As artificial intelligence tightens its hold on various industries and the stock market, Nvidia (NASDAQ: NVDA) dominates investor conversations. With its robust quarterly reports, analysts constantly revising their targets, and NVDA stock hitting new all-time highs almost daily, some traders might feel overwhelmed.

Now, they’re searching for a new frontrunner in the AI landscape, especially after previous disappointments from companies like Intel (NASDAQ: INTC) and Advanced Micro Devices (NASDAQ: AMD). Perhaps Micron Technology (NASDAQ: MU) could emerge as the new contender?

With gains of 14.13% since the previous market close, MU stock closed trading at $109.85 on March 21, further gains of 33.41% on the YTD chart are looking set only to increase after a monster earnings beat.

Picks for you

High expectations? No problem for MU stock and its financials

As investors gravitated back towards Nvidia and the semiconductor sector, viewing it as a ‘safe bet,’ there was a need for Micron Technology to deliver an ‘above expectations’ performance to redirect attention towards memory producers, and Micron rose to the occasion.

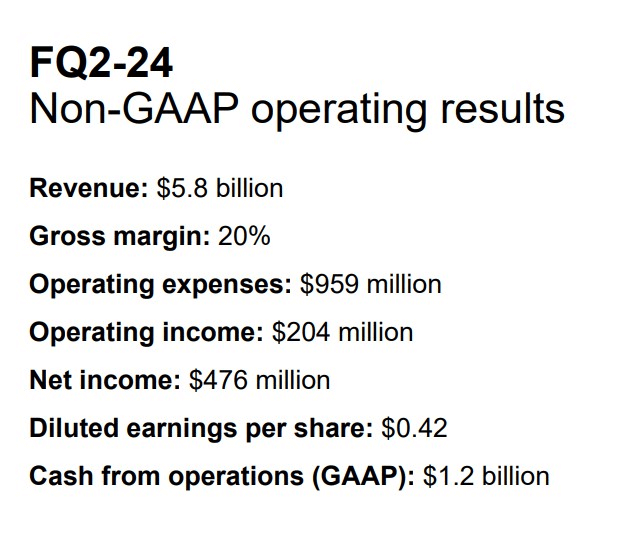

In its Q2 report, Micron exceeded expectations with revenue reaching $5.82 billion, surpassing the anticipated $5.35 billion. This marks a notable increase from the $3.69 billion revenue reported in the same quarter last year. Additionally, Micron achieved a net income of $793 million, showcasing a significant improvement from the $2.3 billion net loss reported during the same period last year.

Looking forward to the fiscal third quarter, Micron expects to report revenue of $6.6 billion, surpassing analysts’ expectations of $6.02 billion, providing even more reasons for joy.

Analysts fell in love with MU stock

The impressive performance and robust quarterly report were bound to catch the attention of Wall Street. Analysts couldn’t help but sing praises of MU stock through price target increases.

Recently, MU stock saw a flurry of price target increases, signaling growing optimism among analysts.

Mizuho Securities raised its target from $105 to $124. Wedbush and Piper Sandler followed suit, setting their target prices at $130. Meanwhile, Rosenblatt set an even more bullish tone, elevating Micron stock to a new Street high of $225.

These upward revisions in price targets reflect the confidence analysts have in Micron’s performance and prospects, further fueling traders’ optimism, and hopes of MU stock’s ability to challenge NVDA in the long run.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.