Semiconductor giant Nvidia (NASDAQ: NVDA) continues to demonstrate a remarkable financial journey after venturing into artificial intelligence (AI), a sector that has seen an explosive increase in investor interest and capital inflow.

This venture has elevated Nvidia to become the world’s most valuable company, surpassing other technology giants, including Microsoft (NASDAQ: MSFT) and Apple (NASDAQ: AAPL).

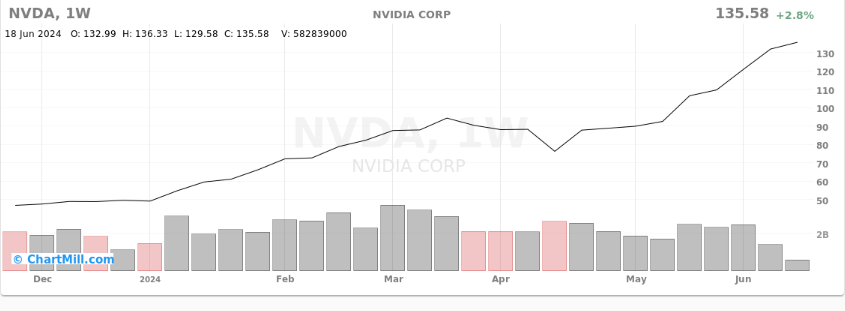

With the growth, the Nvidia stock has been rewarding for investors who bet on the AI sector, considering that the equity has generally traded in the green zone across 2024. Specifically, on a year-to-date basis, Nvidia is up 181.46%.

Investing $1,000 in Nvidia

In this line, Finbold explored how much the equity would return for investors who made specific investments. For instance, if one had the foresight to invest $1,000 in Nvidia stock at the start of 2024, given the 181.46% increase in the stock price, the investment would now be worth $2,814.60, reflecting a profit of $1,814.60.

The remarkable growth of Nvidia’s market value over the past year has highlighted the Wall Street craze fueled by the promise of AI technology. Notably, Nvidia’s rally has boosted its valuation and significantly contributed to the record highs seen in the S&P 500.

In addition to the AI bet, Nvidia’s growth and increased interest can be attributed to the decision to enact a 10-for-1 stock split on May 22. Since then, the share price has surged over 40%, significantly outpacing the S&P 500. This split has made Nvidia’s stock more accessible to a broader range of investors, further fueling its growth.

Nvidia share price analysis

At press time, Nvidia stock was trading at $135.58, having rallied over 3.5% in the last 24 hours.

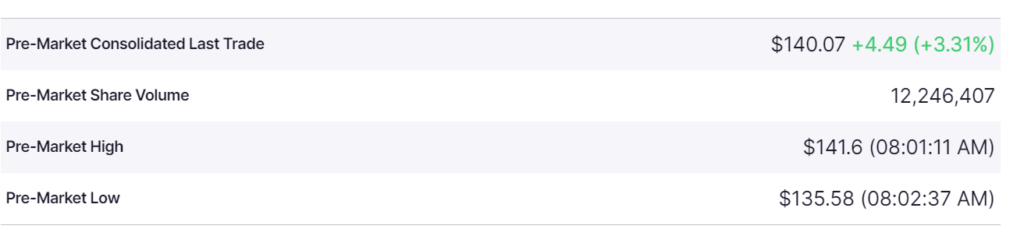

Interestingly, the stock seeks to sustain its momentum. In the pre-market, the equity was up 3.3%, hitting the $140 mark.

NVDA is projected to open above $140 ahead of the market opening on June 20, indicating a pre-stock split valuation of $1,400 for the equity.

The most ideal bullish price target for Nvidia among analysts is the $200 mark. If the stock reaches this valuation, its market capitalization would be a staggering $4.9 trillion.

However, despite the rally, there are concerns that the current hype around AI could diminish if there are signs of reduced spending on AI technologies. These concerns have been exacerbated for Nvidia as technical indicators have flashed warning signs.

According to a Finbold report, the stock’s Relative Strength Index (RSI) has consistently read above the critical 70 mark for consecutive sessions, indicating overbought conditions and signaling a potential crash.