With the increasing geopolitical tensions, uncertainty over inflation, and recession fears around the world rampant, gold has become a go-to commodity for investors.

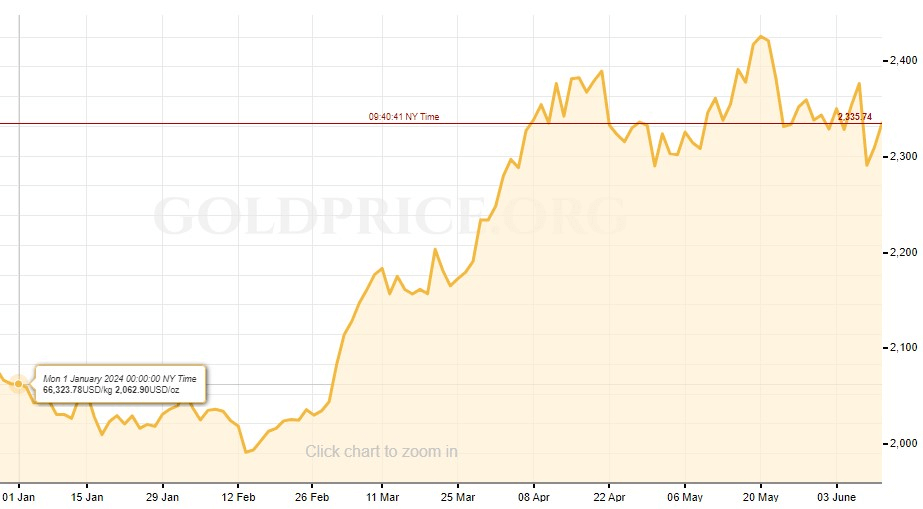

In 2024 alone, gold’s price per ounce has been on an impressive growth trajectory of more than 13%, elevating from $2,062 at the start of this year to $2,339 at the time of writing, mainly thanks to the lower-than-expected consumer price index (CPI) for May.

From a technical perspective, $2,300 now acts as immediate support, followed by the $2,285 zone.

Conversely, the next resistance zone is identified at $2,338.

Despite the US CPI coming in lower than anticipated, geopolitical tensions show no signs of abating and increasing fears of rising inflation around the world, Finbold decided to utilize OpenAI’s newest update to ChatGPT, its 4o version besides expert opinion, to predict gold’s possible trajectory and the timeframe for reaching the $3,000 mark.

ChatGPT-4o offers a most plausible timeline for Gold at $3,000

According to the largest chatbot, major economic crises or a significant market downturn could accelerate the demand for gold, while further geopolitical instability or significant currency devaluation could also push prices higher rapidly.

Given the current price of $2,339 and potential growth scenarios, it is plausible that gold could hit $3,000 per ounce within the next 3 to 5 years if market conditions support a steady growth rate of 10%. However, if growth is more modest, around 5%, it may take closer to 5 years or more.

Based on historical trends and current market factors, the LLM suggests gold could potentially reach $3,000 per ounce by 2027, assuming a steady annual growth rate and no major disruptive events.

Given the current annual growth rate of 13.4%, ChatGPT estimated that gold will reach $3,000 per ounce by mid-2026. This projection assumes the growth rate remains consistent and that no significant economic or geopolitical disruptions alter market dynamics.

Commodity experts’ gold price forecast

Central banks worldwide, particularly in China, have been increasing their gold reserves due to concerns about currency depreciation and geopolitical and economic risks.

Although most analysts and traders are bullish on gold, they believe the likelihood of the precious metal surpassing $3,000 per ounce remains low at this time.

‘It’s not a case of some particular factor holding back gold but rather that $3,000 would mean another 30% from here, which is quite a lot given we have already had some hefty gains,’ said Nikos Kavalis, managing director of Metals Focus.

However, Citi analysts say gold prices could reach $3,000 over the next 12 months, driven by strong physical demand, central bank purchases, and favorable macroeconomic conditions. While the increase may not be linear, the average price is expected to rise in the second half of 2024 and into 2025, frequently testing new all-time highs.

Key factors supporting this forecast include the resilience of gold prices despite a strong US dollar and high interest rates and the potential for weaker US growth and lower yields. Uncertainties around the US election and fiscal policies could also boost demand for gold.

Additionally, an anticipated easing cycle from the Federal Reserve and robust gold purchases by emerging market central banks further support this bullish outlook.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.