread criticism. Additionally, he sold Nvidia (NASDAQ: NVDA) stock shortly before its downturn in early August, while also buying shares of Advanced Micro Devices around the same time.

McCaul’s trading strategy, in particular his targeted sales of Goldman Sachs stock accompanied by purchases in other financial firms, also raised eyebrows. For instance, his sale of Taiwan Semiconductor (NYSE: TSM) stock while chairing the China Task Force on the Foreign Affairs Committee roused suspicion surrounding his August trades.

The consequences of the lack of regulation on congressional trades

Violations of the STOCK Act are frequent, yet penalties remain rare. If the SEC enforced the STOCK Act, it’s likely that Congress members would begin to adhere more strictly to the law. The SEC also holds the authority to regulate government officials’ trading activities through rulemaking. That is, if Congress fails to pass a new legislation, the SEC could choose to address it.

However, this approach could backfire since agencies like the SEC are limited by the powers delegated by Congress, a 2023 study predicts. Moreover, the SEC has shown little interest in regulating insider trading within Congress, aside from a recent investigation into Senator Richard Burr, which concluded without further action.

As the same study reminds us, Congress inaction has led to outside actors stepping in to capitalize on these trades, meaning it’s possible that regulatory bodies may need to enforce existing laws themselves. Despite renewed bipartisan public interest in stricter regulation, there is a real chance that no substantial legislation will pass soon. This would be detrimental, as information asymmetry will allow Congress members to grow wealthier while the public remains uninformed.

The COVID-19 pandemic exposed the willingness of lawmakers and government officials to exploit nonpublic information. By March 2020, all major federal agencies were involved in the pandemic response, and that month saw the most active trading by federal officials in recent history. Officials reported more than 11,600 trades, a 44% increase compared to other months.

Proposed reforms to combat conflicts of interest

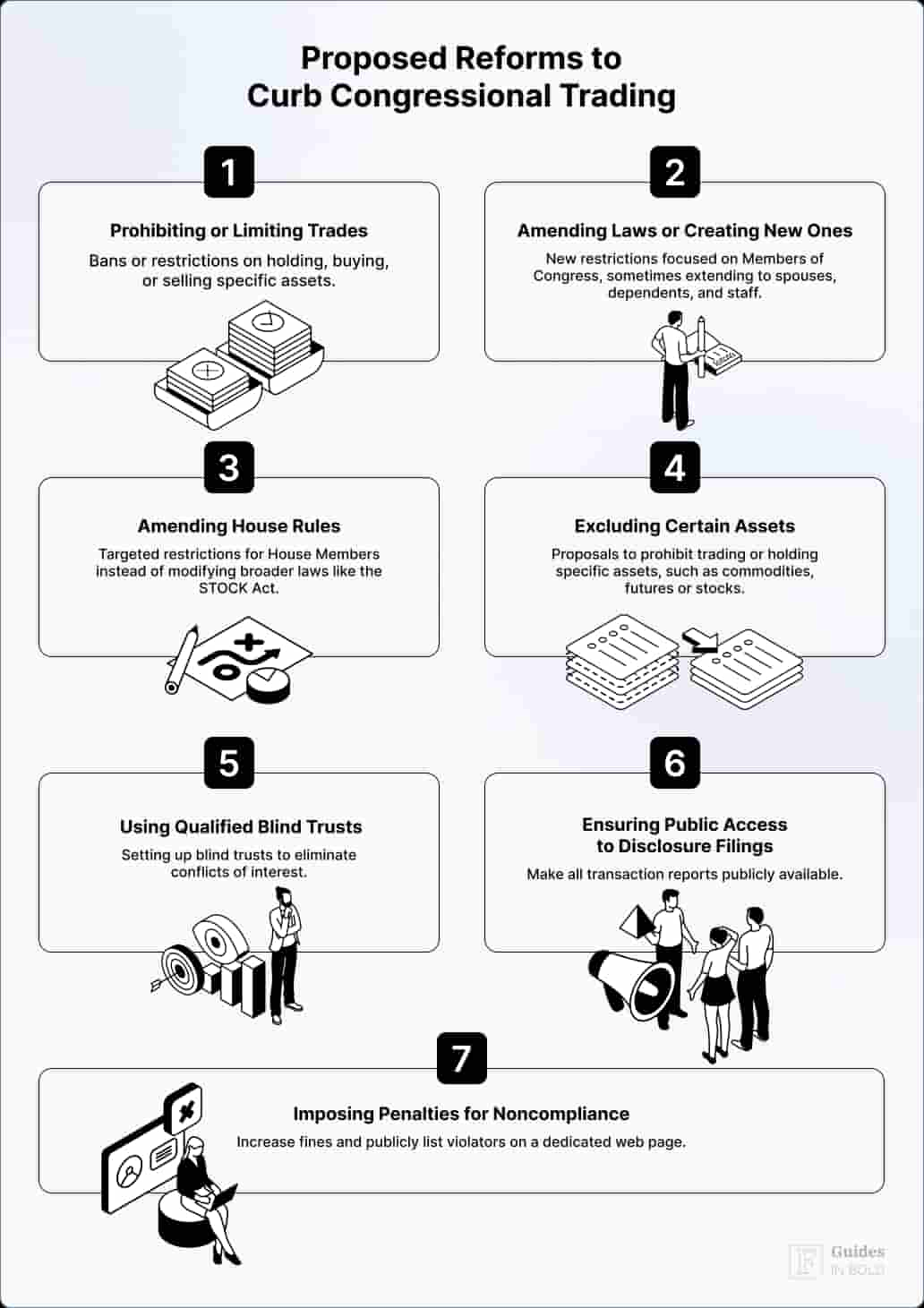

Members of Congress have proposed a number of reforms to regulate the trading of a number of financial instruments by Members of Congress. According to a 2023 Congressional Research Service (CRS) report, some of the proposed reforms include:

- Prohibiting or limiting certain asset trades: The majority of propositions involve outright bans or restrictions on holding, buying, or selling specific assets;

- Amending current laws or creating new ones: Proposals to amend or create new laws regarding congressional trading usually focus on imposing new restrictions. These restrictions would primarily apply to Members of Congress, with some proposals also extending to their spouses, dependents, and, in fewer cases, congressional staff;

- Amending House rules: Some proposals suggest amending the House standing rules to impose additional restrictions on Members of the House of Representatives, rather than modifying existing laws like the STOCK Act. This is a more targeted approach, applying only to sitting House members while they are still in office;

- Excluding some assets: Proposals often seek to prohibit Members of Congress from trading or holding specific assets, such as commodities, securities, and security futures. Currently, Congress does not restrict the ownership of particular financial assets, although some executive branch agencies do;

- Using qualified blind trusts: Under current law, a qualified blind trust can only be set up with the approval of a supervising ethics office, such as the House Committee on Ethics or the Senate Select Committee on Ethics. With a qualified blind trust set up to address issues pertaining to financial conflict of interest, the covered official would entrust their assets to an independent trustee, who makes investment decisions without the official’s knowledge;

- Ensuring public access to disclosure filings: As mentioned, Members of Congress must file transaction reports. For Representatives and Senators, these reports can be accessed by the public on the websites of the Clerk of the House and the Secretary of the Senate. However, periodic transaction and financial disclosure reports for congressional officers and other covered employees are not publicly available;

- Imposing penalties for noncompliance: Most legislative proposals seek to change or increase the penalties for noncompliance. They proposed two primary strategies: imposing fines on individuals for violations and/or listing the names of those found in breach of the law on a dedicated, publicly available web page.

The bottom line

The ongoing debates on congressional trading and numerous scandals that have resulted from it call attention to the tension between lawmakers and the public. Despite the establishment of the STOCK Act, instances of insider trading and conflicts of interest continue to raise concerns about the integrity of not only the political system but also the fairness of the stock market.

As discussions continue, it is becoming clearer that stricter regulations are necessary to ensure transparency and accountability of those holding official positions. Whether through amending existing laws, implementing stricter penalties, or exploring solutions such as qualified blind trusts, most agree that prioritizing the ethical obligations of politicians to their constituents over personal gain is paramount.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs about politician trading and conflicts of interest

What is the STOCK Act?

The Stop Trading on Congressional Knowledge (STOCK) Act is legislation meant to stop congressional insider trading. It prevents Congress members and associates from using non-public information when trading stocks and demands they report all financial transactions (stocks, bonds, commodities) exceeding $1,000 within 45 days.

Are members of Congress allowed to trade stocks while in office?

Yes, Congress members are allowed to trade stocks while in office. However, they are required by law to report their trades exceeding $1,000 within 45 days, and they must not rely on congressional information to increase their chances of profit.

What are the penalties for violating the STOCK Act?

For Senators, the penalty for failing to report a financial transaction on time is $200.

How can you track politicians’ stock trades?

For the most convenient experience, you can use Finbold Signals and receive real-time updates via Email, Telegram, or Discord.

Who regulates politicians’ insider trading?

Politicians’ insider trading is regulated by the SEC, which enforces laws against illegal trading. The STOCK Act subjects members of Congress to these laws, requiring them to disclose trades. Additionally, the Department of Justice (DOJ) can investigate and prosecute any violations.

Receive Signals on US Congress Members' Stock Trades

Stay up-to-date on the trading activity of US Congress members. The signal triggers based on updates from the House disclosure reports, notifying you of their latest stock transactions.