As Nvidia (NASDAQ: NVDA) continues its stellar growth, concerns are rising that the artificial intelligence (AI) hype, which has affected various sectors in recent years, from healthcare to finance, retail to manufacturing, and beyond, has finished its rally and could be nearing its final days.

Indeed, Nvidia’s recent earnings report highlighted its exceptional results, surpassing $30 billion in sales for the first time ever for the three-month period through July and gaining 122% compared to the year before, with triple-digit year-over-year (YoY) sales growth for the fifth subsequent quarter.

Nvidia depends on its big tech customers

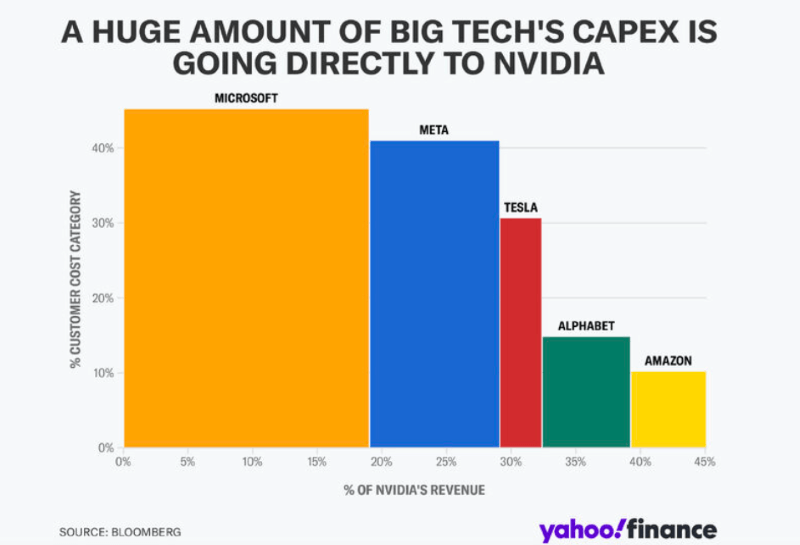

That said, these numbers significantly rely on technology behemoths like Microsoft (NASDAQ: MSFT), Meta Platforms (NASDAQ: META), Alphabet (NASDAQ: GOOGL), and Amazon (NASDAQ: AMZN), using Nvidia’s products to build and train their own AI models.

According to a recent report by Barron’s, Microsoft accounts for about 19% of Nvidia’s sales, Meta 10%, Alphabet 7%, and Amazon 6%, bringing the total to 42%, and with an expectation they would spend roughly $207 billion on new equipment in 2024, up by nearly 40% from 2023 and five times from 2017.

Moreover, nearly 45% of Microsoft’s spend goes to Nvidia, with Meta pouring 41% of its spending, Tesla (NASDAQ: TSLA) spending 30% (and contributing to 3% of Nvidia’s revenue), and Alphabet and Amazon also adding a significant slice to Nvidia’s pie,” according to Spearhead.

And although these companies currently help propel Nvidia’s advances, they could also spell its doom, considering their large contribution to its success. However, Wall Street does not see this happening soon, especially as Nvidia’s big tech customers plan to increase their AI budgets in the near future.

Regardless, the AI party could, indeed, start to wind down by mid-2025, with the expected rise of 13% to $234 billion in 2025, “but only 3%, to $243 billion, in 2026,” and even these numbers “could understate what is really going to happen” in 2026, according to Barron’s:

“Analysts may have simply plugged numbers showing growth going back to normal into their financial models rather than forecasts reflecting an immense technological shift. Maybe capital investment by companies not named Amazon, Microsoft, Meta, and Alphabet can pick up the spending slack.”

Potential Nvidia AI customers

Specifically, as potential industry players to replace these established tech giants as Nvidia’s AI customers, Barron’s has listed hardware-focused companies like HP (NYSE: HPQ), Cisco Systems (NASDAQ: CSCO), Applied Materials (NASDAQ: AMAT), Arista Networks (NYSE: ANET), Qualcomm (NASDAQ: QCOM), Micron (NASDAQ: MU), Intel (NASDAQ: INTC), Advanced Micro Devices (NASDAQ: AMD), Teradyne (NASDAQ: TER), and Equinix (NASDAQ: EQIX).

Furthermore, service-focused firms that could do the same include NetApp (NASDAQ: NTAP), Salesforce (NYSE: CRM), Palo Alto Networks (NASDAQ: PANW), Intuit (NASDAQ: INTU), Synopsys (NASDAQ: SNPS), Cognizant Technology Solutions (NASDAQ: CTSH), IBM (NYSE: IBM), F5 (NASDAQ: FFIV), Mastercard (NYSE: MA), and ServiceNow (NYSE: NOW).

Nvidia stock price analysis

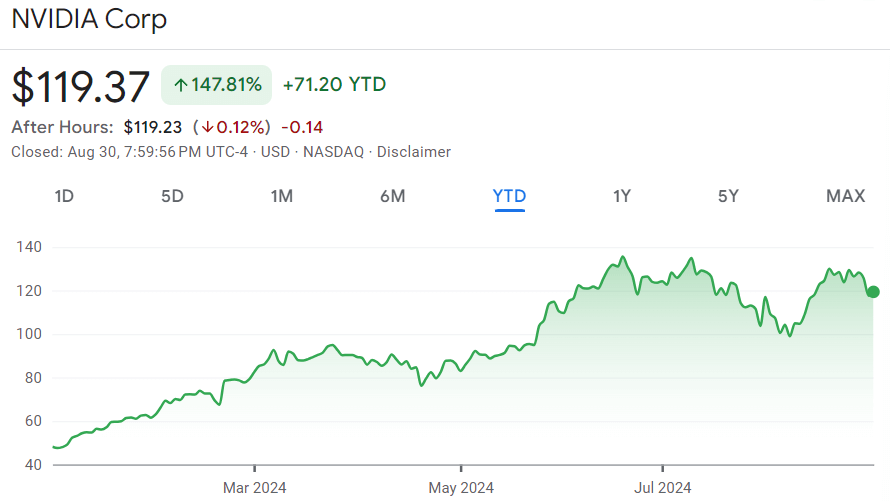

Meanwhile, the price of Nvidia stock at press time stood at $119.37, reflecting a 1.51% gain on the day, declining 7.90% across the past week but advancing 11.28% on its monthly chart and adding up to the 147.81% increase since the year’s start, as per data retrieved by Finbold on September 2.

All things considered, the AI hype propelling the growth of Nvidia stock, as well as other AI-related stocks, still has some fuel left in it, although it could begin sputtering next year as capital investments start to slow down. Regardless, doing one’s own research is critical before investing.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.