Several decades ago, there weren’t that many millionaires. Barring a bountiful inheritance or winning a lottery, earning that sum was quite a feat. Today, however, given enough time, patience, and diligence, everyone has the potential to become a millionaire. And if you already made 100k, you have passed quite some distance from the start line. Today, we’ll provide a guide to maximize your returns and show you how to invest 100k to make $1 million.

Prep work (before you spend any money)

It doesn’t matter whether you got your principal through inheritance, lottery, or savings: investing 100k to make $1 million requires detailed preparation and planning to minimize risks and maximize your returns. Make sure you do the following:

- Eliminate all high-interest debt before investing: First and foremost, close all outstanding debt with high-interest rates (e.g., everything above 5%). Loans and debt can not only negate your returns but bring you into the negatives as well;

- Define your time span and investing goals: Turning 100k into $1 million takes different paths if you are 25, 35, or 50. Certain financial assets have higher potential returns than others. For example, stocks can provide more in return than bonds, therefore reaching one million more quickly. However, the trade-off is that you take on more risk;

- Determine your risk tolerance: No one can guarantee an investment’s success. That said, some bets, like government bonds, are virtually safe. On the other hand, stocks are somewhat volatile but can potentially earn more. Ultimately, high-risk assets like crypto can have stellar potential return rates but remain notoriously unreliable. Make sure to diversify your portfolio with different assets to reach your preferred risk levels;

- Reduce fees and taxes to a minimum: Aiming for optimal returns, people often neglect costs and taxes, which can bite a portion off of all gains. Carefully consider the investing agent or platform you decide to lean on, and make sure to stay informed on the amount of tax you have to pay.

Consider the S&P 500

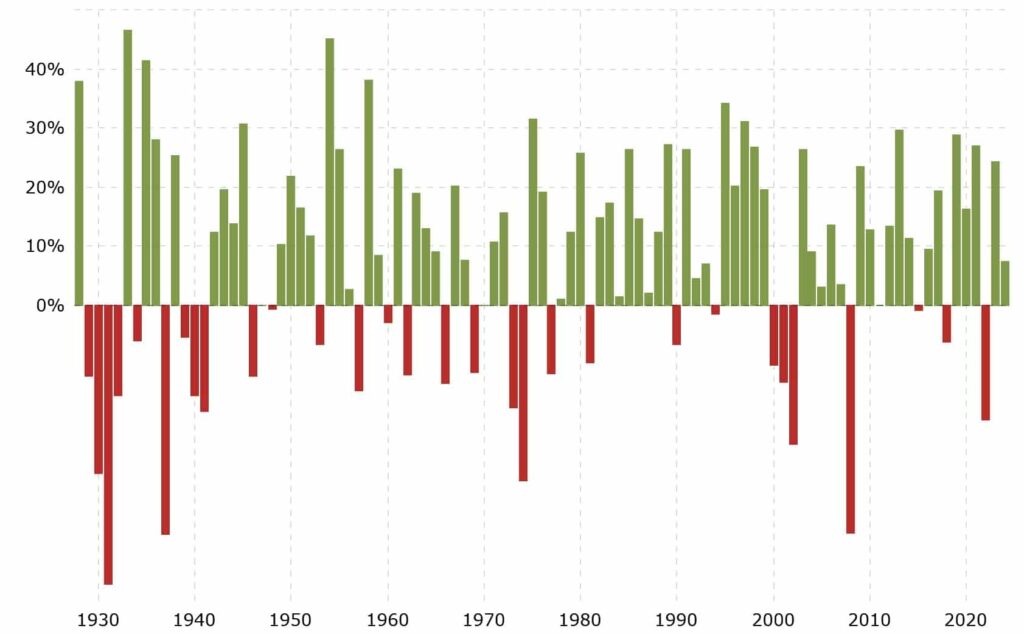

When people think about ways to invest 100k to make $1 million, something as common as the S&P 500 index rarely crosses their minds at first. While it is true that investing in an index fund that tracks the S&P 500 won’t get you above the market average, it is also true it won’t get you below that.

Warren Buffett, the most well-known investor today, also recommends it. In 2007, he bet a million dollars that his S&P 500 investment would beat any actively managed fund in a decade. Suffice it to say he reached a return rate of 125.8% for the period and won the bet.

With dividends reinvested, the S&P 500 provides an average annual return of around 10%, which can turn your 100k into $1 million within 24 years if the returns match the historical average. Adding a monthly sum to the principal would get you there even faster.

Putting everything into the S&P 500 is feasible and relatively low-risk, as most experts bet that the American economy will continue expanding. However, due to the average returns and passivity of such an investment, you might want to diversify that with additional assets.

Dividend stocks for reinvesting success

Some of the best dividend stocks have an annual dividend return rate of over 5%, sometimes reaching 7%, 9%, or even 12%. However, make sure you check a company’s financial status since certain companies offer exceedingly high dividend rates to mask their faltering fiscal performance.

Growth stocks for more reliable returns

Having most of the investing public trusting a company to grow in the future is a positive indicator that its stock is worth buying, as getting returns on your investment is very likely. The only downside is that shares in these companies are often highly valuated as investors flock to cash in on the growth. Furthermore, the “guaranteed” growth can be negated by large sudden market events or failure to meet expectations, leading to a higher volatility of growth stocks.

Loyal investors who endure volatility are eligible to receive beyond-average returns from growth stocks. However, if you decide to invest in them, keep them in a diversified portfolio to better manage the risks involved.

How to invest 100k to make $1 million – additional tips

In addition to the recommended assets, there are many small and neat tips and tricks to help you along the way of becoming a millionaire:

- Keep an emergency fund: While it may be tempting to pour everything into an investing portfolio, keeping three to six months’ worth of living costs available will come in handy in unexpected situations (medical bills or house repairs) and prevent having to take on high-interest debt;

- Research before you invest: Sometimes, a too-good-to-be-true investment opportunity is precisely that. Make sure to check the fundamentals before you spend any money on a lucrative opportunity;

- Keep a level head: Once you make an investing goal, stick to it. Temporary swings in the market could provoke an emotional reaction, but going through the bad weather can reward your patience;

- Do not try to time the market: Timing the market is never a solid investing strategy. To ensure you invest 100k to make $1 million instead of zero, maintain a long-term outlook, and never lose the larger image from your sight;

- Stay informed: Serious investing requires a degree of involvement in the market, such as tracking market trends and following information on the sectors you have a stake in. Knowledge and understanding are the sole difference between an investment and a gamble.

How to invest 100k to make $1 million – the bottom line

With careful preparations and a solid investing plan, everyone with $100,000 can become a millionaire in time. However, this journey is not without its obstacles and requires significant periods of devoted and diligent work.

Hopefully, today’s guide has provided you with the basics. Whether it is an early retirement, financial independence, or something else, we wish you luck and smooth sailing until you reach the $1 million goal line.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.