The Chinese stock market has been on a decisive downward trajectory for more than a year, with the major indices for the Hong Kong, Shenzhen, and Shanghai exchanges dropping between 22% and 30% in the last 52 weeks.

The market, however, made a sharp turn on Tuesday, January 23, as reports that the Chinese government is preparing a stabilization package worth more than $200 billion.

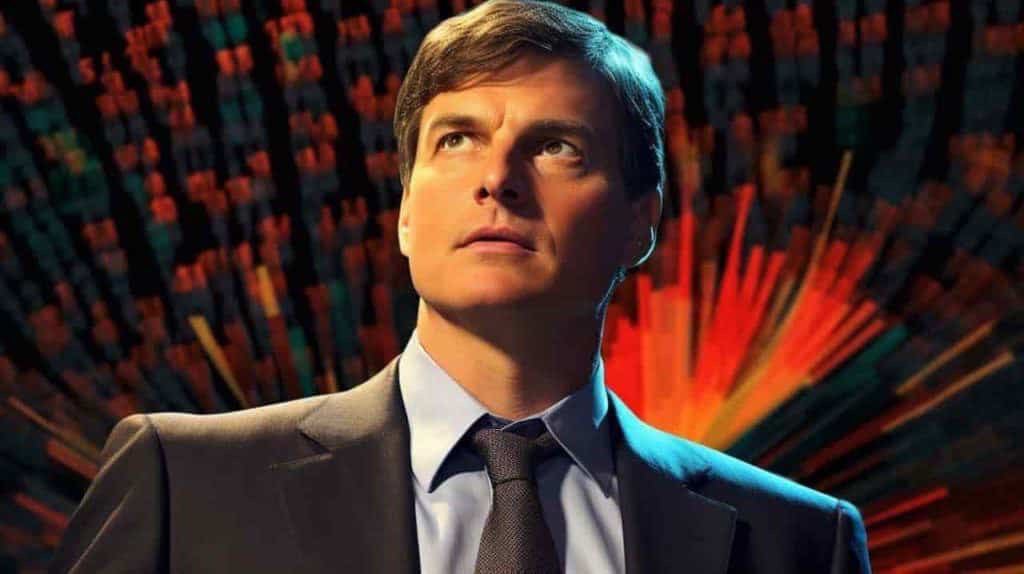

The strongest reaction to the news came from the technology and e-commerce giant Alibaba (NYSE: BABA), which is not only notable as one of China’s most-recognizable stocks but also for a $4.3 million bet Michael Burry, the ‘Big Short’ investor who famously predicted the 2008 crash, made on it.

What of Burry’s 50,000 BABA shares?

While best known for his past ability to predict a massive market crash, Burry’s investment in Alibaba has been ill-timed, according to data available up to January 24.

The famous investor acquired as many as 50,000 BABA shares in the third quarter of 2023, paying approximately $86.74 for each share.

After the stock purchase, Alibaba continued trading with a significant level of volatility and continued on its overall downward trajectory.

While it, for a time, appeared to have entered into a slight recovery in early Q4, hopes for a quick recovery got slashed when it dropped 9% in a single day in mid-November after Jack Ma, its founder, expressed his intent to sell $10 million worth of stock.

In many ways setting the results of 2023 in stone, the news that Alibaba is making significant changes to its structure – with a particular focus on cloud computing and artificial intelligence (AI) technology – failed to rattle the company’s shares.

By December 31, 2023, Burry lost approximately $500,000 on the Alibaba purchase, and by January 24 – even after a significant 24-hour rally for BABA – his loss on the $4.3 million investment is about $600,000.

BABA price analysis

While Alibaba has been having a bad time on the stock market in 2023 – falling 38.03% in the last 52 weeks – and in the first three weeks of 2024 – dropping 0.99% since January 1 – the news of the Chinese government plans might have finally reversed the trend.

Indeed, Alibaba stock rallied an impressive 7.85% – up to $74.02 – on Tuesday, the latest full trading day, from its Monday closing price of $67.7. Additionally, BABA is still rising in the extended hours trading leading towards Wednesday and is up another 1.51% by the time of publication.

Still, it is important to remember that, as of the latest available reports, the Chinese government is not yet fully set on making the $200 billion stock market injection and depending on its final decision – or its indecision on the matter – Alibaba might still experience significant volatility.

Buy stocks now with Interactive Brokers – the most advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.