Less than a month after making an all-time high (ATH), the shares of Super Micro Computer Inc. (NASDAQ: SMCI) have again broken their price record, alongside flashing a signal that could flip that positive trend and turn it into a sell-off following the new ATH.

As it happens, the SMCI stock has reached the second most overbought level in history on its weekly chart, in addition to still boasting the highest weekly relative strength index (RSI), according to the observations by analytics platform Barchart in an X post on March 8.

Indeed, the popular momentum oscillator, which measures the speed and change of price movements to assess overvalued or undervalued conditions in an asset’s price, has hit 94.25, having gotten very close to the upper limit of 100, and suggesting a strong overbought trend for SMCI.

Picks for you

Notably, an RSI reading above 70 usually indicates an overbought situation and represents a bearish signal, whereas a reading below 30 suggests oversold conditions and is, therefore, a bullish sign. The last time SMCI had such a high overbought situation was in July 2023, after which a sell-off ensued.

SMCI stock price analysis

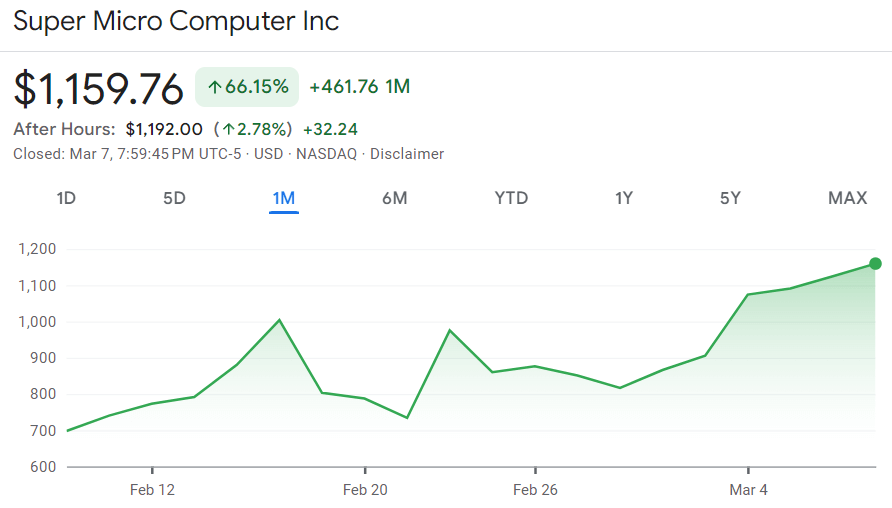

Meanwhile, the price of SMCI stock at press time amounted to $1,159.76, recording an increase of 3.12% on the day, rallying 31.34% across the past week, as well as adding up to the monthly gain of 66.15%, and advancing over 300% this year, according to the most recent charts retrieved by Finbold.

It is worth noting that the recent price gains of the popular semiconductor stock coincides with Super Micro Computer earning itself a place in the prestigious S&P 500, not long after Nvidia (NASDAQ: NVDA) posted a strong set of earnings results in February that started the rally for its server supplier.

More recently, SMCI itself reported strong financial results for the past year and the second quarter, surpassing $7 billion in total revenue for the last year, an increase of 37.09% compared to the year before. In addition, it grew its net income by 124.43% and its earnings per share (EPS) by 114.99%.

On the other hand, CNBC’s ‘Mad Money’ host Jim Cramer is not demonstrating bullish sentiments towards SMCI, recently referring to it as “too hot” for him, so he had to “pullback on this one,” and listing all the stocks he prefers instead, including Dell (NYSE: DELL) and Advanced Micro Devices (NASDAQ: AMD).

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.