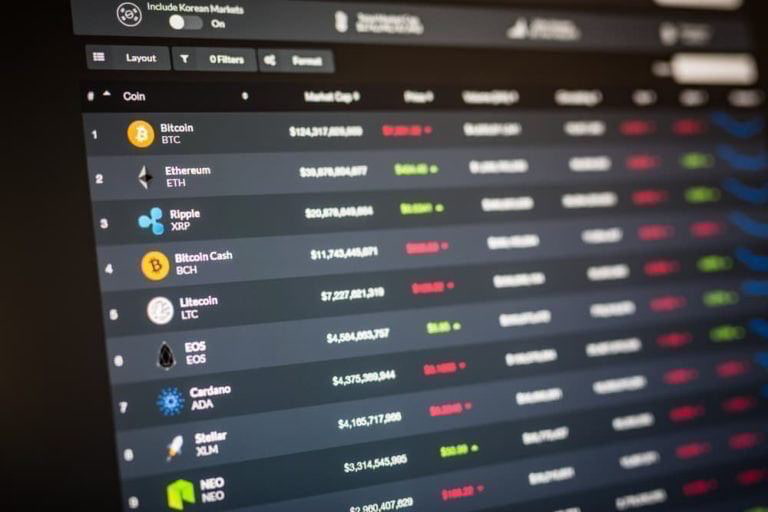

With 2023 already at its sunset and 2024 rapidly approaching, it is time to look back at how the cryptocurrency market as a whole performed, focusing on its biggest winners or those assets that recorded the best results, and its biggest losers or its worst performers, in the year that is almost over.

Interestingly, the cryptocurrency industry’s best performers have registered massive price gains in 2023, ranging from around 1,000% to over 3,000%, whereas its poorest participants only lost two-figure percentages since the year’s turn, indicating that things were overall positive for this sector in general.

Injective (INJ): +3,272%

Specifically, leading the gains in a convincing first place is Injective (INJ), which has increased its value by a whopping 3,272% this year alone and is currently changing hands at the price of $42.37, which also indicates a 74.83% advance across the past week and an increase of 147.09% over the month.

As it happens, the native crypto of the Layer 1 blockchain that combines artificial intelligence (AI) and decentralized finance (DeFi) attracted attention this summer when it became the only large gainer amid the decline of most other top 100 assets and dominated the market, largely due to the still ongoing AI hype.

Kaspa (KAS): +1,939%

Meanwhile, Injective’s runner-up, Kaspa (KAS), has also achieved outstanding results, having accumulated a gain of 1,939% during the same period, although it has lost 10.48% in the last seven days and declined 23.16% on its monthly chart, at press time trading at $0.11.

Indeed, Kaspa has managed to make this significant year-to-date (YTD) advance, regardless of the scathing criticism by CyberCapital founder Justin Bons, who in November argued that the network lacked key features such as Turing-complete smart contracts or proof-of-stake (PoS) consensus mechanism.

Render (RNDR): +972%

Following Kaspa is Render (RNDR), with a no less impressive 972% increase that has led it to its present price of $4.34, which, at the same time, represents a 10.44% gain on its weekly chart and a slightly more significant increase of 19.63% across the previous 30 days, as per data on December 20.

It is also worth noting that the crypto asset of the decentralized GPU-based rendering solutions provider Render Network has recently reached its new yearly high, several weeks after partnering with cloud service io.net to expand its Decentralized Physical Infrastructure Network (DePIN) with more AI-focused GPU suppliers.

ApeCoin (APE): -55%

On the losing side, ApeCoin (APE) has lost 55% of its value since the year’s turn and is at the moment changing hands at $1.63, which, on the other hand, also indicates an increase of 2.59% across the previous seven days and a 13.92% gain on its monthly chart.

One of the reasons behind this year’s poor performance of the Ethereum-based crypto token associated with the Bored Ape Yacht Club non-fungible token (NFT) collection could be the decline in the interest surrounding NFTs and meme coins in general, despite its promise to enhance the future of digital payments.

PancakeSwap (CAKE): -31%

At the same time, although not doing as bad as ApeCoin, PancakeSwap (CAKE) has still declined 31% during 2023, in addition to its most recent losses of 7.71% in the last seven days and 15.02% across the past month, as its current price stands at $2.20, according to the latest charts.

Having said that, the losses for the token of the well-known decentralized crypto exchange PancakeSwap have occurred despite the network’s efforts to deliberately reduce the circulating supply and increase its long-term value appreciation with a diligent CAKE burning schedule.

Chiliz (CHZ): -18%

Finally, Chiliz (CHZ), the native token of the fintech platform for the sports industry, has lost 18% to its price since the beginning of this year and was, at the time of publication, trading at $0.08, which also indicates an increase of 2.16% across the week and a 6.21% advance during this past month.

Indeed, although it started the year on a positive note, Chiliz took a turn for the worse in May, as investors started losing confidence, the ecosystem began to struggle with attracting an ever smaller number of new users, and long-term holders increased their selling activity.

Conclusion

Although the above cryptocurrencies might currently fall into the categories of winners or losers, the situation in this industry can sometimes change on a whim, which is why it is important to ‘zoom out,’ carry out one’s own research, and weigh the risks before investing in (or outright avoiding) any of them.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.