While illegal insider trading can have serious consequences, legal insider trading—company executives, directors, or employees buying or selling stocks—can provide valuable insights for regular investors. By learning how to analyze insider trades, you can potentially predict market movements and make better investment decisions. Here’s a guide on how to do that.

Receive Signals on SEC-verified Insider Stock Trades

This signal is triggered upon the reporting of the trade to the Securities and Exchange Commission (SEC).

What is insider trading?

“Insider trading is a victimless crime that can actually benefit the market by moving stock prices closer to their true value.” — Henry G. Manne, American legal scholar and economist

Insider trading occurs when individuals within a company, such as executives, directors, or key employees, buy or sell shares of their own company. This activity is legal only if they report their trades to the Securities and Exchange Commission (SEC) and don’t act on non-public, material information.

Recommended video: Insider Trading Explained in 2 Minutes

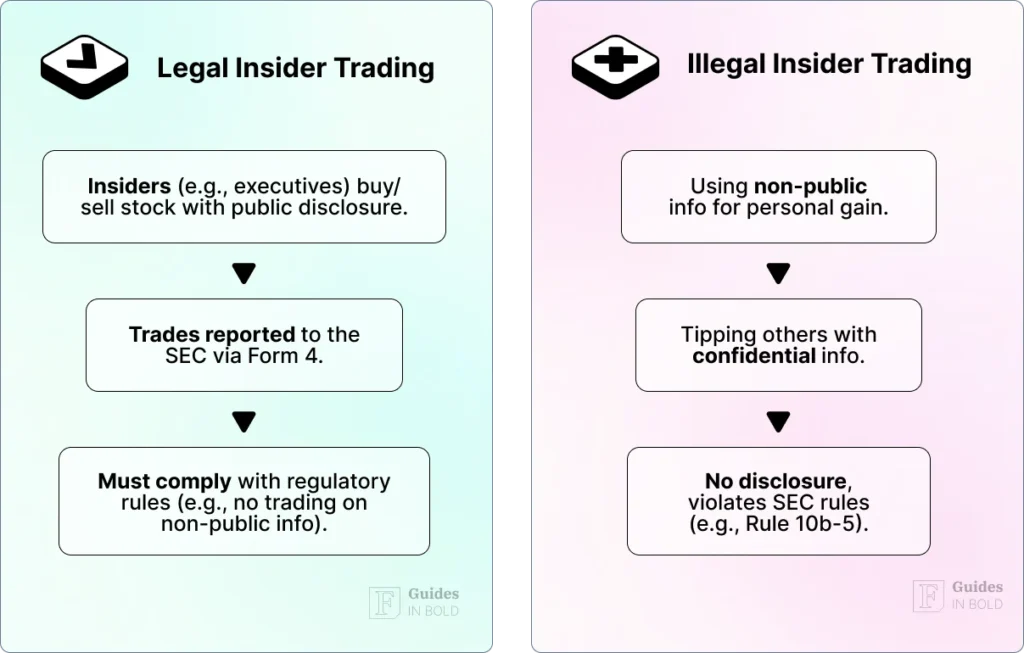

Difference between legal and illegal insider trading

Here’s how legal and illegal insider trading differs from each other:

- Legal insider trading: When insider trade based on publicly available information and report their trades to the SEC;

- Illegal insider trading: When insiders trade based on material, nonpublic information that can affect stock price (e.g., a pending merger or acquisition).

Legal insider trading is common, and you can track these trades using public records.

Why do insider trades matter?

In essence, insiders know their company better than anyone. They understand the internal dynamics, future strategies, and financial health. Therefore, if they’re buying or selling a significant amount of stock, it can signal something important.

Here are some reasons why analyzing insider trades can be helpful:

- Confidence in growth: Insiders buy shares when they believe the stock will rise;

- Red flags: Significant selling by insiders could signal concerns about the company’s future performance;

- Sentiment indicator: Watching insider buying or selling patterns provides insights into the overall sentiment within the company.

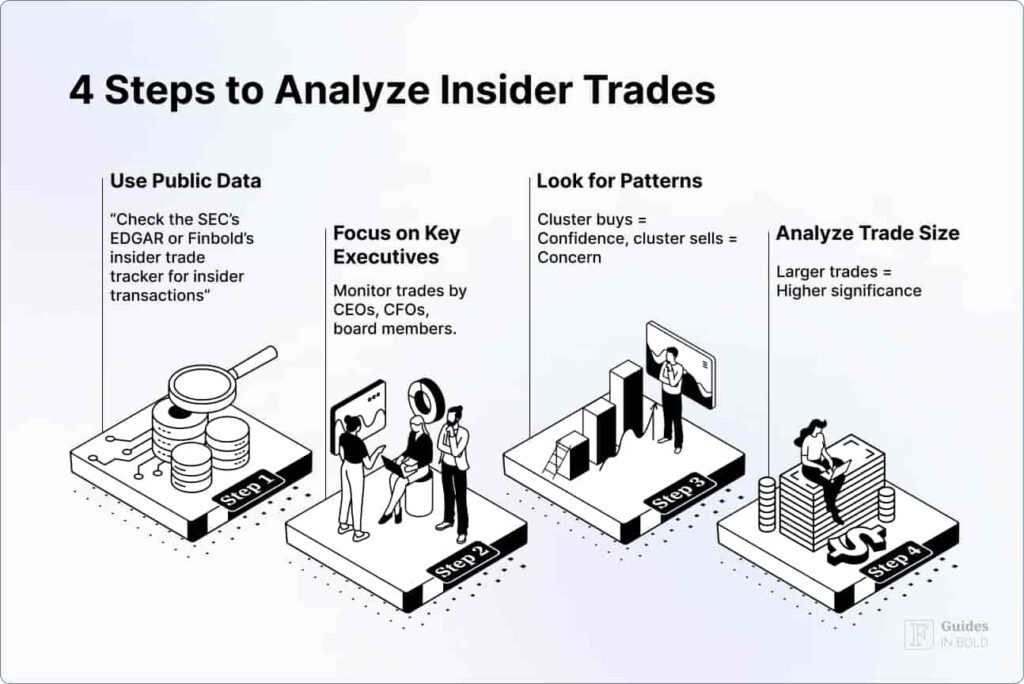

How to analyze insider trades: Step-by-step

Here’s how you can analyze insider trades in four simple steps:

Step 1: Use publicly available data

First off, you should start by using websites like SEC’s EDGAR database or on specialized financial websites such as Finbold, which offers signals on insider transactions and provide data on who’s buying or selling and how much.

Receive Signals on SEC-verified Insider Stock Trades

This signal is triggered upon the reporting of the trade to the Securities and Exchange Commission (SEC).

Step 2: Focus on key executives

While all insider trades are worth noting, you should only focus on trades made by high-level executives. CEOs, CFOs, and board members have the most influence and insight into the company’s performance, which means their trades carry more weight.

Step 3: Look for patterns

One-off insider trades might not mean much, but patterns can reveal a lot. You should, therefore, look for the following:

- Cluster buys: Multiple insiders purchasing shares within a short period could signal growing confidence in the company;

- Cluster sells: Similarly, multiple insiders selling shares could be a sign of concern.

Step 4: Analyze the trade size

Lastly, larger trades tend to have more significance. A small trade may only be part of routine portfolio management, but when insiders invest a significant amount of money, they’re likely confident about the company’s future.

What to watch out for

It’s key to understand that not all insider trades are created equal. Insiders might sell shares for personal reasons unrelated to company performance (e.g., buying a house or diversifying their investments). To avoid false signals, you should consider these factors:

- Insider buy-sell ratio: A higher ratio of buys to sells generally indicates positive sentiment;

- Trading timing: Check whether the trade was made before or after a major announcement like earnings report, mergers, etc.;

- Company performance: Look at the company’s earnings, growth prospects, and market conditions.

How can insider trades predict market movements?

The theory behind analyzing insider trades is simple. Namely, if insiders are buying heavily, they likely expect the stock to rise. On the other hand, if they’re selling, they might anticipate a downturn in stock price.

That said, here’s a simple step-by-step breakdown of how you can use insider trading data to predict market movements:

- Track significant purchases: If top executives buy a large amount of stock, it signals confidence in future performance. This could indicate a price rise;

- Watch for unusual sell-offs: If several key insiders dump a large quantity of stock, it might signal trouble ahead. This could be a lead-up to a drop in stock price;

- Combine with technical analysis: Use insider trading data alongside technical analysis indicators like moving averages and relative strength index (RSI) to confirm potential price movements.

Key differences between insider buying and insider selling

Here’s a brief overview of the differences between insider buying and insider selling:

| Factor | Insider buying | Insider selling |

| Signal | Confidence in company growth | Potential warning sign (but not always) |

| Motivation | Expectation of stock price increase | Could be for personal reasons or concerns |

| Cluster activity | Strong signal when multiple insiders buy | Strong signal when multiple insiders sell |

Red flags to look out for

It is essential not to interpret every insider transaction as a signal of future stock performance. The thing is, insider selling, for instance, isn’t always a bad sign. However, there are certain red flags that you should keep an eye on, such as:

- Consistent selling: If an executive regularly sells shares at regular intervals, this may be part of a pre-arranged 10b5-1 plan rather than a warning sign;

- Small purchases: Small, infrequent purchases by insiders might not be as meaningful as larger, coordinated buys;

- Newly public companies: In the case of initial public offerings (IPOs), insiders may have restrictions on selling shares for a certain period. Once the lock-up period expires, insiders may sell large quantities of stock, which doesn’t necessarily mean negative future performance.

The bottom line

In summary, analyzing insider trades can provide valuable insights into a company’s future prospects. While it’s not foolproof, understanding insider buying and selling patterns can help you predict the market sentiment and make better investment decisions.

Nevertheless, it’s key to combine insider data with other forms of analysis to get a well-rounded view of the market and always consider the bigger picture before making any moves.

Receive Signals on SEC-verified Insider Stock Trades

This signal is triggered upon the reporting of the trade to the Securities and Exchange Commission (SEC).

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs on how to analyze insider trades

What is insider trading?

Insider trading refers to the buying or selling of a company’s stock by individuals with access to non-public, material information about the company. Legal insider trading happens when insiders trade based on publicly available information and report their transactions to the SEC. On the flip side, illegal insider trading occurs when individuals use confidential information to gain an unfair advantage in the stock market.

Is insider trading illegal?

Not always. Legal insider trading is common and happens when corporate executives, employees, or board members buy or sell shares based on publicly available information and disclose it to regulatory bodies. Illegal insider trading happens when someone uses non-public information to trade for profit, which is prohibited by law.

How can insider trades help predict stock movements?

Insider trades can serve as signals for future stock performance. Large purchases by insiders, especially top executives, often indicate confidence in the company’s future growth, which may lead to stock price increases. On the other hand, multiple insiders selling large amounts of stock could be a red flag suggesting potential downturns.

How do I find insider trading data?

You can receive real-time updates on insider trading by subscribing to Finbold Signals. Also, the SEC’s EDGAR database is another good source to track insider trades.

What should I focus on when analyzing insider trades?

Focus on large trades by key executives, such as the CEO or CFO, cluster buys or sells by multiple insiders, and the timing of trades relative to major company announcements. Large purchases usually indicate confidence in the company’s future, while large sell-offs could signal potential trouble.