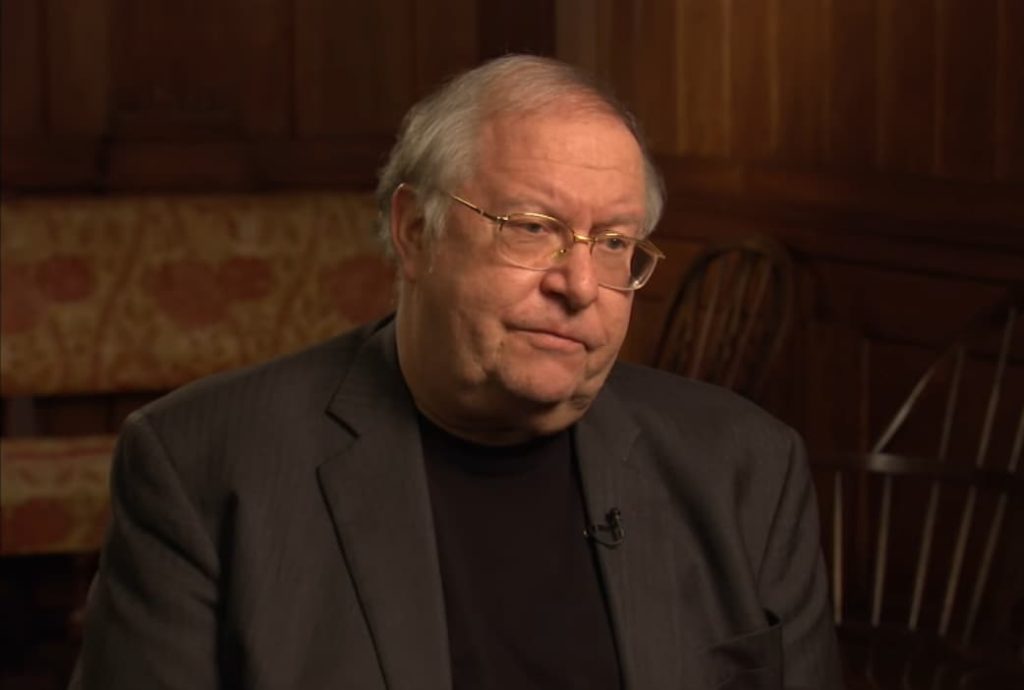

As the cryptocurrency market starts to recover back into the green zone with Bitcoin (BTC) leading the charge, the flagship digital asset doesn’t lack vocal supporters, including the early Amazon (NASDAQ: AMZN) investor Bill Miller III.

Specifically, Miller believes that Bitcoin is “dramatically different” from the entities such as FTX and Celsius Network, the failure of which has put off many potential investors from the crypto field, as he explained in an interview on CNBC’s ‘Closing Bell’ on January 6.

According to the legendary investor:

“The FTX collapse, that was a centralized enterprise, as was Celsius, and I think that it’s very important to understand that Bitcoin is dramatically different from that.”

Furthermore, Miller has drawn attention to the troubles in the traditional markets during the pandemic, when they scrambled for liquidity, and the Federal Reserve had to step up and throw them a lifeline, whereas Bitcoin did just fine on its own:

“The Fed had to come in and clean those markets by just injecting the massive amounts of liquidity, Bitcoin trades 24/7/365. There wasn’t a hiccup in the Bitcoin market.”

What about volatility?

Further comparing Bitcoin to the traditional markets, the famed investor touched upon the long-criticized volatility of the maiden crypto asset, stressing that “the market is up 70% and Bitcoin is up 190%. (…) In the past month or so, it has been less volatile than the market.”

A well-known Bitcoin bull, Miller has earlier expressed his surprise at the “remarkable” performance of the largest digital asset by market capitalization in spite of the recent troublesome events, like the FTX implosion and the arrest of its founder Sam Bankman-Fried, that have shaken the crypto sector, as Finbold reported.

A respected investment expert with a portfolio that consistently beat the S&P 500 Index from 1991 to 2005, Miller has also recently disclosed shares in crypto investment firm Silvergate Capital (which recently sank 40%) and crypto trading platform Coinbase.

Bitcoin price analysis

Meanwhile, Bitcoin was at press time trading at the price of $17,273.91, up 0.01% on the day, as well as recording an increase of 3.16% over the week, adding up to the 0.67% gain on its monthly chart.

At the same time, Bitcoin’s market cap stood at $332.66 billion, with a 24-hour trading volume of $15.82 billion (915,557 BTC), as per data retrieved by Finbold from the crypto tracking platform CoinMarketCap on January 10.

Featured image via WealthTrack YouTube.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.