With Nvidia’s (NASDAQ: NVDA) share price trading below the crucial $100 support level, several market participants point to various theories that might impact the stock.

As a recap, Nvidia closed the August 7 session valued at $98, with less than 0.1% gains over the 24 hours. Although NVDA is down over 15% on the weekly chart, it continues to benefit from the company’s artificial intelligence (AI) bet, with the share price surging 105% in 2024.

Amid the downturn, Jim Cramer, host of “Mad Money,” highlighted the increased bearish activity surrounding the stock. In an X post on August 8, Cramer suggested that short-sellers are significantly impacting Nvidia’s share price while questioning the possibility of insider information at play.

At the same time, Cramer stated that Nvidia, along with Eli Lilly (NYSE: LLY), is currently under significant bearish pressure as short-sellers look for opportunities they consider “easy money.”

“Bears looking for easy money are betting big against Lilly and Nvidia once again.. Those are the two keys to this market and don’t you know it,” he said.

The financial commentator pointed out that bearish investors are targeting both Lilly and Nvidia, which he views as pivotal to the broader market’s performance. He highlighted a recent instance where Lilly’s impressive quarterly report had a notable impact on Nvidia’s stock performance, illustrating how closely linked these two equities are.

Nvidia short interest drop

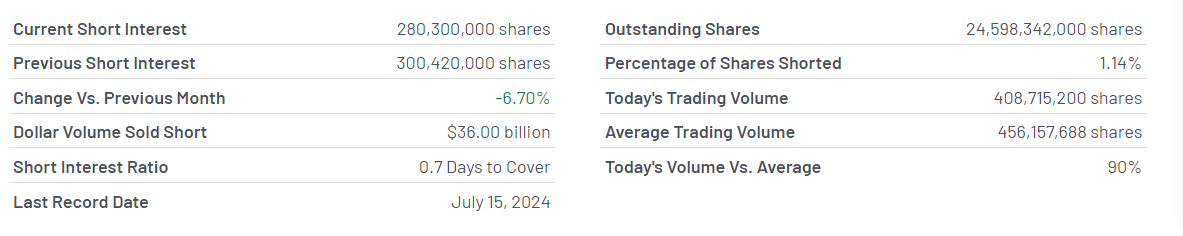

It’s worth noting that, according to data from MarketBeat on August 8, Nvidia reported a short interest of 280.30 million shares as of July 15, reflecting a 6.70% decrease from the previous month. This decline suggests that while Nvidia has faced downward pressure, bearish sentiment in the stock may not be as intense as it appears.

The short interest ratio, which measures the days needed to cover short positions based on the average trading volume of 456.16 million shares, is 0.7 days. Indicating a relatively quick coverage period for short sellers, suggesting a shift in market sentiment towards Nvidia.

Recession fears for the stock market

Although Nvidia and the general stock market have faced significant volatility, primarily due to fears of a possible recession in the United States, Cramer has offered a contrary opinion. He noted that current corporate earnings do not indicate an impending recession.

Despite Cramer’s take on the chip maker, the equity has exhibited unique trading momentum recently, recording significant capital swings. This volatility has recently earned NVDA the status of a meme or penny stock.

Following the sell-off, market participants focus on the upcoming earnings reports, which could positively influence the stock if the financial results surpass analysts’ estimates. Attention will be on the tech giant’s ability to demonstrate how its AI chips generate money for its customers.

Overall, Nvidia’s share price remains uncertain, although Wall Street analysts remain bullish for the long term.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.