As Bitcoin‘s (BTC) price shows stability above $100,000, a cryptocurrency trading expert is warning that the maiden digital currency might enter a bear market within months.

According to Ali Martinez, historical trends indicate that Bitcoin’s downturn may be imminent, despite the anticipation that the asset will rise further amid a changing regulatory landscape, he said in an X post on January 24.

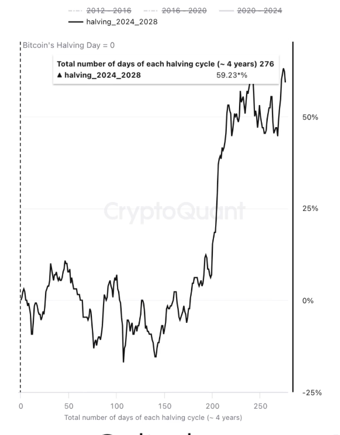

Martinez highlighted that during Bitcoin’s previous halving cycles, the asset reached a market top within specific timeframes. Following the 2012 halving, the market top occurred 367 days later.

After the 2016 halving, the peak came 526 days after the halving. Similarly, after the 2020 halving, Bitcoin reached its top 547 days later, marking the start of a bear market.

Currently, Bitcoin sits at 276 days since the 2024 halving. If history repeats itself, Martinez predicts that the next market top—and subsequent bear market—could occur between 100 and 270 days from now, translating to a timeline between May and October 2025.

“If history were to repeat itself, the next Bitcoin market top could be 100 to 270 days away, which could be anywhere between May and October 2025,” he said.

Notably, as reported by Finbold, trading expert Trader Tardigrade noted, based on historical trends, Bitcoin might hit the top at the end of March 2025 with a price target of $170,000.

Impact of regulatory changes on Bitcoin’s price

This projection comes as most market players anticipate a Bitcoin rally, bolstered by positive regulatory developments spearheaded by President Donald Trump.

Barely a week into office, the new administration has unveiled its cryptocurrency agenda, including exploring a strategic Bitcoin reserve to stabilize its price and legitimize it as an asset.

Regulatory reforms include a new Securities Exchange Commission (SEC) task force and a working group to draft clearer crypto rules, signaling a shift toward crypto-friendly policies.

Additionally, Trump has banned central bank digital currencies (CBDCs) to protect Bitcoin and reversed restrictive SEC rules, encouraging banks and institutions to engage with cryptocurrency.

In response, banking giants such as Morgan Stanley (NYSE: MS) have signaled their willingness to collaborate with regulators to offer cryptocurrency solutions to clients.

It’s worth noting that before Trump’s election, there was anticipation that Bitcoin would rally significantly, with some dubbing him the “first crypto president.” However, Bitcoin has struggled to make a decisive breakout, with the $110,000 remaining a key barrier.

What next for BTC

Amid this potentially friendly cryptocurrency environment, analysts have set several price targets for Bitcoin. For instance, pseudonymous analyst Crypto General, in an X post on January 24, observed strong signs of an impending rally as Bitcoin approaches its all-time high.

The analyst noted that the price has broken out from a consolidation zone near $88,000, with the next major resistance level projected at $130,000. This target aligns with optimism fueled by the Trump administration’s favorable developments.

Technical indicators further reinforce a bullish outlook. Bitcoin has surged past the $100,000 psychological barrier, which is now a strong support level.

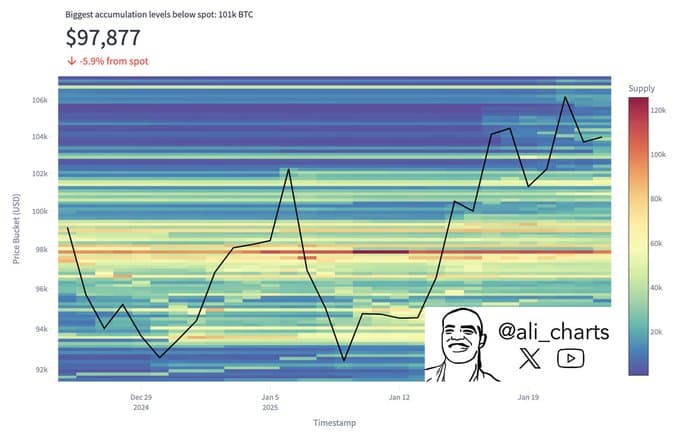

In the short term, Martinez’s data suggests that Bitcoin’s bullish trend hinges on maintaining support at $97,877. On-chain data reveals that over 101,000 BTC were accumulated at this price point, making it a pivotal zone for buyers.

Holding above this level is crucial for sustaining the current upward momentum. However, a drop below this support could trigger selling pressure, potentially jeopardizing the bullish trajectory.

Bitcoin price analysis

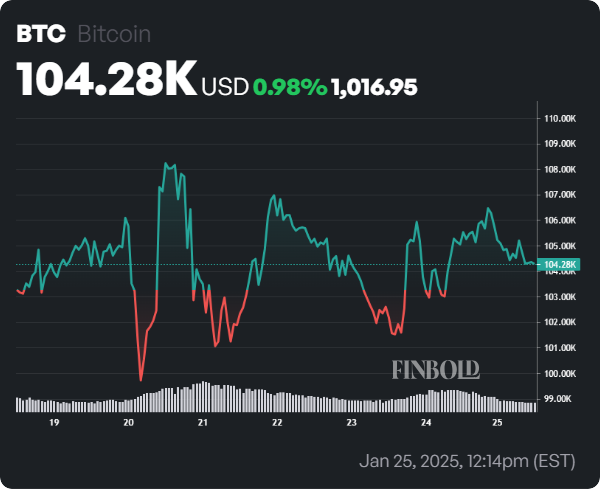

Bitcoin was trading at $104,280 at press time, dipping 1.1% in the last 24 hours. On the weekly chart, BTC has gained a modest 1%.

As Bitcoin shows stability above the $100,000 mark, bulls must take charge and trigger a decisive move toward $110,000, as a drop below $100,000 could invalidate bullish sentiment.

Featured image via Shutterstock