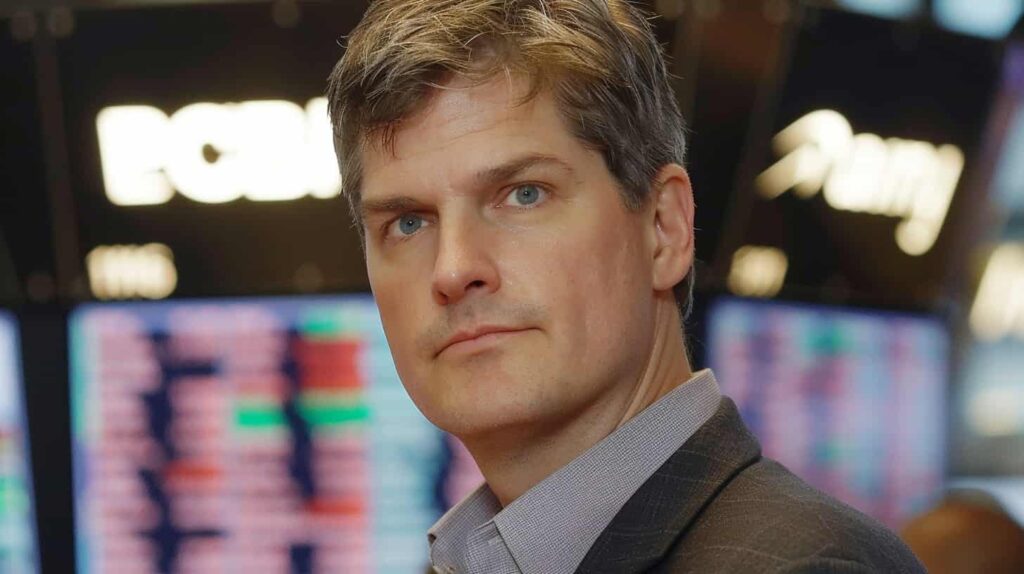

While Michael Burry undoubtedly pulled off one of the most masterful stock market maneuvers during the 2008 crisis with his ‘Big Short,’ Burry’s performance since has been checkered, albeit leaning toward successful.

Much has been said about his abandoned 2023 bet against the semiconductor industry, and his massive $4 million bet on the Chinese technology and e-commerce giant Alibaba (NASDAQ: BABA), Burry’s portfolio boasts numerous other, less-known diamonds in the rough.

Among the hidden gems, GEN Restaurant Chain (NASDAQ: GENK) with its 30% growth in 2024, and HCA Healthcare (NYSE: HCA) with 18% stand apart next to RealReal (NASDAQ: REAL) with 77%.

Indeed, if REAL is the diamond in the rough among the holdings, Big Lots (NYSE: BIG) is certainly “the rough.”

Still, there remain multiple promising stocks in the Burry portfolio, and Finbold decided to take a look at three more of the best ones and to try to figure out how much ‘The Big Short’ investor is in the green on them.

Qurate Retail Inc Series A (NASDAQ: QRTEA)

Qurate Retail (NASDAQ: QRTEA) – a U.S. media conglomerate – has been one of Michael Burry’s most active positions in recent years with the investor building and dismantling his stock holding multiple times since the third quarter of 2020.

For example, the hedge fund manager sold all of his QRTEA shares in Q3, 2023 only to buy 600,000 more in the next trimester.

The last quarter of 2023 saw the end of a protracted downturn for Qurate stock and the beginning of the uptrend that lasted – mostly uninterrupted – until the very end of February 2024.

In the last 52 weeks, QRTEA rose 29.89% and, oddly enough, is 29.89% in the green year-to-date (YTD). The most recent performance has, however, been less positive and the stock dropped 15.04% in the last 30 days and closed 2.59% in the red at $1.13 on the latest full trading day, Monday, March 25.

Assuming Burry bought the stock near the Q4 2023 lows, he would be approximately $400,000 up on his investment. Still, judging by the established pattern, it wouldn’t be surprising if ‘The Big Short’ investor already cleared his position and will buy once more as soon as the current downtrend ends.

Toast Inc. (NYSE: TOST)

Toast Inc. (NYSE: TOST) – a U.S. cloud-based restaurant management software firm – is a relative newcomer to Michael Burry’s portfolio with the first purchase taking place as recently as last quarter.

In the final trimester of 2023, TOST shares continued their decline – which started in the summer months – and bottomed in mid-November. Since then, they have been on a relatively steady upward trajectory and are 31.78% in the green year-to-date at $23.80.

Assuming Michael Burry bought his 200,000 shares near the last quarter’s bottom at approximately $14, he has made $2 million on the trade by the market’s close on March 25.

Advance Auto Parts, Inc (NYSE: AAP)

The stock of Advance Auto Parts (NYSE: AAP) – an American company dealing with car replacement parts – is, in many ways, similar to that of Toast Inc. The shares are a newcomer to the Burry portfolio having been bought in Q4 2023, and that particular trimester saw the end to a protracted decline for the shares.

Since the start of 2024, AAP is up as much as 36% – though the bulk of the growth took place after February 28 – and the most recent performance is somewhat weaker as the stock is 0.05% in the green on the weekly chart, and fell 1.76% on the last trading day having closed at $84.25.

Given that, in the grand scheme of things, AAP stock remained relatively stable through Q4 2023, it can be assumed that Burry bought his 70,000 near the average closing price for the period which stood close to $55. If this is the case, Burry made as much as $2 million on the investment.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.