Trading on July 24, 2024, gave many investors a fright as the stock market wiped more than $1 trillion in a single day. Despite the large downturn, many experts believe they are not a cause for concern as they do not stray from regular annual moves, and some prominent analysts have taken the opportunity to find the best stocks to buy at a likely short-lived discount.

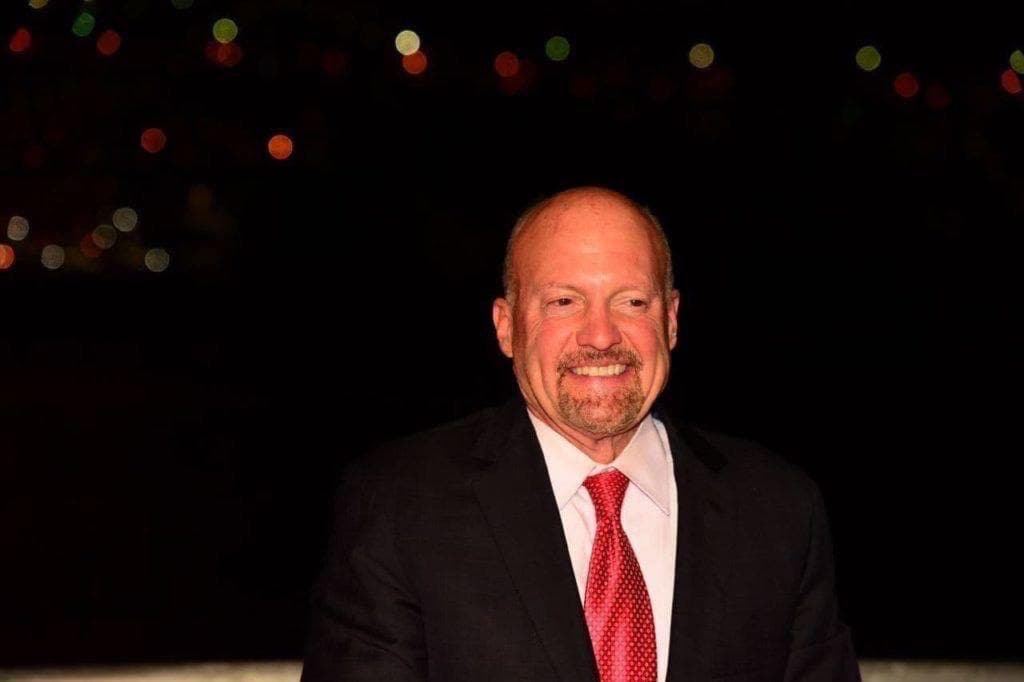

Jim Cramer, the former hedge fund manager and energetic host of CNBC’s Mad Money, was one of these figures, and he, in a July 25 X post, took the time to recommend two companies: Nvidia (NASDAQ: NVDA) and Apple (NASDAQ: AAPL), stating:

“Watch Apple and Nvidia. Those are the two that are the highest quality…They will tell you what to do”

Cramer, though recognizable as a figure of ridicule due to his many ill-timed assessments, nonetheless boasts a good reputation within the industry and has made many right calls through his long and storied career.

Nvidia (NASDAQ: NVDA)

Perhaps the most notable example of the host being very much in the right is his persistent bullishness about Nvidia – bullishness so strong the expert even named his dog after the semiconductor giant.

For years, Cramer has been a cheerleader for NVDA shares, first calling them significantly undervalued for such a promising company and more recently, after Nvidia’s incredible rise, he has been recommending people keep their faith in the artificial intelligence (AI) boom as he believes it is only at its beginning.

NVDA stock has, for its part, been performing exceptionally well and is up as much as 151.43% in the last 12 months of trading. Still, there has been some turbulence more recently and the blue-chip chipmaker is down 8.66% in the last 30 days to its press time price of $115.45.

Apple (NASDAQ: AAPL)

Jim Cramer has also been a long-standing proponent of Apple, even though, for much of 2024, the big tech giant has not been performing in line with its incredible historic growth.

The expert has mostly been focused on hedge fund exposure to AAPL, as well as the firm’s strong sales figures in massive markets such as China. Given Apple’s relatively recent partnership with OpenAI and Cramer’s optimism about AI’s future, the analyst has only become more bullish, as evidenced by his naming the firm as one of the ‘highest quality.’

AAPL stock, though initially depressed in 2024, has seen a veritable price explosion more recently and is up as much as 18.44% in the year-to-date (YTD) chart.

Still, much like Nvidia and many other technology stocks, Apple has been severely affected by the most recent downturn and is 3.88% in the red in the last full week of trading to its press time price of $219.90.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.