Renowned investor ‘The Big Short,’ Michael Burry, celebrated for his lucrative investments during the 2008 recession where he accurately foresaw the housing market collapse, is poised to reap substantial gains from his confidence in Alibaba Group Holdings (NYSE: BABA) stock following recent developments.

Specifically, Alibaba announced its repurchase of shares totaling $4.8 billion in the quarter ending March, marking its second-largest buyback ever and largest quarterly after bolstering its stock buyback program in February. The company expanded its share buyback initiative by an additional $25 billion to satisfy investors.

Alibaba, listed on both the Hong Kong and U.S. exchanges, had previously repurchased $2.9 billion worth of stock in the preceding quarter.

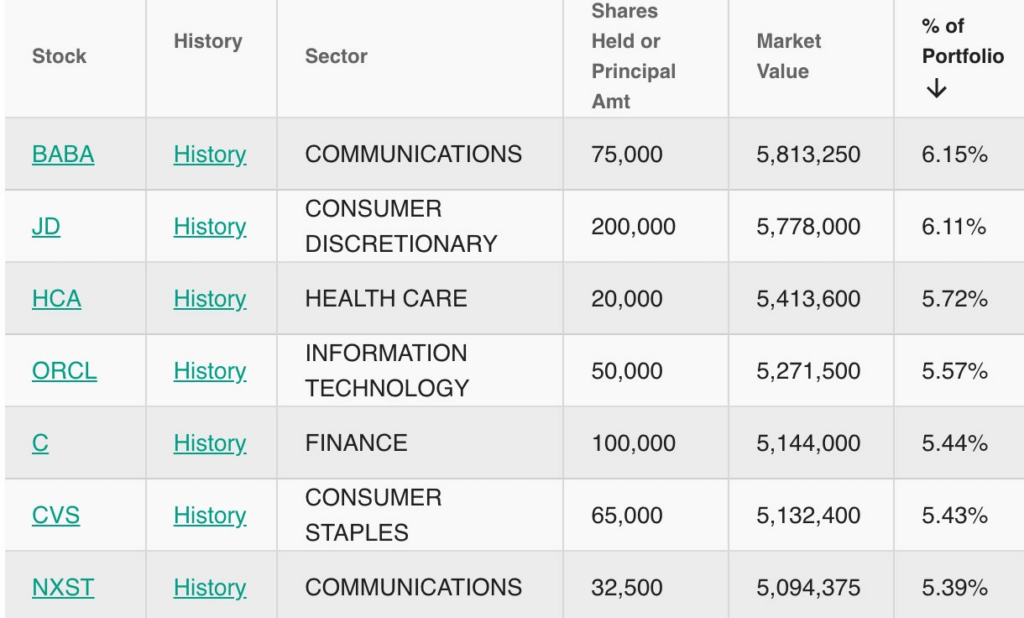

BABA is Burry’s largest holding

In a February 13F filing from Scion Asset Management, it’s revealed that Burry acquired 25,000 shares of BABA during the fourth quarter, boosting his total holdings to 75,000 shares, valued at $5.46 million.

This signifies a 50% surge in shares owned, elevating the percentage of BABA in the portfolio from 4.38% to 6.15%. This stands as Burry’s most significant holding in Q4.

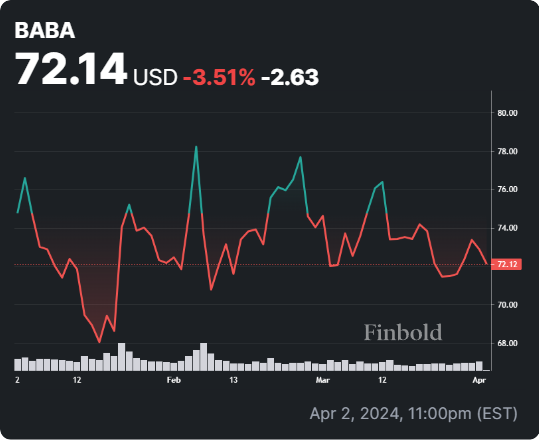

BABA stock price chart

Although the impact of the recent stock buyback announcement in the latest quarter has yet to show on the price charts, BABA stock is currently trading at $72.88. BABA shares experienced a slight decline of -0.67% in the latest session, but this retracement was offset by gains of 1.45% over the past five trading days.

However, since the beginning of 2024, BABA shares have declined by -3.51%.

Whether Alibaba’s efforts to increase stock value and appease its shareholders will succeed remains to be seen. However, the support it garners from a prominent investor like Burry can only enhance its reputation further.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.