Nancy Pelosi’s stock portfolio had an impressive performance in 2023, earning her $43 million. Now, it’s worth revisiting her portfolio performance three months into 2024 to see her current gains.

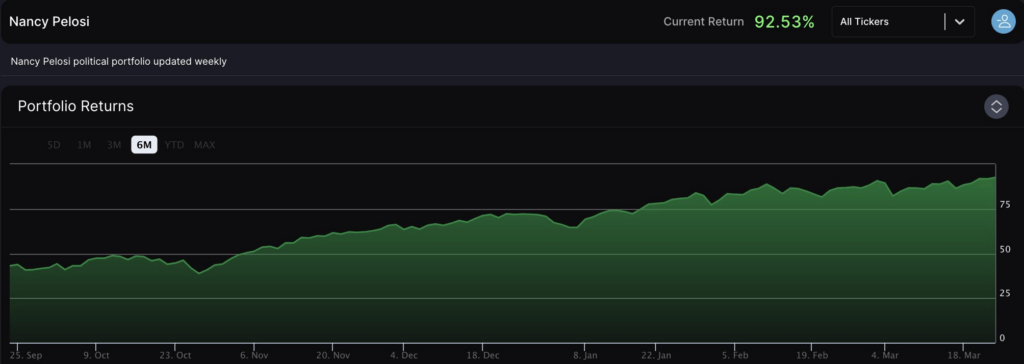

Estimates suggest Pelosi’s portfolio has already accumulated an impressive $9 million in profits, according to Quiver Quantitative, an insider and US politician stock tracker, However, this trend falls short of her previous year’s performance at the moment, where she earned $43 million. It’s possible that additional investments could help her surpass her previous record.

Finbold analyzed her portfolio to identify her largest holdings and determine their gains since January 1.

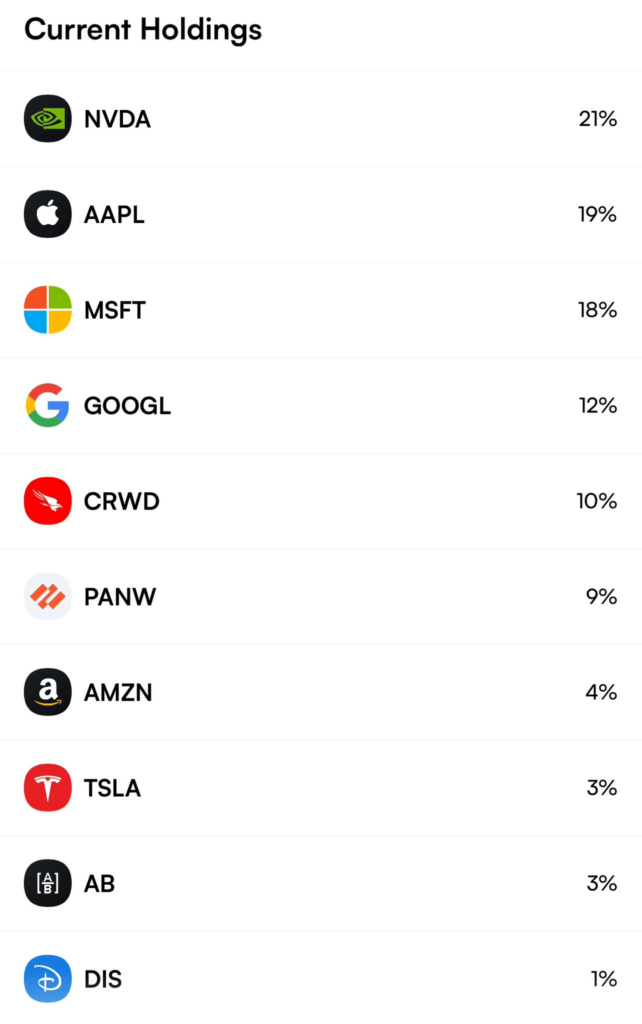

Nancy Pelosi’s updated stock portfolio holdings

An updated look into Pelosi’s stock portfolio reveals her significant investment in technology stocks, a trend that’s understandable given the current hype around artificial intelligence and its impact on the stock market.

Her largest holding, coincidentally the biggest winner, is Nvidia (NASDAQ: NVDA), which occupies 21% of her portfolio and has gained 95.75% in value since the start of 2024.

Other notable winners include Microsoft (NASDAQ: MSFT), representing 18% of her portfolio with a gain of 15.60%, Alphabet (NASDAQ: GOOGL) with a 12% presence and a gain of 9.12%, and Amazon (NASDAQ: AMZN) making up 4% of her portfolio with a gain of 19.30% since January 1.

However, not all holdings are performing well. Apple (NASDAQ: AAPL), the second-largest holding at 19%, has recorded losses of -7% in the last three months. Additionally, Tesla (NASDAQ: TSLA), although in a smaller position at 3%, has seen a significant decrease of -31% in its value over the same period.

A new addition to the portfolio, and a new all-time high

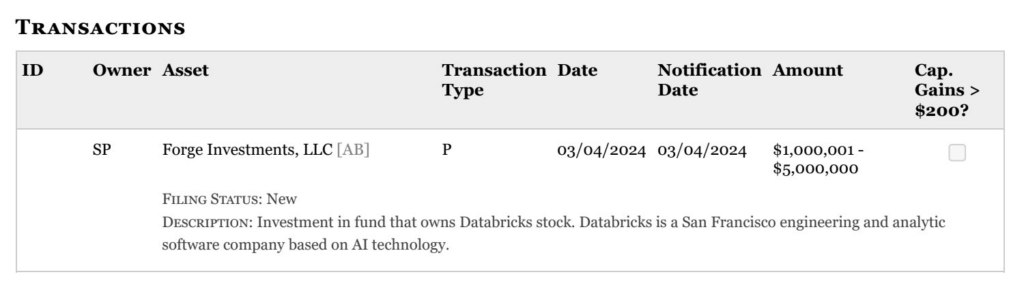

Pelosi’s most recent investment, made through Forge Investments on March 22, is in Databricks, a company specializing in big data and generative AI. It’s worth noting that Databricks is a pre-IPO company, and Pelosi utilized Forge’s secondary markets platform to invest between $1 to $5 million, as disclosed in the latest SEC filing.

Concurrently, on the same date, thanks to the gains made, Pelosi’s portfolio hit an all-time high, with a 92.53% return on investment, as reported by a congress and insider trade stock tracker unusual_whales.

Investors are eager to monitor and track stock trades and new acquisitions by US politicians, as these transactions are often believed to be based on insider knowledge that isn’t accessible to the general public.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.