Becoming a millionaire might sound like wishful thinking, but it’s not an unattainable goal if you start early and invest wisely. With the right approach and commitment, you can achieve millionaire status in just a decade. In this guide, we’ll explore the strategies and calculations you need to consider so you can determine how much to invest to be a millionaire in 10 years.

Setting the goal

Before diving into the numbers, it’s essential to set a clear goal—becoming a millionaire by 2035. This gives us a timeframe of ten years to work with. Time is a crucial factor in investing, as it allows your money to grow through the power of compounding.

Understanding the power of compounding

Let’s illustrate the power of compounding with an example:

Suppose you invest $1,000 today at an annual interest rate of 8%. After one year, your investment grows to $1,080. In the second year, you earn 8% interest on $1,080, resulting in $1,166.40, and so on.

As is evident from the example, your money grows exponentially over time due to compounding.

How much to invest to be a millionaire in 10 years?

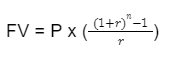

To determine how much to invest to be a millionaire in 10 years with an annual return rate of 7%, we can use the formula for the future value of a series of cash flows (monthly investments) at a regular interval, compounded at a regular rate. The formula for the future value of an annuity (FV) is given by:

where:

- P is the monthly investment amount;

- r is the monthly interest rate (annual rate divided by 12);

- n is the total number of payments (months).

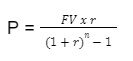

You’re targeting a future value (FV) of $1,000,000, the annual interest rate is 7% (so the monthly interest rate is 0.07/12), and the total number of payments over 10 years (120 months).

We can rearrange the formula to solve for P, the monthly investment amount:

With this done, we can calculate.

To become a millionaire in 10 years with an annual return rate of 7%, you would need to invest approximately $5,777.51 monthly.

How to reach your goal?

Now that we know the monthly investment required, let’s explore some strategies to make this goal more achievable:

- Start early: The earlier you start investing, the more time your money has to grow. Even small contributions can accumulate significantly over time thanks to the power of compounding;

- Diversify your investments: Spread your investments across different asset classes, such as stocks, bonds, real estate, and mutual funds, to reduce risk and maximize returns;

- Increase your savings rate: If investing $8,333.33 per month seems unattainable, consider ways to increase your income or reduce your expenses to free up more money for investing;

- Take advantage of tax-advantaged accounts: Contribute to retirement accounts like 401(k)s or IRAs, which offer tax benefits that can help your money grow faster;

- Stay disciplined: Stick to your investment plan and resist the urge to withdraw funds prematurely. Consistency is key to long-term success in investing.

Example scenario

Let’s consider a hypothetical scenario to illustrate how these strategies can work in practice. Namely, our fictional investor is a 25-year-old professional who wants to become a millionaire by the time they turn 35. They decide to follow the advice outlined above and start investing $1,000 per month in a diversified portfolio of stocks and bonds.

Using a compound interest calculator, the fictional investor estimates that with an average annual return of 7%, they could potentially reach their goal by their 35th birthday.

Here’s how their investment might grow over the years:

| Year | Age | Monthly investment | Total investment | Projected portfolio value |

| 2025 | 25 | $1,000 | $12,000 | $12,840 |

| 2026 | 26 | $1,000 | $24,000 | $26,028 |

| 2027 | 27 | $1,000 | $36,000 | $39,702 |

| 2028 | 28 | $1,000 | $48,000 | $53,891 |

| 2029 | 29 | $1,000 | $60,000 | $68,625 |

| 2030 | 30 | $1,000 | $72,000 | $83,935 |

| 2031 | 31 | $1,000 | $84,000 | $99,854 |

| 2032 | 32 | $1,000 | $96,000 | $116,415 |

| 2033 | 33 | $1,000 | $108,000 | $133,653 |

| 2034 | 34 | $1,000 | $120,000 | $151,605 |

| 2035 | 35 | $1,000 | $132,000 | $170,311 |

By the time the fictional investor turns 35 in 2035, their portfolio could potentially be worth over $170,000, putting them well on their way to achieving millionaire status.

Conclusion

Although we answered the question of how much to invest to be a millionaire in 10 years, we must point out that this is a fictional scenario.

Nevertheless, it’s key to remember that you should start early, use the power of compounding, and most importantly—stay disciplined. By following these three principles, you can turn your dream into reality.

Also, remember to regularly review and adjust your investment plan as needed to stay on track toward financial success.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.