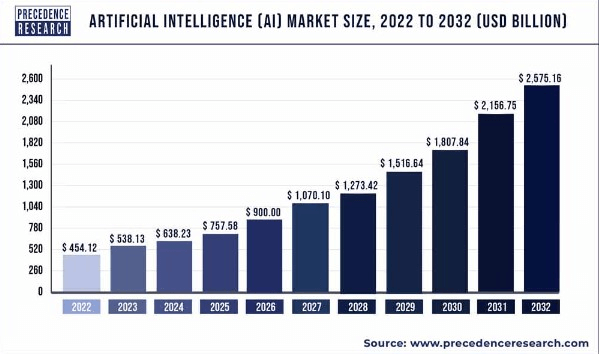

The surge in artificial intelligence (AI) stocks over the past two years is not just a temporary trend but the beginning of a revolution affecting nearly every industry.

Projections suggest the AI market could reach $2.57 trillion by 2032, with a remarkable compound annual growth rate (CAGR) of 20.4% between 2024 and 2032.

Nvidia (NASDAQ: NVDA), a Santa Clara-based company specializing in designing and selling specialized GPUs, has become emblematic of the AI boom. The company’s stock has soared almost 3,000% over the past five years and continued its stellar performance in 2024, rising 162.40% year-to-date.

Nvidia also offers a modest dividend yield of 0.02%. However, after briefly holding the title of the world’s most valuable company last week, Nvidia’s shares have since declined by 16% from their peak, with June 24 marking the stock’s worst decline in the past two months.

Are Nvidia insiders to blame for the decline in NVDA stock?

One likely reason for the recent decline is profit-taking after Nvidia’s significant run-up, as the stock was technically overbought before the pullback.

Additionally, some market watchers are concerned about heavy insider selling amid the recent weakness in Nvidia’s stock. As Nvidia competed with Microsoft (NASDAQ: MSFT) and Apple (NASDAQ: AAPL) for the world’s most valuable company title, Nvidia insiders were selling their shares.

This includes co-founder and CEO Jensen Huang, who sold 240,000 shares on June 21 at an average price of $131.49, totaling approximately $31.56 million.

Earlier in the month, Huang sold shares worth $63.1 million in two tranches, leaving him with a 35.2% ownership stake in Nvidia, still a substantial holding.

Other Nvidia insiders have also been selling shares. Long-time director Tench Coxe sold $119 million earlier in the month.

Additionally, Chief Financial Officer Colette Kress recently executed a significant sale of NVDA shares, totaling $24.4 million. This transaction marks her largest sale, doubling the amount of her previous record sale conducted last week.

Will NVDA stock crash?

Despite a substantial number of NVDA stock insider sales, investors shouldn’t be worried. While insider stock sales often grab headlines, they usually have straightforward explanations.

Executives at growth-oriented tech companies like Nvidia are frequently compensated with stock, and such sales are often part of pre-scheduled plans set months or years in advance, reducing their relevance as sentiment indicators.

This perspective suggests that Nvidia’s underlying fundamentals remain strong, and the recent insider sales do not reflect a lack of confidence in the company’s future prospects.

Especially with the recent bullish stance that analysts on Wall Street have regarding this semiconductor maker and its stock.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.