Institutional investors pool large sums of money and invest it on behalf of others. In this article, we’ll explore the different types of institutional investors, their roles in the financial world, and how they impact both markets and individual investors.

What are institutional investors?

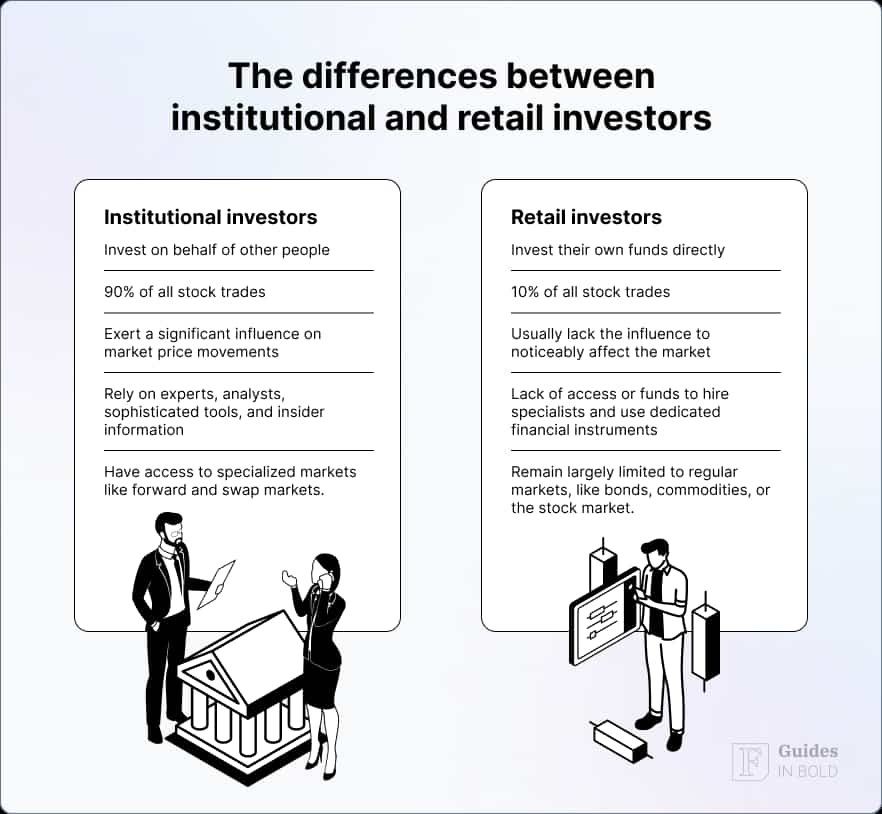

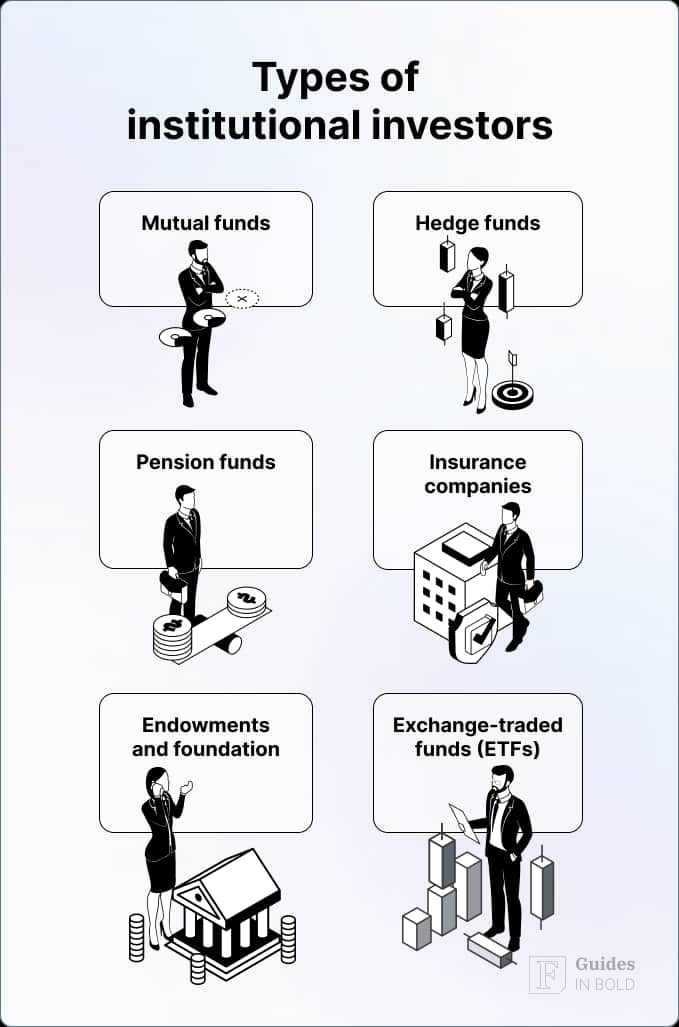

Institutional investors are large organizations that invest substantial sums of money on behalf of others, such as mutual funds, hedge funds, pension funds, insurance companies, endowments and foundations, and exchange-traded funds (ETFs). They manage these funds to achieve financial returns, typically for beneficiaries like retirees, policyholders, or shareholders.

Because of their significant financial resources, institutional investors have a major influence on financial markets and corporate governance. Their investments span across various asset classes, including stocks, bonds, real estate, and private equity, and their strategies often emphasize long-term growth and stability.

Unlike retail investors, who typically make smaller, individual investments, institutional investors can negotiate better terms and access exclusive opportunities, further amplifying their impact on the market.

In a study published in the Journal of Financial Economics, Diane Del Guercio examined how institutional investors affect stock market efficiency. She found that while institutional investors contribute to market liquidity, their large trades can sometimes distort stock prices, especially when they move in and out of positions quickly.

“The trading activities of institutional investors, while typically beneficial in enhancing liquidity, can inadvertently lead to temporary price distortions, particularly in less liquid markets.” — Del Guercio

Different types of institutional investors

Here’s a brief overview of different types of institutional investors:

1. Mutual funds

Mutual funds pool money from many individual investors to invest in a diversified portfolio of stocks, bonds, or other securities. Professional portfolio managers actively manage these funds, deciding which assets to buy or sell based on the fund’s strategy.

Mutual funds offer small investors access to professionally managed, diversified portfolios that they might not be able to create on their own. However, they also come with management fees that can vary in size, depending on whether the fund is actively or passively managed.

Types of mutual funds:

- Equity funds: Focus on stocks and aim for capital growth;

- Bond funds: Invest in bonds and prioritize income generation;

- Index funds: Aim to replicate the performance of a specific market index, such as the S&P 500, with lower fees.

2. Hedge funds

Hedge funds are private investment funds that use a variety of strategies to generate high returns, often with a higher risk profile than other institutional investors. They are typically available only to accredited investors or institutions due to their riskier nature and less regulatory oversight. Hedge funds employ complex strategies such as short selling, leverage, derivates, and arbitrage to achieve their investment goals.

These funds aim for absolute returns, meaning they seek to make a profit in any market condition, whether the market is rising or falling. Hedge funds are known for their active management and high-performance fees, often structured as a percentage of profits.

3. Pension funds

Pension funds are organizations that manage the retirement savings of employees. These funds collect contributions from employees and employers over the course of the employees’ careers and then invest these contributions to generate returns. When the employees retire, the funds use these investments to provide monthly pension payments.

Pension funds are often considered long-term investors, meaning they can afford to invest in riskier or more volatile assets because they do not need to cash out for many years. This long-term approach enables pension funds to invest in things like infrastructure projects or private equity, which may take years to provide returns.

4. Insurance companies

Insurance companies are also major institutional investors. These companies collect premiums from their policyholders and invest them to meet future claims. The premiums are invested in various asset classes, including bonds, stocks, and real estate, to generate a return.

Insurance companies tend to have a conservative approach to investing, as they need to maintain enough liquidity to meet potential insurance claims while also aiming to maximize returns to benefit shareholders.

5. Endowment funds and foundations

Endowment funds are typically associated with universities, hospitals, and non-profit organizations. These funds consist of donations and are invested to provide ongoing financial support to the institutions. The earnings generated from endowments are used to fund research, scholarships, or operational costs.

Endowment funds have a very long-term investment horizon, and they often aim for both income generation and capital preservation. Their portfolios can include a broad mix of asset classes, such as stocks, bonds, and real estate.

6. Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are investment funds that trade on stock exchanges, much like individual stocks. ETFs hold a basket of assets, such as stocks, bonds, or commodities, and aim to replicate the performance of a specific index or sector. They are popular among both institutional and retail investors due to their liquidity, transparency, and lower management fees compared to mutual funds.

ETFs can be passively or actively managed, though the majority track a specific index. Institutions often use ETFs for efficient asset allocation, hedging, or gaining exposure to particular markets without the need to directly buy individual securities.

How do institutional investors impact the markets?

Institutional investors have a significant impact on financial markets due to their large-scale investments. They can influence market trends, asset prices, and even corporate governance. For example, when institutional investors sell large quantities of a stock, it can drive the stock price down. Conversely, their investment in a company can boost its stock value.

Additionally, institutional investors often hold voting rights in the companies they invest in, giving them the power to influence corporate strategies, governance, and policies. This role can be pivotal in shaping the direction of major corporations.

Tracking institutional investors

Insider trading and institutional investors

What is insider trading?

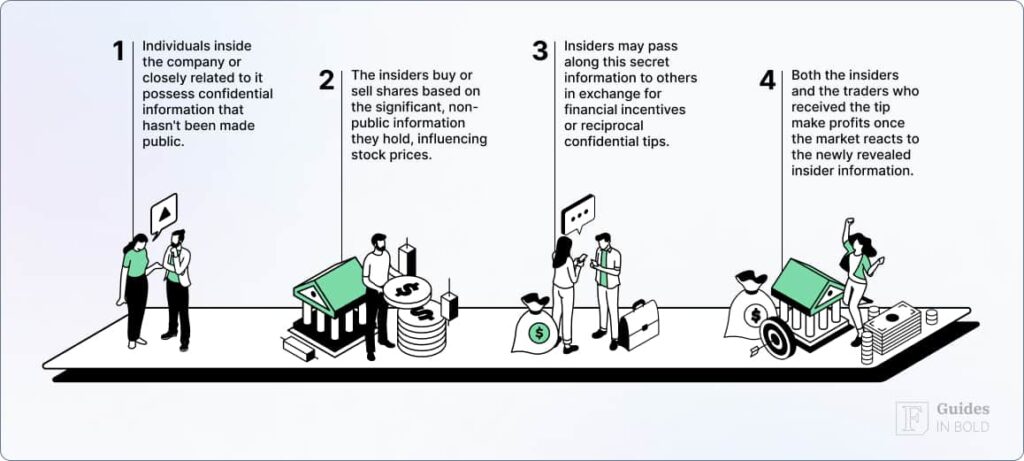

While institutional investors typically operate within legal boundaries, they must be careful to avoid any appearance of insider trading. Due to their significant access to company management and financial details, institutional investors are under strict regulations to ensure that they do not exploit privileged information for unfair trading advantages.

Recommended video: What is Insider Trading? Explained in 2 Minutes

The bottom line

Institutional investors play an essential role in the global financial markets. Their large-scale investments and long-term perspectives often help stabilize markets, while their influence on corporate governance can lead to better outcomes for shareholders and other stakeholders.

What’s more, they shape economies, and their decisions impact both individual investors and the broader market. Therefore, tracking their moves can be a useful way to shape your investment strategy and potentially make a profit.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs on different types of institutional investors

What are institutional investors?

Institutional investors are large organizations that manage substantial sums of money on behalf of others. They invest in a variety of assets, including stocks, bonds, real estate, and more, with a long-term focus on achieving financial returns.

How do institutional investors differ from individual investors?

Institutional investors manage much larger sums of money than individuals. They have access to specialized investment strategies, lower fees, and can influence markets and corporate governance more significantly.

What types of assets do institutional investors typically invest in?

Institutional investors invest in a wide range of asset classes, including stocks, bonds, real estate, private equity, infrastructure, and sometimes alternative investments like commodities or hedge funds.

Do institutional investors influence corporate governance?

Yes, institutional investors, particularly those with significant ownership in companies, often hold voting rights and can influence corporate governance. They can push for changes in company policies, executive compensation, and strategic decisions to better align with shareholder interests.

How do institutional investors affect market prices?

Institutional investors can have a major impact on market prices due to the size of their trades. When they buy or sell large quantities of a stock or asset, it can lead to price fluctuations.

Can retail investors benefit from the actions of institutional investors?

Yes, retail investors can benefit from the increased liquidity, market stability, and price discovery that institutional investors provide. However, they should also be aware that large trades by institutional investors can sometimes cause short-term volatility, which might impact their investments.