Inflation affects everyone, including stock market investors. Yet, how is inflation calculated? Understanding this can help you make better financial decisions and protect your investments. In this guide, we’ll break down inflation into simple terms, ensuring you can navigate it with confidence.

What is inflation?

Inflation measures the rate at which the general level of prices for goods and services rises, eroding purchasing power. When inflation is high, your money buys less than it did before. Conversely, low inflation means prices are stable, and your purchasing power remains steady.

How is inflation calculated?

Calculating inflation involves several steps and uses various economic indicators. Here’s a detailed look at the primary methods and measures used.

Consumer Price Index (CPI)

The Consumer Price Index (CPI) is the most commonly used measure of inflation. It tracks the changes in prices of a basket of goods and services over time.

How is CPI calculated?

Steps to calculate CPI include:

- Selection of goods and services: The Bureau of Labor Statistics (BLS) selects a representative sample of goods and services that reflects typical consumer spending;

- Price collection: BLS collects prices of these items from various locations nationwide;

- Weight assignment: Each item in the basket is assigned a weight based on its importance in the average consumer’s budget;

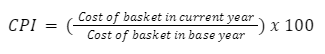

- Index calculation: BLS calculates the CPI by comparing the cost of the basket in the current period to the cost in a base period. The formula is:

| Item | Quantity | Price in base year | Price in current year | Cost in base year | Cost in current year |

| Bread (loaf) | 100 | $1.00 | $1.10 | $100 | $110 |

| Milk (gallon) | 50 | $3.00 | $3.20 | $150 | $160 |

| Gasoline (gallon) | 200 | $2.50 | $3.00 | $500 | $600 |

| Total cost | – | – | – | $750 | $870 |

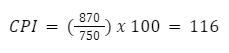

In this example:

This indicates a 16% increase in the cost of the basket of goods and services from the base year.

Producer Price Index (PPI)

The Producer Price Index (PPI) measures inflation from the perspective of producers. It tracks changes in prices at the wholesale level before products reach consumers.

Key points about PPI:

- Covers different sectors: PPI includes various industries like manufacturing, agriculture, mining, and services;

- Multiple indexes: PPI consists of several indexes that measure price changes for different stages of production;

- Impact on consumers: While PPI measures wholesale prices, these costs often pass on to consumers, indirectly affecting the CPI.

Personal Consumption Expenditures (PCE) Index

The PCE Price Index is another measure of inflation, preferred by the Federal Reserve. It includes a broader range of expenditures than CPI and uses different weights.

Differences between PCE and CPI:

- Scope of coverage: PCE includes more comprehensive data, such as spending by non-profit institutions serving households;

- Weighting differences: PCE weights change more frequently, reflecting current consumer behavior more accurately;

- Healthcare costs: PCE captures healthcare costs more effectively, considering both out-of-pocket expenses and insurance payments.

Core Inflation

Core inflation excludes volatile items like food and energy prices to provide a clearer picture of underlying inflation trends. Both CPI and PCE have core versions, known as Core CPI and Core PCE.

Why Core Inflation matters:

- Volatility reduction: By excluding food and energy, core inflation provides a more stable measure of long-term inflation trends;

- Policymaking: Central banks often use core inflation to make monetary policy decisions, aiming to control inflation without overreacting to short-term price spikes.

What factors influence inflation?

Several factors influence inflation rates, making it important to understand the underlying causes.

Demand-pull inflation

This occurs when demand for goods and services exceeds supply, driving prices up. Common causes include:

- Economic growth: Increased consumer spending during economic expansions;

- Government spending: Large public projects and spending can increase demand;

- Low interest rates: Cheaper borrowing encourages spending and investment.

Cost-push inflation

Cost-push inflation happens when production costs rise, leading producers to increase prices. Contributing factors include:

- Wage increases: Higher wages raise production costs, leading to higher prices;

- Raw material costs: Increased prices for raw materials, like oil, affect production costs;

- Supply chain disruptions: Issues like natural disasters or geopolitical conflicts can raise costs.

Built-in inflation

Also known as wage-price inflation, built-in inflation results from a cycle where higher wages lead to higher prices, which then lead to demands for even higher wages.

- Expectations: If workers expect prices to rise, they demand higher wages, perpetuating the cycle;

- Indexation: Automatic adjustments of wages and contracts based on inflation rates can entrench inflation.

How to protect against inflation?

As mentioned, understanding inflation helps investors take steps to protect their portfolios. Here are some strategies that can help hedge against inflation:

- Invest in inflation-protected securities: Treasury Inflation-Protected Securities (TIPS) adjust their principal value based on inflation;

- Diversify with real assets: Real estate, commodities like gold, and other tangible assets often retain value during inflationary periods;

- Invest in equities: Stocks, particularly those of companies with strong pricing power, can outpace inflation over the long term;

- Consider floating rate bonds: These bonds have interest rates that adjust with inflation, providing protection against rising prices;

- Reevaluate fixed-income investments: Traditional bonds can lose value during inflation; consider shorter-duration bonds to mitigate risk.

| Asset class | Impact of inflation |

| Stocks | Potential to outpace inflation, but sensitive to interest rates and economic cycles. |

| Bonds | Fixed-rate bonds lose value as inflation erodes purchasing power; floating-rate bonds fare better. |

| Real estate | Often appreciates with inflation; rental income can adjust with rising prices. |

| Commodities | Tend to increase in value during inflationary periods due to rising raw material costs. |

| Cash | Loses value as purchasing power decreases. Investing in interest-bearing accounts can help offset this. |

The bottom line

Understanding how inflation is calculated and its impact on investments is crucial for every investor. By keeping an eye on inflation indicators like CPI, PPI, and PCE, you can make informed decisions to protect and grow your wealth. Also, by implementing different strategies to hedge against inflation, you can ensure that your portfolio remains resilient in changing economic conditions.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.