XRP appears primed for a significant rally after months of consolidation, with key technical indicators pointing to a shift toward bullish momentum.

Notably, in an X post, analyst DarkDefender highlighted that XRP has confirmed a breakout on the four-hour chart, signaling a clear shift in market sentiment.

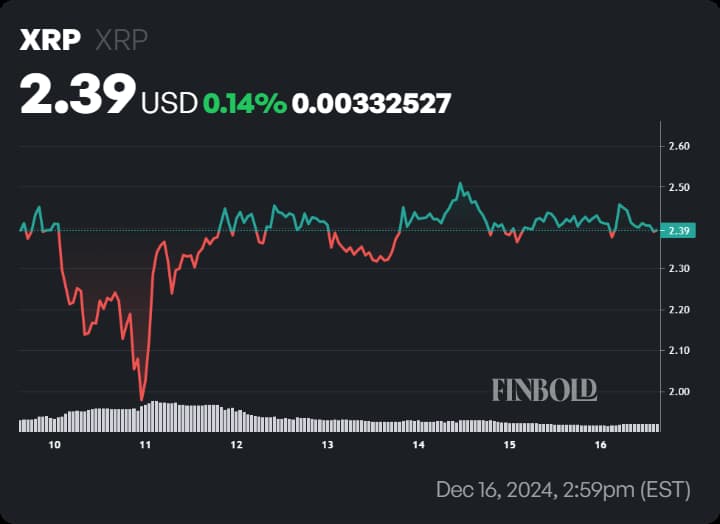

At press time, XRP is trading at $2.40, marking a strong recovery from its prolonged consolidation range of $0.50 to $0.60.

The digital asset has posted a 0.14% gain on the weekly chart and is up an impressive 326% year-to-date. This breakout comes on the heels of XRP reaching a local high of $2.71 on December 3, further fueling optimism for continued upside momentum.

Technical indicators confirm bullish momentum

According to the analysis, XRP’s breakout above a descending trendline on the four-hour timeframe signals a potential reversal of its earlier downtrend. However, a daily close above $2.52 is required to solidify this bullish outlook.

The Ichimoku Cloud is projecting a bullish trend, with XRP now trading above the cloud, a signal traditionally associated with further upside potential. Moreover, the Relative Strength Index (RSI) has formed a Golden Cross, confirming increasing buying pressure and a definitive shift in momentum

Key levels to watch

The immediate focus now lies on XRP’s ability to clear the critical resistance at $2.52. A confirmed daily close above this level could open the door for a retest of the December 3 high at $2.71.

Beyond that, DarkDefender has outlined short-term price targets of $5.85 and $8.76, supported by bullish market conditions and historical price movements.

On the downside, XRP must defend key support levels to sustain its bullish outlook. Analysts point to $2.29, $2.24, $2.10, and $2.02 as critical zones where buyers are expected to step in to maintain the bullish momentum.

Derivatives market data and broader ecosystem developments

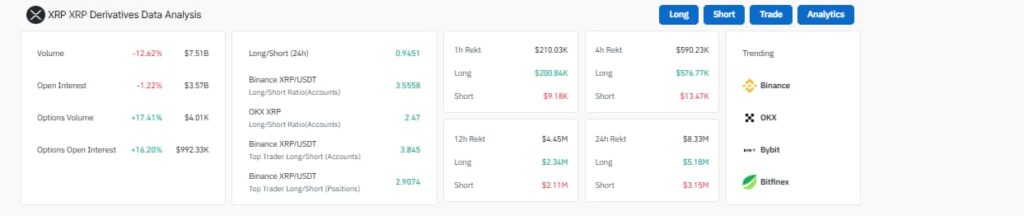

Derivatives data from CoinGlass further reinforces XRP’s bullish outlook. Options open interest has surged by 16.20% to $992.33K, reflecting growing confidence among traders in XRP’s upward trajectory.

Meanwhile, options volume has increased by 17.41%, suggesting heightened activity as traders position themselves for volatility.

The Binance long/short ratio among top traders stands at 3.845, indicating a clear bullish bias. Despite a slight decline of 12.62% in overall derivatives volume, open interest remains stable, signaling sustained market engagement and confidence in XRP’s potential for further gains.

Moreover, investors are quite bullish on XRP and the wider Ripple Labs ecosystem, particularly as its stablecoin, RLUSD, has recently received final approval from the New York Department of Financial Services (NYDFS).

This milestone enhances confidence in Ripple’s ecosystem and strengthens XRP’s position within the broader digital asset market.

Bull flag pattern points to a $4 target

While long-term projections for XRP remain ambitious, with some analysts predicting prices as high as $48, short-term forecasts point to immediate upside potential.

Notably, cryptocurrency analyst Ali Martinez, in a December 12 X post, identified a bull flag pattern on XRP’s chart, which suggests XRP could rally to $4 in the near term.

Martinez highlighted $2.46 as a key breakout level to confirm the pattern and noted that any short-term pullback could present a buying opportunity for traders looking to capitalize on the next upward move.

That being said, XRP’s recent breakout, coupled with strong technical indicators and improving market sentiment, presents a bullish outlook for the digital asset.

A decisive close above $2.52 could mark the beginning of XRP’s next major rally, with analysts projecting targets of $4 in the near term and $8.76 in subsequent moves.

At $4, XRP’s market cap would rise to approximately $228.75 billion, surpassing Tether’s (USDT) valuation while remaining behind Ethereum (ETH), which currently holds a market cap of $471.63 billion.

However, at $8.76, XRP’s market cap would surge to around $500.97 billion, surpassing Ethereum and solidifying its position as the second-largest cryptocurrency behind Bitcoin (BTC), which currently holds a market cap exceeding $2 trillion.

Supported by rising derivatives interest and Ripple’s expanding ecosystem, XRP remains a key asset to watch as it positions itself for further gains in the ongoing market recovery.

Featured image via Shutterstock