With their significant wealth, influence, and expertise, institutional investors are considered much more sophisticated than individuals who invest their money directly. Therefore, it can be beneficial to follow in the footsteps of Wall Street whales. This guide will explain the top investment sectors according to institutional investors and their favorite strategies for beating the market.

What is institutional investing?

What is an institutional investor?

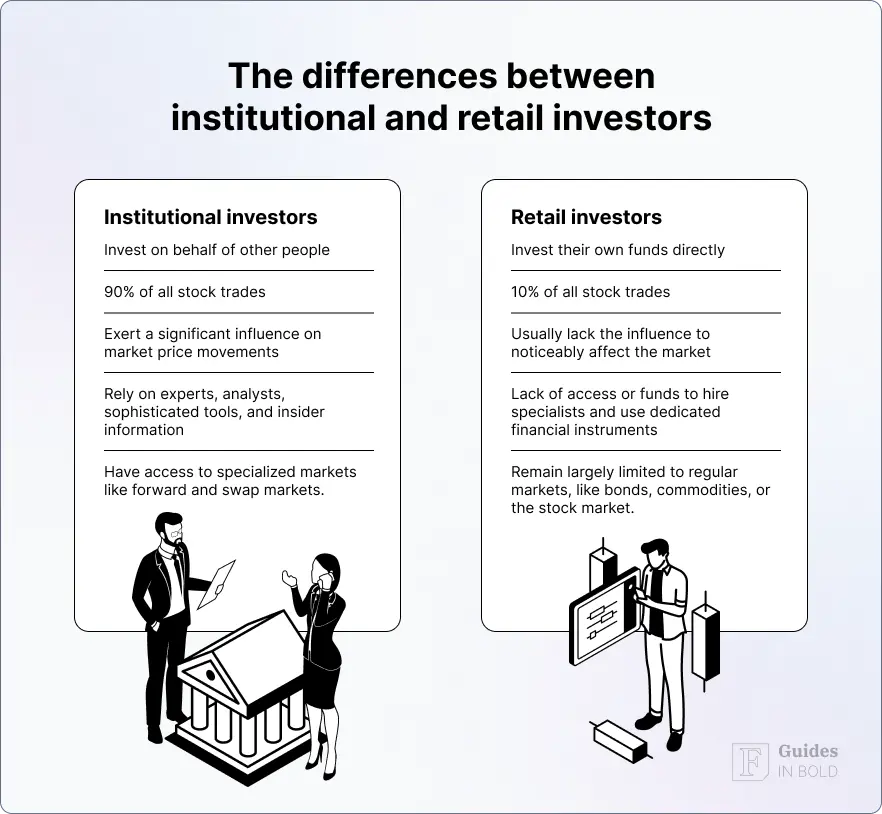

By contrast, retail investors are individuals who invest their own money, either directly or through a broker. Since they invest with limited funds and have little access to expert knowledge and software, retail investors are considered less sophisticated than their institutional rivals.

This difference is illustrated by the fact that institutional investing accounts for over 90% of stock trading volume. Due to better access to expertise and their financial leverage, they can enter exclusive markets (like ‘dark pools’) and trade private financial assets such as pre-IPO stocks.

Smart money

As institutional investing exerts far more influence on the market, it is frequently referred to as ‘smart money.’ Smart money is embodied by the behavior, flow, supply, and demand of institutional capital. Many investors believe that following smart money and tracking its transactions can be beneficial to retail investors.

Observing and following smart money includes:

- Buying and selling periods: In addition to regular market movements, smart money introduces periods of high demand and high selling pressure, which can reveal perfect points when retail investors should buy and sell;

- Order flow trading: Besides pressure points, investors monitoring smart money pay attention to the shifts in the flow of institutional transactions, e.g., selling in an uptrend or buying in a downtrend. The whales make these when anticipating the potential reversal in the price movement trend. Ultimately, retail investors can spot these flow reversals and conduct optimal trades;

- Institutional influence on the market: Smart money also recognizes that institutional effects can be observed separately from the rest of market activity. Therefore, investors can put patterns from the broader financial environment in the context of institutional activity. The additional financial layer helps traders figure out which signs represent false flags and which indicate valid signals that can inform one’s investments.

Top investment sectors for institutional investors

To begin with, institutional investors contribute over 90% to the total stock market trading volume. In other words, there are virtually no sectors where you won’t find institutional capital. That said, they do favor some sectors over others.

1. Technology

Technology is undoubtedly the favorite sector for institutional investors. Digital and information technology, especially AI-oriented companies, have high growth and innovation potential. Additionally, the current digital transformation trend gives it leverage across industries.

For example, BlackRock, the world’s largest institutional investor by assets under management, had more than 44% of its portfolio in the technology sector at the start of 2024, while 29.4% of its portfolio came exclusively from software companies.

2. Financial services

Financial services, such as insurance, banking, asset management, and especially fintech, remain a busy sector for institutional investors despite being overshadowed by digital technologies.

Investments in finances still provide stable returns, especially in the subsector of financial technology. Additionally, they represent an excellent opportunity for diversification and less reliance on software companies.

3. E-commerce and consumer goods

During the 2020 global pandemic, e-commerce exponentially grew, and our society continued with this trend even after the virus subsided. Institutional investors have recognized this sector’s potential and invested vast amounts of capital to profit from changing consumer preferences.

Online marketplaces, retail, and consumer electronics remain the favorite domains, and there are little signs of their prominence declining in the near future.

4. Healthcare

Despite the downturn of the post-pandemic period, healthcare remains a vital sector for institutional investors, especially within pharmaceutical, biotech, and medical device subsectors.

The aging global population and rising standards of health awareness increase the demand for healthcare services and technology. Furthermore, the innovation potential of biotech and healthcare technology improvements maintain the prospects of high growth.

Top stocks for institutional investors

The dominance of the technology sector is evident in institutional investors’ favorite stocks. Here are the most significant stock holdings of some of the largest institutional investors:

BlackRock:

- Microsoft (NASDAQ: MSFT) – 5.6% or 553.98 million shares;

- Nvidia (NASDAQ: NVDA) – 5.14% or 1,839.27 million shares;

- Apple (NASDAQ: AAPL) – 5.01% or 1,050.22 million shares;

- Amazon (NASDAQ: AMZN) – 2.84% or 648.70 million shares;

- Meta Platforms (NASDAQ: META) – 1.84% or 157.85 million shares.

Vanguard Group:

- Microsoft (MSFT) – 5.8% or 675.91 million shares;

- Apple (AAPL) – 5.36% or 1,324.97 million shares;

- Nvidia (NVDA) – 5.09% or 2,144.78 million shares;

- Amazon (AMZN) – 2.85% or 771.05 million shares;

- Meta Platforms (META) – 1.83% or 186.35 million shares.

Fidelity Management & Research

- Nvidia (NVDA) – 8.25% or 1,043.90 million shares;

- Microsoft (MSFT) – 6.2% or 216.69 million shares;

- Apple (AAPL) – 4.66% or 345.64 million shares;

- Meta Platforms (META) – 4.47% or 138.46 million shares;

- Amazon (AMZN) – 4.07% or 329.31 million shares.

Therefore, as of 2024, the largest institutional investors’ favorite companies are Amazon, Apple, Meta, Microsoft, and Nvidia.

Top investment strategies used by institutional investors

Several types of institutional investors exist, and there are differences between their investing approaches. Still, some of the most effective and widely used strategies can be extracted at a global level:

- Fundamental analysis: The basis of many long-term investing strategies, fundamental analysis helps investors determine the inherent value of a stock that does not necessarily correspond with its market price. It involves analyzing financial reports for the company’s financial health, determining the quality of its management and leadership, as well as its position in the global market;

- Technical analysis: This type revolves entirely around the stock’s market price. Technical analysis deals with historical price and volume to spot specific price patterns that can help investors predict future price movements. This approach depends on tracking indicators to deliver patterns and relies heavily on accurate time management. It commonly finds its place in the short-term investing approach.

- Mass-trading: The sheer scale of institutional investing allows big players to utilize machine learning, advanced algorithms, and automation to optimize stock trading. The methods used include high-frequency trading to benefit from fractional price differences, mass arbitrage that capitalizes on differences across markets, and AI models that forecast future market movements.

The bottom line

Top investment sectors and strategies used by most institutional investors are no secret, owing to them being obligated to report their portfolios and relevant information to financial authorities. Individuals willing to track Wall Street whales can benefit from this knowledge and use these insights to inform and improve their trade.

Due to their sophisticated methods and vast pools of expertise and tools, institutional investors have an insurmountable edge over retail investors. However, this advantage can be bridged by replicating the successful moves of the most successful institutions.

With an institutional stock trading tracker like Finbold Signals, you can have relevant reports and notifications about significant institutional investing developments delivered to you in the shortest time when they matter the most. Using institutional investment insights before others can be pretty beneficial for your investing.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs

What is an institutional investor?

Institutional investor is a company or organization that pools funds and invests that money on behalf of other people in various assets and financial instruments, including stocks, bonds, real estate, and others.

Who are the key institutional investors?

The five largest institutional investors in the world are BlackRock, The Vanguard Group, UBS, Fidelity Investments, and State Street.

What is the concept of smart money?

“Smart money” refers to institutional investing and the behavior, flow, supply, and demand of institutional capital. Many retail investors believe that tracking smart money and monitoring its effects can benefit their investments.

What are the top investment sectors for institutional investors?

The top sector choices for institutional investors include technology, financial services, e-commerce and consumer goods, and healthcare.

What are the top stocks for institutional investors?

As of 2024, the largest institutional investors’ favorite stocks are Amazon, Apple, Meta, Microsoft, and Nvidia.