On August 28, the current largest U.S. defense contractor, Lockheed Martin (NYSE: LMT), received a $5 billion contract from the U.S. Army to produce and maintain necessary military and defense equipment.

The contract envisions allocating $3.9 billion to the manufacturing of F-35 Lightening II aircraft, its maintenance, and upgrades, while the other $1 billion is aimed at funding the maintenance of F-35 Joint Strike Fighter (JSF) laboratory facilities and F-35 developmental flight test activities.

This contract further cements the company’s role as the leading defense contractor not only in the U.S. but worldwide, as the company reported $64 billion in revenue from defense contracts in 2023.

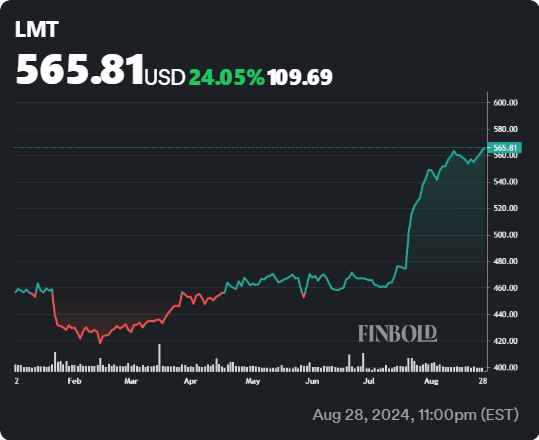

LMT stock price chart

Lockheed Martin stock closed the August 28 trading session at a valuation of $563.98 after adding 0.64%, extending the gains of 1.42% from the previous five trading days.

The news of a $5 billion contract has yet to affect LMT’s share price, as pre-market trading shows a loss of 0.26%.

Zooming out, the year-to-date (YTD) chart shows a steady progress of 23.65% in the past months.

LMT stock technical analysis

Looking at the monthly technical price chart, LMT shares have recently surpassed their closest resistance zone at $562.87 and are close to breaching the next resistance level set at $564.35. This shows strong positive momentum based on the nearest support zone of $553.21.

The 50, 100, and 200-day simple moving averages (SMAs) further aid the strong momentum argument, showing that the current price range is well above these indicators.

An upward momentum from the Relative Strength Index (RSI), which shows the latest reading at the close of 58.59, shows that the stock is currently experiencing a rising buying volume from investors.

Wall Street is cautious about LMT stock

Due to an already high valuation and 20.47 price-to-earnings ratio (P/E), Wall Street analysts think that LMT shares don’t have much more room for growth, as they assign a “moderate buy” rating based on 15 examinations. Of these, 8 advise a “buy,” 6 recommend a “hold,” and one opts for a “sell.”

The average price target of $561.93 reflects a downside of 0.36% from the current price levels.

Two of the most recent price target updates, from Seaport Global on August 23 (maintained “buy” rating, with a price target of $577) and Morgan Stanley on August 15 (“hold” rating, and an unchanged price target of $599), reflect the sentiment among Wall Street institutions regarding this defense stock, and that is, its room for growth remains small.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.