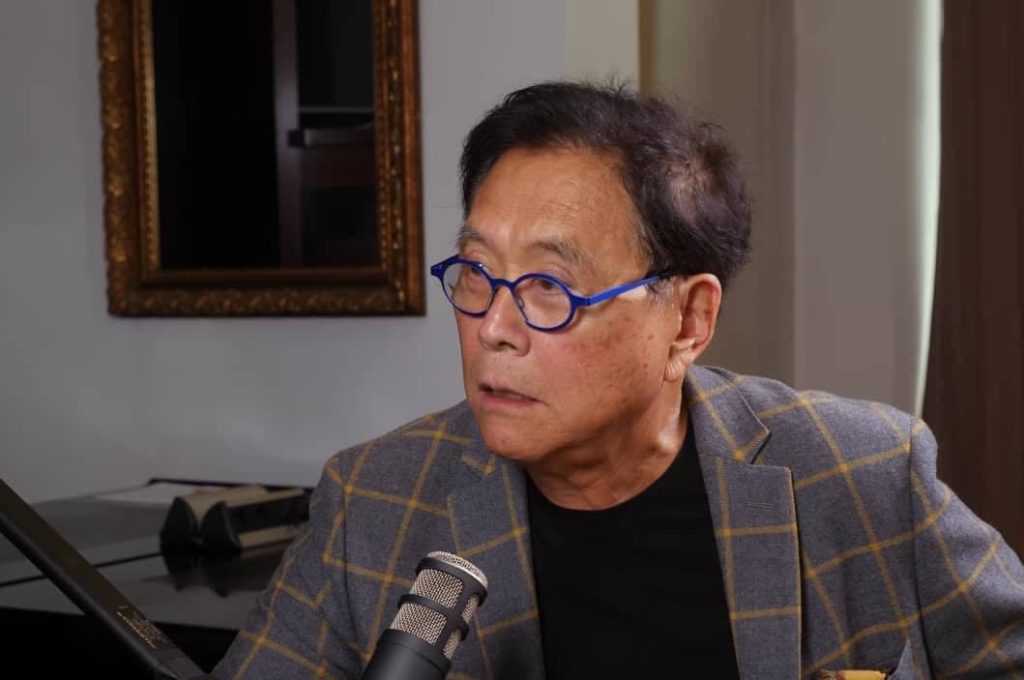

Robert Kiyosaki, author of the best-selling personal finance book “Rich Dad, Poor Dad,” has attributed the recent rise in cryptocurrencies such as Bitcoin (BTC) and precious metals to declining financial health.

According to Kiyosaki, the impact on the financial health of the United States has affected the poor while the middle class is getting poorer, a factor he insinuates might be driving demand for alternative investment products such as Bitcoin, he said in a tweet on January 31.

Therefore, he called for investments in assets such as silver that are relatively cheaper at the moment while projecting investors are likely to get richer.

“Why are gold, silver, Bitcoin going higher? A: Because U.S. poor and middle class getting poorer & deeper in bad debt. Please don’t get poorer. At least buy one silver coin. Only $30 and start to get richer,” he said.

Kiyosaki’s support for Bitcoin

Amid rising inflation and interest rate hikes, Kiyosaki has been at the forefront of advocating for investors opting for Bitcoin and gold. According to the author, the assets offer a much-needed cushion in a financial crash.

Interestingly, Kiyosaki believes that Bitcoin will be the only standing cryptocurrency citing regulatory backing.

“I am very excited about Bitcoin. Why? Because Bitcoin is classified as a commodity, much like gold, silver, and oil. Most crypto tokens are classified as a security, and SEC regulations will crush most of them. I am buying more BTC,” he said.

In the meantime, Bitcoin has rallied by almost 40% in 2023 while attempting to exit the 2022 bear market.

Global recession

As reported by Finbold, Kiyosaki recently suggested that the global economy is already in a recession while cautioning against a possible rough landing. In this line, Kiyosaki believes the landing will emanate from rising bankruptcy, unemployment, and homelessness rates.

In particular, the author has blamed the Federal Reserve for failing to handle the inflationary situation. With a gloomy economic outlook, Kiyosaki had earlier pointed out that investors should avoid paper money and go for gold. He suggested that the potential of gold is highlighted by the continued accumulation of the metal by central banks.