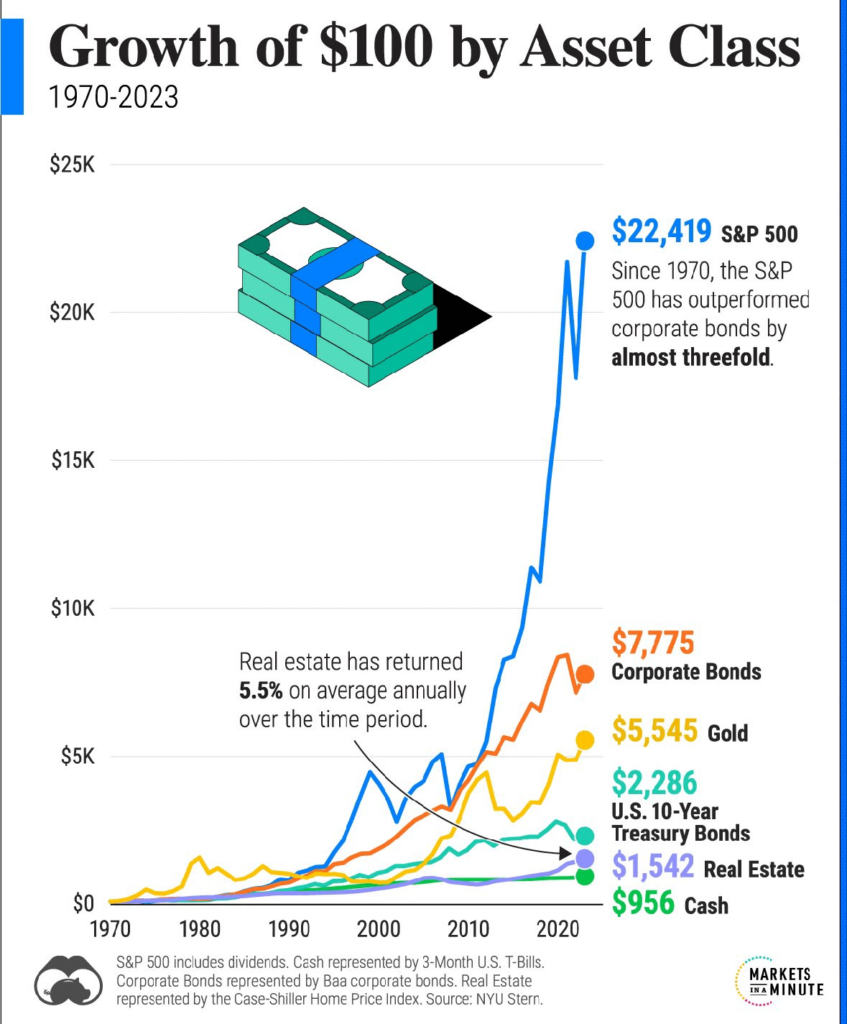

While $100 might not initially seem like much, its potential for growth turns out to be substantial, particularly when you consider the returns it can generate over time.

Let’s delve into a hypothetical scenario: imagine your parents or someone you know invested $100 in a particular asset or commodity back in 1970, a period spanning 54 years, which is well within the average human lifespan.

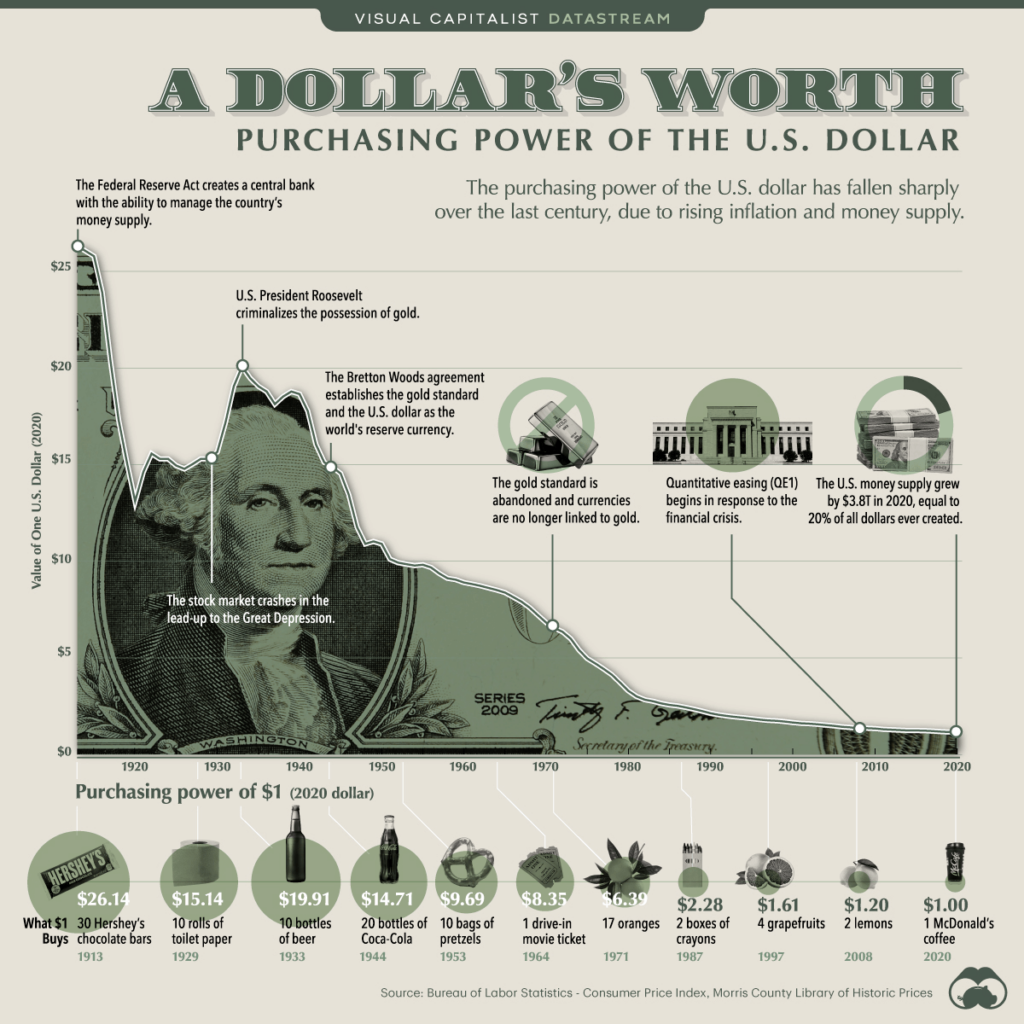

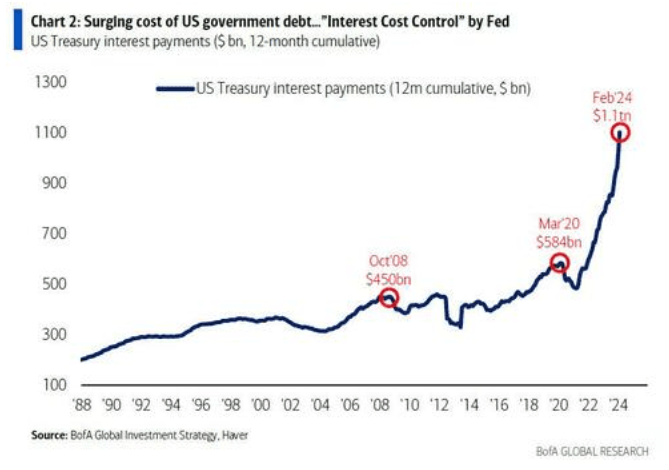

We’ll start with the worst-case scenario: if your parents simply held onto the $100 bill for most of their lives, its value would grow to $956. However, its purchasing power would significantly diminish over time due to inflation and the increasing money supply.

Optimal and common investments

This example vividly illustrates the power of compound investing. If they chose to invest in real estate, their initial $100 would have grown to $1,542 by now, assuming an average annual return rate of 5.5%. Alternatively, opting for US 10-year treasury bonds would have yielded a value of $2,286 today.

Turning to the perennial favorite for guarding against inflation, gold, the initial $100 investment would now be worth $5,545 in 2024. Similarly, investing in corporate bonds, a type of debt security issued by corporations to investors, would have multiplied the initial $100 to $7,775.

Best-case scenario investment

If you chose to disregard all the previous investment options and remained steadfast through numerous economic crises, including the dot-com bubble and the 2008 financial crisis, the stock market would ultimately reward your patience and faith handsomely.

Specifically, investing $100 in the S&P 500 five decades ago would have grown to an impressive $22,419 in your bank account, boasting a robust annual return of 11.3%.

These returns underscore the significance and benefits of investing, offering protection against inflation and, in the best-case scenario, yielding substantial returns.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.