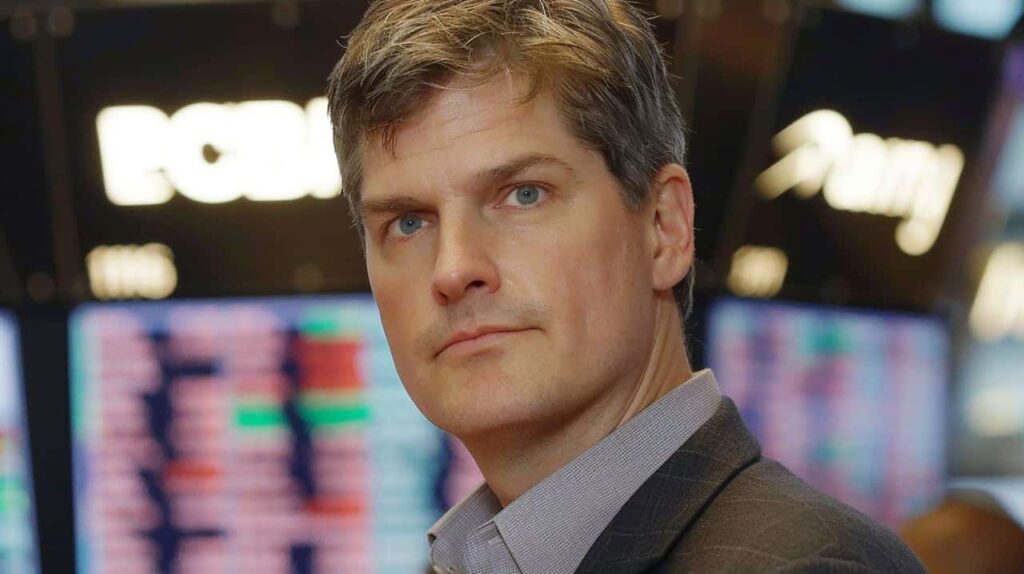

The famous investor Michael Burry has been known for his knack for seeing what most can’t in the stock market ever since he pulled off “The Big Short” by predicting the 2008 financial crisis.

More recently, he has become known for his more mixed performance and controversial decisions like the 2023 bet against the semiconductor industry – which was dropped in the fourth quarter of the year – and his investment in the Chinese technology and e-commerce giant, Alibaba (NASDAQ: BABA).

This March, however, some of the smaller, lesser-known stocks in Burry’s portfolio have started taking the spotlight thanks to their excellent performance – either in recent weeks or in recent months.

Among these, a luxury commerce platform called The RealReal Inc. (NASDAQ: REAL) stands out for its incredible rise over the course of 52 weeks as it has, in the time frame, surged a full 200%.

When did “Big Short” Michael Burry buy REAL?

According to Michael Burry’s 13-f filings, the stock of The RealReal first came onto his radar in the first quarter of 2023 when he acquired 684,442 shares worth, at the end of the trimester, a total of $862,000.

The timing doesn’t appear to have been accidental as it was preceded by a major decline for REAL which saw it, in just under two years, fall from approximately $28 to a little over $1.

The 2022 decline marked the end of the protracted fall from RealReal stock’s initial public offering (IPO) price – also at approximately $28 – which ultimately saw the shares lose 88.17% of their value.

Michael Burry has made some changes throughout 2023 and has sold some of his stake in RealReal but, by the end of the year, still held as many as 654,806. The position was worth, at the tail end of the year, $1.3 million.

RealReal stock price chart

RealReal, a company that specializes in selling expert-authenticated luxury goods, has had a turbulent 52 weeks in the stock market, despite the ultimately positive performance. The company underwent multiple rallies and corrections within the time frame but found itself – largely thanks to a major late February price surge – 200% in the green on the 12-month chart.

Additionally, the rally ensured the company rose 92.13% in the last 30 days of trading, though the weekly chart shows that the stock is struggling somewhat to maintain the current value as it is only 0.59% in the green. Still, the most recent performance shows signs of strength as REAL shares rose 9.97% in Tuesday’s session up to $3.42.

How much did Michael Burry make on his REAL bet?

While it is impossible to tell at which price Michael Burry bought The RealReal stock in Q1 2023 by looking at the 13-f, it is known that his investment was worth approximately $1.3 million at the end of the year when the shares were priced at approximately $2.

This means that assuming “The Big Short” neither bought nor sold additional REAL shares, his investment is worth a total of $2.23 million, meaning he made more than $900,000 since the start of 2024.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.