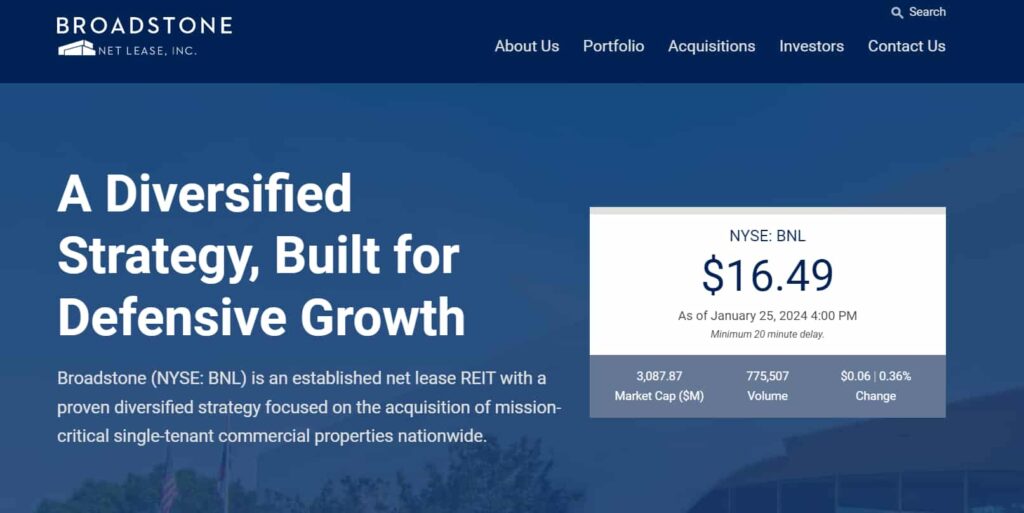

Summary: Broadstone Net Lease (NYSE: BNL) is a real estate investment trust that specializes in single-tenant, net-leased commercial properties. The most convenient way to buy Broadstone Net Lease is through a reputable brokerage platform, such as eToro.

Highly Rated Stock Trading & Investing Platform

-

Invest in stocks, ETFs, options and crypto

-

Copy top-performing crypto-traders in real time, automatically.

-

0% commission on buying stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

eToro USA is registered with FINRA for securities trading.

About Broadstone Net Lease

Broadstone Net Lease is a real estate investment trust (REIT) that specializes in single-tenant, net-leased commercial properties. This means that the tenants are responsible for paying not only rent but also property expenses, such as taxes, insurance, and maintenance. Furthermore, BNL focuses on a diversified portfolio of properties across various industries, providing investors with a stable and predictable income stream.

How to buy Broadstone Net Lease stock: Step-by-step process

If you’re interested in buying Broadstone Net Lease stock, you can follow our step-by-step guide in the following segment.

Step 1: Choose the right broker

The first step in buying Broadstone Net Lease stock is selecting a reputable brokerage platform. A brokerage serves as an intermediary that facilitates the buying and selling of stocks. As such, our go-to broker is eToro, a popular platform with numerous features, some of which include:

- Commission-free stock trading;

- Access to over 2,000 stocks from 17 different exchanges;

- The option to purchase fractional shares;

- Charting tools;

- A user-friendly platform that simplifies the trading experience.

Highly Rated Stock Trading & Investing Platform

-

Invest in stocks, ETFs, options and crypto

-

Copy top-performing crypto-traders in real time, automatically.

-

0% commission on buying stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

eToro USA is registered with FINRA for securities trading.

Step 2: Fund your account

Once you’ve chosen a broker, you’ll need to fund your investment account. Most brokers accept bank transfers, wire transfers, or deposits via check. To do so, simply follow the instructions provided by your chosen brokerage to add funds to your account.

Step 3: Place your order

With your account funded, you’re ready to place an order for Broadstone Net Lease stock. Follow these steps:

- Log in to your brokerage account;

- Search for Broadstone Net Lease or use the BNL stock symbol;

- Review the current stock price and decide how many shares you want to purchase;

- Choose the type of order you want to place.

- Confirm and submit your order.

Broadstone Net Lease stock price today

Pros and cons of buying Broadstone Net Lease stock

Pros

- Stable income: BNL’s focus on single-tenant, net-leased properties often results in a stable and predictable income stream for investors;

- Diversification: Investing in BNL provides exposure to a diversified portfolio of commercial properties across different sectors, reducing risk compared to owning individual properties;

- Passive investment: As a REIT, BNL allows investors to participate in the real estate market without the responsibilities of property management.

Cons

- Interest rate sensitivity: Like many REITs, BNL can be sensitive to changes in interest rates, which may impact its stock price;

- Market risks: The value of BNL stock can be influenced by broader market conditions, economic factors, and industry trends.

For other top net lease REITs, feel free to check out these guides:

- How to Buy W. P. Carey Stock;

- How to Buy Realty Income Stock;

- How to Buy EPR Properties Stock;

- How to Buy Agree Realty Stock.

Common mistakes when investing in net lease REITs

Failing to research and understand the specific REIT, such as BNL, can lead to uninformed investment decisions, and it’s one of the most common investing mistakes that you can make. However, it’s not the sole one. You should also avoid:

- Ignoring risks: Not considering the potential risks associated with the real estate market, interest rate fluctuations, and economic downturns can lead to unexpected losses;

- Overlooking fees: Some brokers may charge additional fees or have different fee structures for trading REITs. Be aware of these fees to make informed investment decisions.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs about how to buy Broadstone Net Lease stock

What is a net lease REIT?

A net lease REIT specializes in commercial real estate, with tenants responsible for additional costs like taxes and maintenance. These REITs focus on single-tenant properties, providing investors with a stable income through regular dividend distributions. It’s important to understand the specific terms and risks associated with net leases before investing.

What is Broadstone Net Lease’s stock symbol?

Broadstone Net Lease’s stock is listed on the New York Stock Exchange (NYSE) under the stock symbol BNL.

Is investing in Broadstone Net Lease suitable for beginners?

Yes, investing in Broadstone Net Lease can be suitable for beginners, especially those seeking a passive income stream from real estate, without the complexities of property management.

How often does Broadstone Net Lease pay dividends?

Broadstone Net Lease typically pays dividends every quarter. The specific schedule can be found on the company’s investor relations page or through your brokerage platform.

Are there tax implications when investing in BNL?

Yes, as a REIT, Broadstone Net Lease must distribute at least 90% of its taxable income to shareholders in the form of dividends. Investors should be aware of the tax implications related to these distributions.

Highly Rated Stock Trading & Investing Platform

-

Invest in stocks, ETFs, options and crypto

-

Copy top-performing crypto-traders in real time, automatically.

-

0% commission on buying stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

eToro USA is registered with FINRA for securities trading.

![How to Buy Boradstone Net Lease Stock [2024] | Invest in BNL](https://assets.finbold.com/uploads/2024/01/How-to-Buy-Boradstone-Net-Lease-Stock-2024-Invest-in-BNL.jpg)