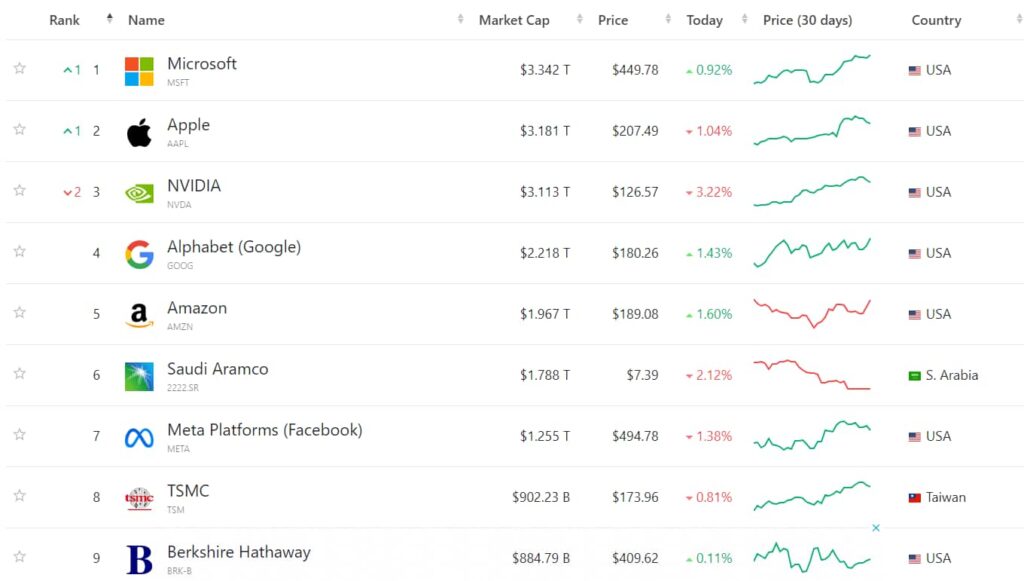

Nvidia (NASDAQ: NVDA) recently reached a significant milestone by briefly claiming the top spot in global market capitalization, surpassing both Microsoft (NASDAQ: MSFT) and Apple (NASDAQ: AAPL). On June 18, 2024, Nvidia’s market cap reached an impressive $3.3 trillion making it the most valuable company., though it has since fluctuated.

Despite this achievement, Nvidia’s shares have dropped 6.7% over the past two days, wiping out over $220 billion from its market cap. By Friday, Nvidia’s market cap fell to about $3.1 trillion, placing it behind Apple at $3.18 trillion and Microsoft at $3.3 trillion.

Even at this adjusted market cap, Nvidia surpasses the GDP of all but five global economies. According to 2023 GDP data from the World Bank, only the United States ($25.44 trillion), China ($17.96 trillion), Japan ($4.26 trillion), Germany ($4.08 trillion), and India ($3.42 trillion) have higher GDPs.

Additionally, Nvidia’s market cap exceeds the entire stock markets of France, Germany, and the UK, according to Deutsche Bank Research. This comparison underscores the immense value and influence Nvidia holds in the global market.

Driving forces behind Nvidia’s growth

Nvidia achieved a remarkable feat by adding $1 trillion to its market cap in just 23 trading days since May 20 — the fastest pace ever recorded, according to Deutsche Bank. For comparison, Warren Buffett’s Berkshire Hathaway (NYSE: BRK.A) has a total market cap of approximately $900 billion after 135 years. This rapid surge highlights Nvidia’s significant influence in the tech industry and the increasing demand for its cutting-edge products.

Nvidia’s rapid rise is largely due to the growing demand for artificial intelligence (AI) technologies. The company’s GPUs are critical in AI applications, making Nvidia a key player in this technological revolution. Nvidia’s advanced chips and technological solutions are highly sought after in various industries, from data centers to autonomous driving and electric vehicles.

Earlier this month, Nvidia revealed plans to launch its most advanced AI platform by 2026. Additionally, Foxconn announced it would build an advanced computing center in Taiwan using Nvidia’s Blackwell chips.

This collaboration aims to expand Nvidia’s footprint in data centers, autonomous driving, and the electric vehicle market. Tesla (NASDAQ: TSLA), a leader in electric vehicles, currently uses Nvidia’s chips but plans to develop custom chips in-house in the future.

Stock split and financial performance

Nvidia’s recent 10-for-1 stock split, effective June 10, has also significantly influenced its market dynamics. Lowering the share price could make Nvidia eligible for inclusion in the Dow 30, a price-weighted index. Previous stock splits have seen companies like Apple and Amazon (NASDAQ: AMZN) join the Dow, suggesting a similar potential for Nvidia.

The company reported exceptional first-quarter fiscal 2024 results, with sales increasing 262% to $26 billion and earnings per share up 461% to $6.12. Nvidia has also partnered with Microsoft to integrate the latest AI software with Nvidia’s GPUs, further cementing its leadership in the AI space.

Nvidia’s record-breaking market cap and rapid growth show its dominant position in the tech industry. Analysts from Baird, Susquehanna, and Barclays have all raised their price targets for Nvidia, reflecting strong confidence in its continued growth.

Nvidia, Apple, and Microsoft have recently been vying for the top spot by market capitalization, with their combined value surging to nearly $10 trillion. This concentration of wealth mirrors the total market value of the S&P 500 in 2010, raising concerns about market stability and the risks associated with such a significant portion of value resting on just a few companies.

While Nvidia’s recent market cap volatility highlights the dynamic nature of the tech industry, its leadership in AI and impressive growth trajectory suggest a future filled with opportunities.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.