2023 has been a challenging year for Lucid (NASDAQ: LCID), with troubles that never seem to end, with significant workforce reductions, with over 18% cut last March.

Additionally, the December departure of its Chief Financial Officer (CFO), Sherry House, further underscored the challenges. The company’s full-year production outlook also declined due to weakening demand.

Compounding the issues, the stock was removed from the Nasdaq 100 index, and multiple analysts downgraded it, citing low interest in its costly vehicles.

But troubles also continue in 2024, as this stock has experienced a decline of over 18% from the beginning of this year. Falling from $4.17 to $3.41 at the time of writing.

Will 2024 be a year of revival?

As the year commences, the outlook looks bleak. However, LCID might be able to see a light at the end of the tunnel as it receives massive backing from its investors in Saudi Arabia.

Lucid benefits significantly from substantial backing provided by the Saudi Arabian government, holding a 60% stake in the company through its Public Investment Fund (PIF). As part of its efforts to shift away from reliance on fossil fuels, the kingdom may position the struggling automaker as a national champion, aiding in realizing its long-term diversification objectives.

The Saudi Arabian government has also pledged to buy 100,000 Lucid vehicles within the coming decade. In September, it inaugurated the inaugural car manufacturing facility near its capital, Jeddah.

Given Lucid’s integral role in Saudi Arabia’s clean energy transition, it appears improbable that the government will allow the automaker to face bankruptcy. At a minimum, the Public Investment Fund (PIF) will likely persist as a crucial debt and equity financing source.

With all this news, it is still too early to tell because even with all the backing, Lucid is still not guaranteed to succeed, as it has many problems to deal with.

LCID stock price analysis

At the time of press, LCID stock was trading at $3.41, marking a decrease of -5.80% from the previous closure and a loss of -14.11% in the last 5 trading sessions.

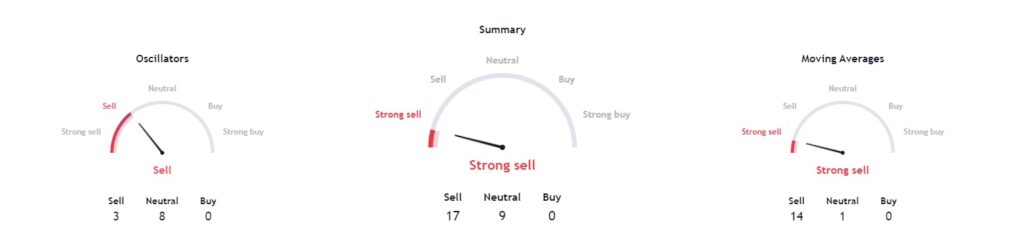

The stock’s outlook appears grim based on technical indicators. There’s a consensus of ‘strong sell’ from 17, and moving averages also lean towards ‘strong sell’ with a score of 14. Oscillators align with a ‘sell’ recommendation, supported by 3 signals.

Even with the strong backing from the Saudi government, Lucid stock is currently a weak performer, and there is no sign of these troubles ending soon.

Buy stocks now with Interactive Brokers – the most advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.