After Bitcoin (BTC) attained an all-time high of above $73,000, the market has been on edge regarding the next step for the maiden crypto. Indeed, a section of the market anticipates that Bitcoin might be experiencing a pre-halving retracement after falling from the record high to around $65,000 within hours.

Amid the anticipation, crypto trading expert Trading Shot has observed that based on technical indicators, Bitcoin is likely to see another all-time high by the end of March.

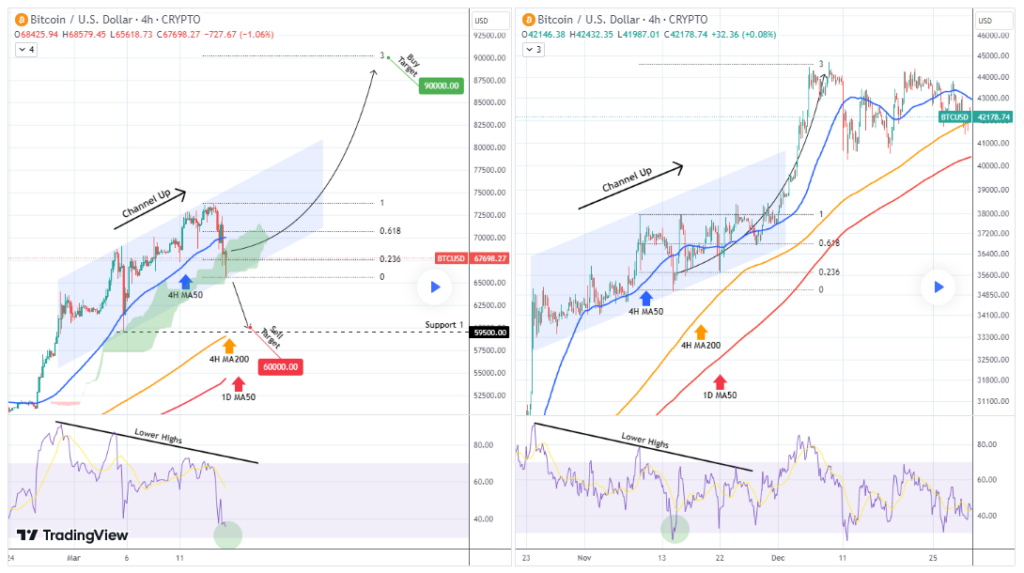

In a TradingView post on March 15, the analyst pointed out that the drop to $65,000 saw Bitcoin breaking below the four-hour MA50 and entering the green Ichimoku Cloud for the first time in the month, while also touching the bottom of the short-term channel up pattern.

Notably, the Ichimoku Cloud is a technical indicator used to assess potential future price movements and to identify key levels of support and resistance.

Despite this dip, the analyst pointed out that this marks the second higher low for the pattern, indicating a potential continuation of the bullish trend. According to the expert, as long as the candles continue to close inside the channel up, investors should anticipate the bullish trend to persist, potentially leading to a break-out attempt towards the 3.0 Fibonacci extension at $90,000.

“As long as the 1D MA50 (red trend-line) holds, we can look forward to a bullish reversal and higher accumulation towards yet another ATH near the end of the month or at worst first week of April,” he said.

The trading expert highlighted similarities between the current pattern and December 2023, not just in price action and moving averages (MA) but also in relative strength index (RSI) sequences, reinforcing confidence in a bullish continuation.

Potential Bitcoin downside

However, he cautioned that a downside break in the channel up pattern could lead to a potential downturn to $60,000, coinciding with testing the four-hour MA200.

It’s worth noting that after hitting the $73,700 mark, Bitcoin sharply corrected, with a section of the market noting that the trajectory mirrored past performance where BTC tended to experience volatility in the aftermath of hitting a record high.

Regarding the next Bitcoin price movement, investors should be keen on keeping an eye on select price levels in the coming days. Notably, the $64,750 to $66,700 range remains a key support at the moment, and if it’s lost, investors should watch out for $60,760 and $62,790.

Bitcoin price analysis

By press time, Bitcoin was trading at $67,930, having lost its value by about 0.35% in the last 24 hours. Over the past seven days, Bitcoin is down about 0.47%.

In summary, investors should be on the lookout for the next Bitcoin trajectory as it remains susceptible to overall market sentiments while monitoring key support and resistance levels.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.