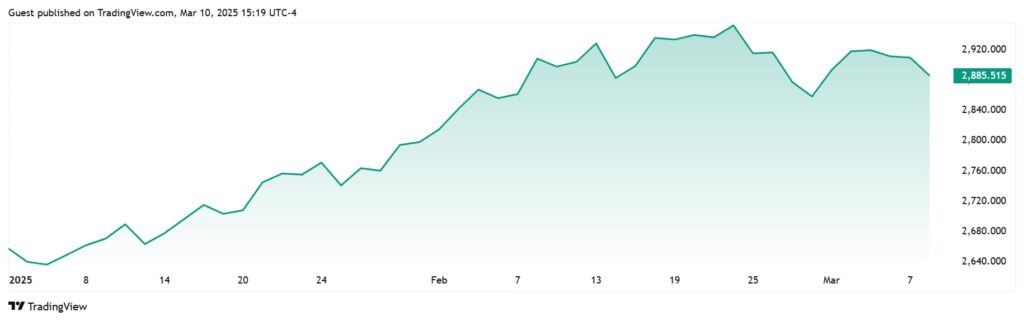

Gold trades lower near $2,900, struggling to gain strong bullish momentum but holding within a narrow range. The precious metal continues to benefit from weak U.S. economic data, growing expectations of Federal Reserve interest rate cuts, and ongoing global trade uncertainty.

At press time, gold is trading at $2,885, reflecting a 9% year-to-date gain. While the macroeconomic backdrop remains favorable, upcoming catalysts such as inflation data and Federal Reserve policy decisions will be key in determining whether gold can maintain its upward trajectory toward $3,000.

Technical setup signals potential move to $3,100

From a technical standpoint, gold continues to follow a well-defined Channel Up pattern, a trend that has remained intact since the October 2022 inflation crisis bottom, as noted by TradingShot. This pattern has historically triggered price surges of nearly 20%, with the 50-day moving average (MA50) serving as critical dynamic support.

When this support level fails, gold has typically corrected toward the 0.382 Fibonacci retracement level, presenting a buying opportunity before resuming its upward trajectory.

Currently, gold is trading within the 0.5 – 0.382 Fibonacci zone, an area that has previously led to strong rebounds, including a 22% rally in past cycles.

If this trend holds, gold is likely to peak around $3,100. However, traders should monitor the one-day RSI Double Top pattern, which has historically been the most effective sell signal. If the RSI confirms a double top, it could indicate an upcoming pullback before gold resumes its next move.

Macroeconomic factors driving Gold’s price action

Gold’s short-term direction hinges on inflation data and Federal Reserve rate expectations. The U.S. labor market showed signs of cooling, with February’s NFP report revealing 151,000 jobs added, missing the forecasted 160,000. This weaker-than-expected data reinforced market expectations that the Federal Reserve may cut rates again in May or June.

Meanwhile, Fed Chair Jerome Powell struck a more cautious tone on the economy in a March 7 speech in Chicago highlighting signs of slowing consumer spending and growing uncertainty among households and businesses.

While Powell did not signal immediate concerns, his remarks were notably less optimistic than in previous statements, fueling fresh speculation over the pace of economic growth and its impact on monetary policy.

Trade tensions and consumer sentiment weigh on Gold

Escalating trade tensions continue to influence gold prices, with the U.S. implementing new 25% tariffs on imports from Mexico and Canada, alongside additional tariffs on Chinese goods, leaving investors wary about the long-term direction of trade policy and its potential economic impact.

Meanwhile, consumer confidence remains under pressure, with the University of Michigan’s Consumer Sentiment Index set for release on March 14. February’s 10% decline in the index was largely linked to tariff-related concerns and broader economic uncertainty. If sentiment deteriorates further, it could strengthen gold’s appeal as a safe-haven asset.

Gold’s Outlook: Can It reach $3,000?

Gold’s fundamental and technical landscape remains bullish, supported by macroeconomic conditions, historical price patterns, and investor demand for safe-haven assets. However, short-term volatility could emerge as markets react to upcoming inflation data and shifting Federal Reserve rate expectations.

If the current technical and economic patterns hold, gold could be on track for a move toward $3,100, though traders should prepare for potential corrections along the way.

A recent Finbold report highlights ChatGPT’s AI projections, which suggest that gold could reach this milestone by the first quarter of 2025, further strengthening the bullish sentiment despite potential short-term volatility.

Featured image via Shutterstock