Since Dana White, the CEO of one of the biggest sports brands in the world, the Ultimate Fighting Championship (UFC), decided to throw out all Peloton bikes from his training facilities last year, Peloton (NASDAQ: PTON) stock has been struggling to return to its former glory.

As it happens, White ordered the removal of all Peloton bikes from the UFC gyms after comedian Theo Von told him that Peloton, one of the sponsors of Von’s podcast ‘This Past Weekend,’ asked him to take down his interview with the then-Democratic presidential candidate Robert F. Kennedy Jr.

Specifically, in an episode aired on November 14, 2023, Von told White about the incident, to which White responded with indignation, remarking that “Peloton sells stationary bikes, and they’ve got a problem with Robert f–ing Kennedy. F— you, Peloton. Who the f— are they?” adding that:

“My guys are going to take the Pelotons out of the gym today. We’re getting rid of them. We’re going to throw them in the f—ing garbage today. We’re throwing them out of the UFC gym.”

Peloton stock feels the burn of Dana White’s boycott

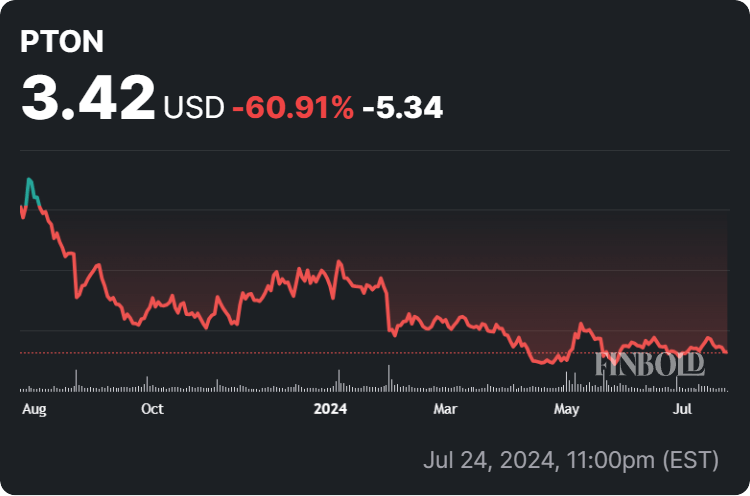

Not long after, Peloton rival Echelon shared an Instagram reel from one of White’s gyms, with the UFC CEO showing the Echelon bikes that replaced Pelotons, and PTON stock started to decline, dropping from $5.83 where it stood on November 29, 2023, eventually dropping to $3.42.

In other words, the shares of Peloton Interactive, the American exercise equipment and media company known for such products as stationary bicycles, indoor rowers, the Peloton treadmill, Peloton apparel, and Peloton shoes, have declined in price by 41.34% since the Instagram video.

At the same time, the current PTON stock price reflects a decline of 2.13% on the day, an 8.99% drop across the week, a modest increase of 1.60% on its monthly chart, yet a 60.91% dip accumulated in the last 12 months, according to the most recent data retrieved on July 25.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.