Warren Buffett, the celebrated investor and Chairman of Berkshire Hathaway (NYSE: BRKA, BRKB), made substantial changes to his extensive portfolio last quarter.

On February 14, it was revealed that Buffett’s portfolio underwent significant adjustments. These changes included substantial reductions and increases in shares of specific companies and complete divestment from others.

Faltering confidence in AAPL?

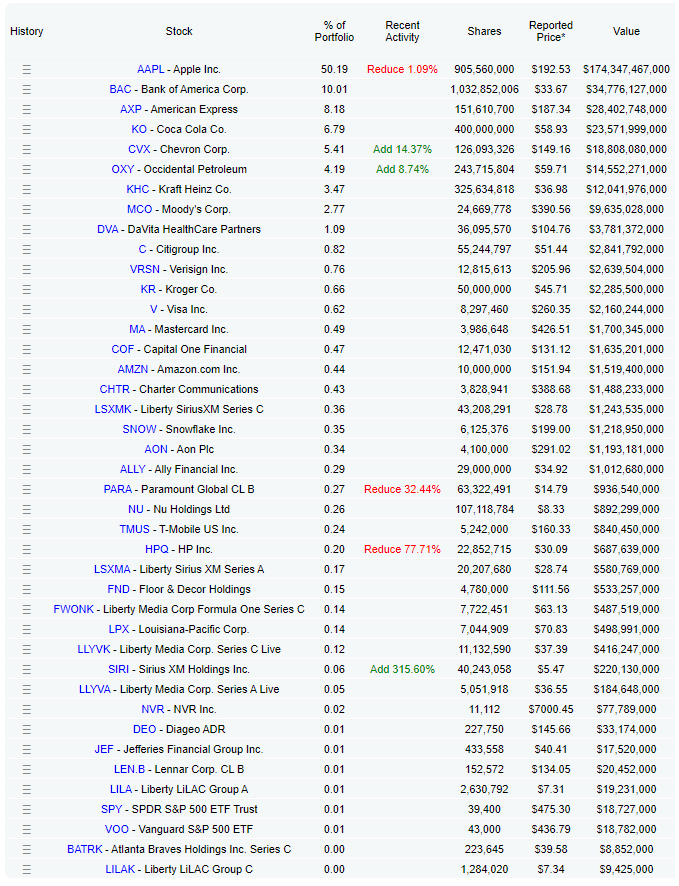

In the last quarter, Buffett initiated a reduction of his holdings in Apple (NASDAQ: AAPL) by selling 10 million shares. This move decreased his position by -1.09%, from 915 million to 905 million shares owned.

What’s intriguing is that Apple is scheduled to distribute its quarterly dividend on February 15, amounting to $0.24 per share. This means the ‘Oracle of Omaha’ will receive a $217.3 million dividend check from Apple, a decrease from the $219.7 million he would have received.

This isn’t the first instance of Buffett decreasing his stake in the Cupertino Giant. Historically, each time he has done so, it has foreshadowed a significant market downturn.

Reduced and completely exited positions

In the recent period, several companies witnessed a substantial reduction in their shares within Buffett’s portfolio, while others experienced a loss of confidence and exited his portfolio entirely.

Apart from AAPL’s reduction, other noteworthy deductions include Paramount Global (NASDAQ: PARA) at a reduction of -32.44% and HP (NYSE: HPQ) sizeably removed at -77.71%.

Additionally, positions in D.R. Horton (NYSE: DHI), Markel Group (NYSE: MKL), StoneCo (NASDAQ: STNE), and GlobeLife (NYSE: GL) were eliminated from the portfolio.

Most significant additions to the portfolio

Buffett showed increasing nostalgia and confidence in the media sector during the previous period. Sirius XM Holdings (NASDAQ: SIRI) experienced the most substantial growth, with the legendary investor acquiring 30,559,834 shares, marking a remarkable 315.60% increase in this position.

Buffett also demonstrated trust in the petroleum sector, which is evident in Chevron’s (NYSE: CVX) shares rising by 15,845,037 or 14.37%.

Additionally, Occidental Petroleum (NYSE: OXY) witnessed an expansion of its position by 8.74%, adding 19,586,612 shares.

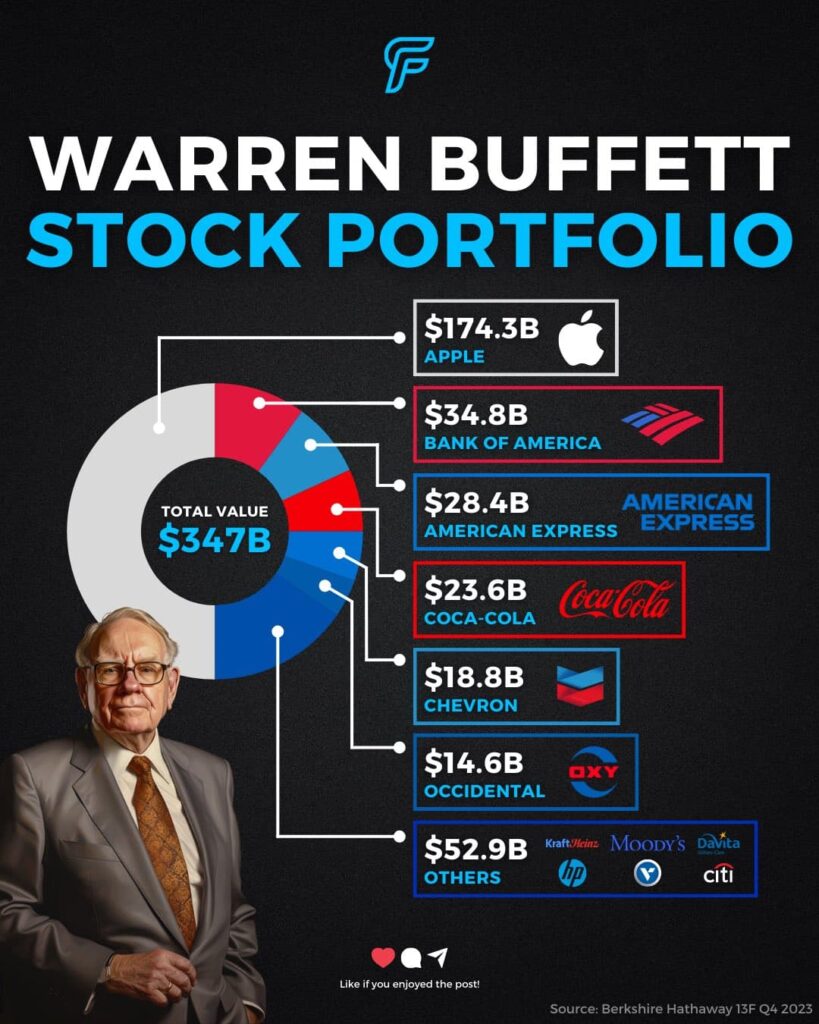

Following the latest update, Warren Buffett’s largest holdings reflect a diversified portfolio across various sectors. Topping the list is Apple, with a substantial value of $174 billion. Bank of America (NYSE: BAC) follows closely behind at $34 billion, demonstrating Buffett’s confidence in the banking sector.

American Express (NYSE: AXP) holds a significant position at $28 billion, showcasing Buffett’s continued interest in financial services. Coca-Cola (NYSE: KO), a long-standing favorite of Buffett, maintains a sizable stake at $23 billion.

Additionally, Buffett has shown trust in the energy sector, with Chevron valued at $18 billion and Occidental Petroleum at $14 billion, highlighting his strategic investments across different industries.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.